Bitcoin recently achieved a new all-time high (ATH), which reignited bullish sentiment among crypto enthusiasts. However, as the price approaches new highs, investor skepticism is growing.

Some investors are locking in profits, creating uncertainty about whether this rally can be sustained. The question remains: can Bitcoin continue its bullish momentum, or is the current price action a sign of things to come?

Bitcoin Investors Remain Uncertain

Bitcoin’s Liveliness, a key metric used to track the activity of long-term holders (LTH), has reached its highest level in nearly four years. This increase in Liveliness indicates that long-term holders are beginning to sell, signaling that they may be securing their gains after Bitcoin’s recent price surge.

LTHs are typically seen as the backbones of Bitcoin’s price stability, and their selling behavior often suggests that investor sentiment is shifting toward skepticism.

When LTHs decide to sell, it often marks a turning point in the market. Their selling can lead to increased market volatility and a potential price correction. With more LTHs exiting the market, Bitcoin faces additional pressure that may impede further price growth in the short term.

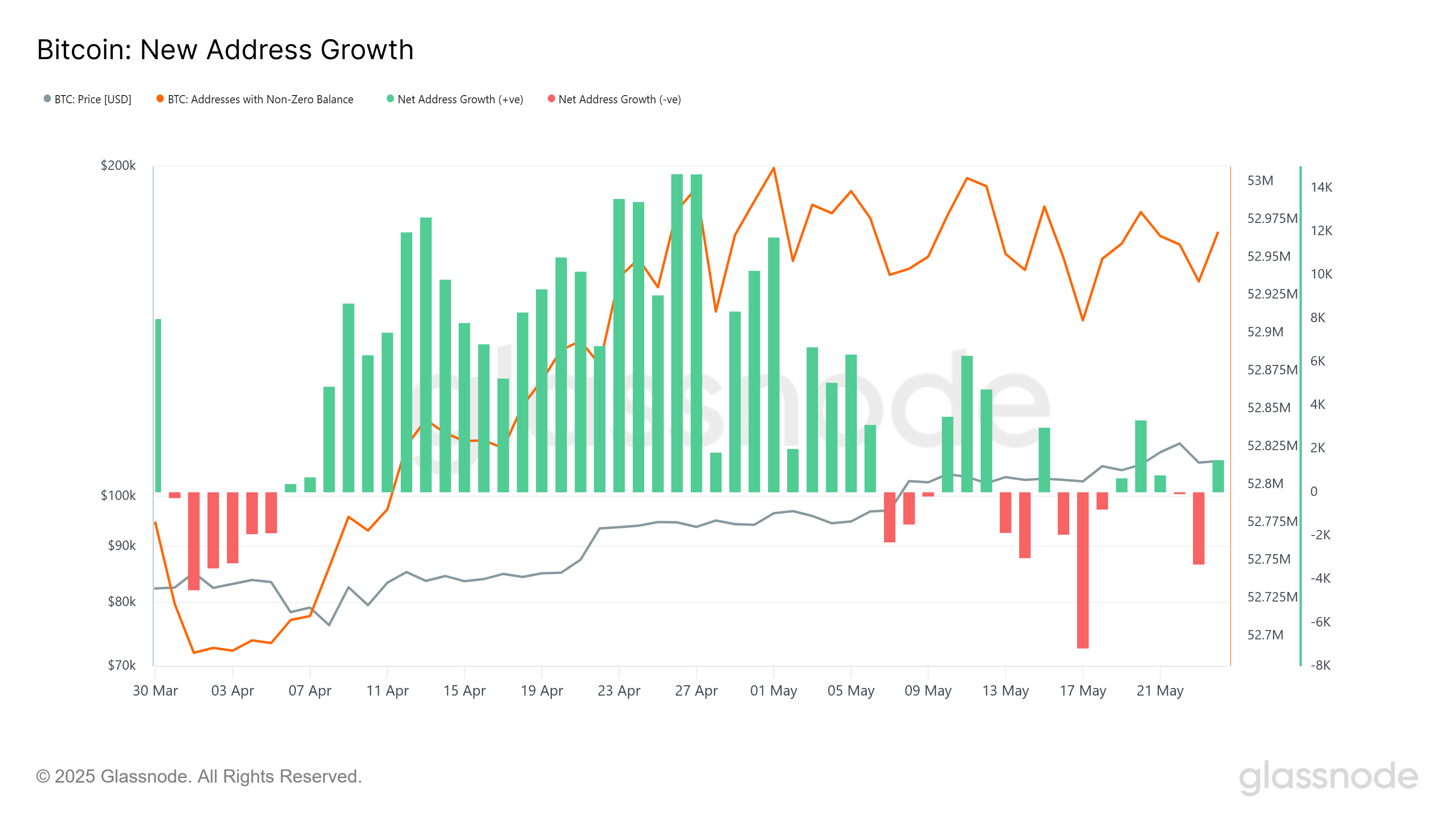

The growth of new Bitcoin addresses has been highly volatile this month. The number of new addresses reached new highs earlier in the month, but now, red bars on the chart signal a sharp decline.

This slowdown in address growth suggests that fewer new investors are entering the market, and some existing holders are choosing to exit. This could indicate a purging of wallets, a move typically seen during periods of rising skepticism.

Compared to April, address growth has been considerably more erratic this month. As Bitcoin’s price climbs, investors are becoming more cautious and focused on securing their profits.

The volatility in new address growth reflects the uncertainty surrounding Bitcoin’s future price action, with investors remaining wary of the long-term sustainability of this rally.

BTC Price Is Not Too Far From ATH

Bitcoin’s price is currently at $106,708, just under 5% from its ATH of $111,980, achieved last week. However, the path to reaching this level again depends largely on how investors react to the current market conditions.

If skepticism and selling continue, Bitcoin could face difficulty regaining its bullish momentum.

If the price continues to slide, Bitcoin may struggle to recover. A break below the support level of $106,265 could lead to further declines, potentially pushing the price down to $105,000 or even $102,734 in the short term.

However, if Bitcoin manages to hold above $106,265 and sees renewed buying interest, it could easily invalidate the bearish outlook. A breach of the $110,000 resistance level would provide the momentum needed to push through $111,980, paving the way for a new ATH.