Bitcoin recently experienced a significant drop on Monday, falling to a two-month low of $89,000. However, this dip did not constitute a crash, as the cryptocurrency quickly rebounded.

Renewed optimism among both small and large Bitcoin investors drove this recovery, signaling resilience in the market.

Bitcoin Investors Are Bullish

ETF inflows are returning to Bitcoin after a slow start to 2025. Over the past week, inflows into Bitcoin totaled $1.7 billion, surpassing the weekly average of $1.35 billion recorded between October and December 2024. This renewed interest highlights growing confidence in crypto as a viable investment option.

As investors move to pour money into the spot BTC ETFs again, they contribute to the building momentum needed for Bitcoin’s recovery. This highlights broader market optimism extending to the macro-financial markets, laying the foundation for sustained growth in the cryptocurrency’s price.

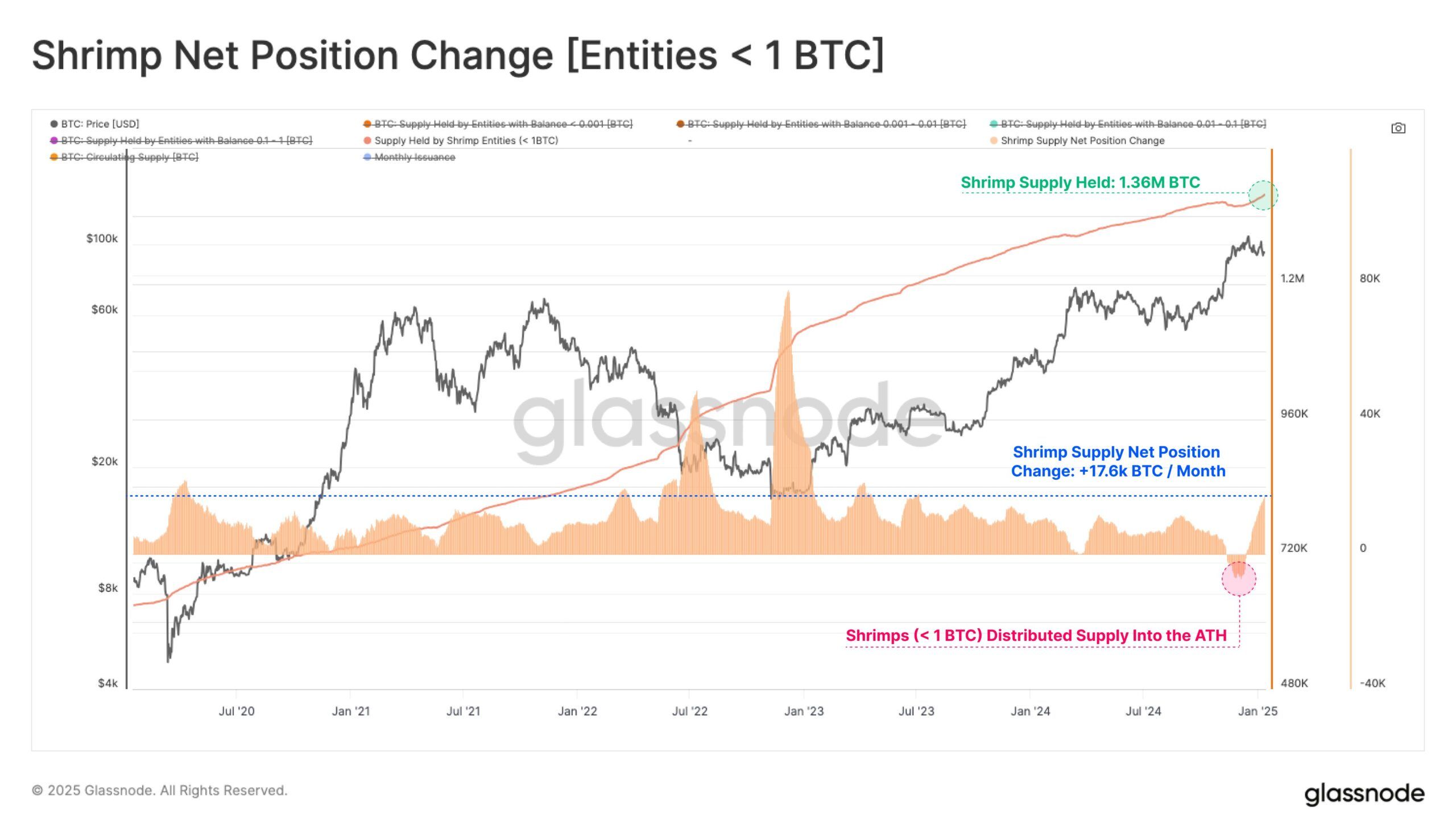

On a macro level, Bitcoin’s Shrimps net position change shows bullish behavior among small investors. Shrimps, holding less than 1 BTC, are accumulating at an aggressive rate of 17,600 BTC per month. Their total holdings now stand at 1.36 million BTC, reflecting strong optimism about future price increases.

This accumulation by Shrimps, who are typically reactive to price changes, indicates bullish sentiment among retail investors. Their continued buying activity suggests confidence in Bitcoin’s ability to recover and climb higher in the near term.

BTC Price Prediction: Looking For a Breach

Bitcoin’s price fell to $89,000 in the past 24 hours, marking a two-month low after losing critical support at $92,005. This drop raised concerns but was quickly followed by a strong rebound, demonstrating market resilience.

This price action suggests a fakeout, positioning Bitcoin to breach the $95,668 resistance level. Supported by strong ETF inflows and Shrimp accumulation, Bitcoin could regain momentum and set its sights on the psychological milestone of $100,000.

While a drop seems unlikely, Bitcoin could struggle to breach $95,668, leading to consolidation below this resistance and above the $93,625 support level. Such a scenario would delay the recovery and extend the current range-bound trading pattern.