Few topics divide the crypto industry more than politics. Donald Trump is often referred to as “America’s first crypto president,” while the Biden administration earned a reputation for being hostile toward the sector.

But when rhetoric is stripped away and replaced with market data, the picture becomes more nuanced. The key question is not which administration spoke more favorably about crypto, but under whose leadership Bitcoin ultimately performed better.

Bitcoin Performance: The Numbers Tell a Clear Story

In the 2024 United States presidential election, Trump positioned himself as a pro-crypto candidate, vowing to make the US the “crypto capital of the world.” He promised to halt anti-crypto actions, rein in SEC crackdowns, and, in his own words:

“End Joe Biden’s war on crypto and we will ensure that the future of crypto and the future of Bitcoin will be made in America.”

This fueled optimism in the market and ignited hopes for a bull run. Fast forward to near the end of 2025, and Bitcoin is down nearly 5%.

By comparison, during Biden’s first year as president, the world’s largest cryptocurrency gained roughly 65%. Performance weakened in 2022, but momentum returned in the following years.

Bitcoin rebounded strongly, rising approximately 155% in 2023 and a further 120.7% in 2024.

| Year | Bitcoin return (%) |

| 2021 | 65% |

| 2022 | – 64.2% |

| 2023 | 155% |

| 2024 | 120.7% |

| 2025 (As of December 26) | -5% |

When examining Trump’s first term as president, an analyst noted that it was “the greatest crypto bull run” in history, during which the total cryptocurrency market capitalization increased by roughly 115 times from the beginning of his term to its end.

“Biden’s term returned 4.5x from beginning to end, and even at the worst moment, it never went below the annual open for his term. Trump’s 2nd term so far is below annual open, but 3 more years to go,” the pseudonymous analyst wrote.

Bitcoin Under Trump

So what actually happened this year? The pullback is not something that can be understood by looking at headline 2025 returns alone.

In January, momentum was broadly on Bitcoin’s side. Ahead of Trump’s inauguration, BTC rallied above $109,000, marking a new all-time high at the time. There were also developments on the regulatory side, with the SEC creating a task force to offer a transparent regulatory framework for digital assets.

Nonetheless, Trump’s next moves erased all these gains. After he announced tariffs on the EU and later expanded on them at Liberation Day, cryptocurrency markets declined alongside equities.

Notably, the announcement of a pause led to a modest recovery. This highlighted the market’s sensitivity to broader macroeconomic developments and pointed to increased volatility.

Meanwhile, adoption continued to rise as state-level Bitcoin reserve initiatives and institutional involvement increased. Bitcoin’s price continued to trend higher, posting positive returns for four consecutive months from April through July.

A key trend during this period was the emergence of digital asset treasuries (DATs). Public companies increasingly began adopting Bitcoin as a reserve asset, following the playbook popularized by Micro (Strategy).

Bitcoin benefited from this shift, as many experts argued institutional involvement could help reduce volatility and signal the asset’s maturation within traditional finance.

As confidence grew, so did the risk appetite and the use of leverage. High-risk, highly leveraged traders drew widespread attention. On the macroeconomic front, the Fed slashed interest rates in September. This was again bullish for risk assets.

Bitcoin went on to reach a new all-time high in October, peaking at $125,761 on October 6. Many projected further upside, with targets ranging from $185,000 to $200,000 by year-end.

This optimism was supported by favorable macroeconomic catalysts and Bitcoin’s historically strong performance during the fourth quarter.

BeInCrypto reported that on October 11, Trump’s announcement of 100% tariffs on China pulled the market lower. Over $19 billion in leveraged positions were wiped out, resulting in significant losses for many traders.

The broader downturn persisted in the coming months, amplified by leverage.

“It also appears to be a structural and mechanical downturn. It all began with institutional outflows in mid-to-late October. In the first week of November, crypto funds saw -$1.2 billion of outflows. The problem becomes excessive levels of leverage AMID these outflows…Excessive levels of leverage have resulted in a seemingly hypersensitive market,” The Kobeissi Letter posted in November.

Bitcoin dropped 17.67% in November and has since lost an additional 1.7% of its value this month, according to Coinglass data.

From Bitcoin ETFs to Altcoins: Regulatory Changes and Market Response

The Trump and Biden administrations differed on several key issues, one of which was crypto ETFs. Under the Biden administration, the SEC initially took a far more cautious approach to the crypto sector. This stance extended to crypto ETFs.

However, the regulatory position shifted following a ruling by the US Court of Appeals for the DC Circuit, which ordered the SEC to reconsider Grayscale Investments’ application to convert its flagship GBTC fund into a spot Bitcoin ETF.

Thus, the SEC approved spot Bitcoin ETFs in January 2024 and later greenlit spot Ethereum ETFs in July.

Notably, after Gary Gensler’s departure from the SEC, asset managers were quick to file multiple applications for altcoin ETFs. Firms including Bitwise, 21 Capital, and Canary Capital, among others, submitted filings to launch a range of crypto-based investment products.

In September, the SEC approved generic listing standards, eliminating the need for case-by-case approvals. Following this shift, ETFs linked to assets such as SOL, HBAR, XRP, LTC, LINK, and DOGE entered the market.

In November, Canary Capital’s XRP ETF saw $58.6 million in trading volume on its first day, ranking as the strongest debut among more than 900 ETFs launched in 2025. Bitwise’s Solana ETF also attracted significant interest, generating $56 million in first-day volume, while other products recorded comparatively lower activity.

From a regulatory standpoint, the ETFs have increased market access, and the ruling reduced barriers for issuers. However, early performance data suggest that the introduction of additional crypto ETFs has not yet translated into a proportional increase in aggregate market inflows.

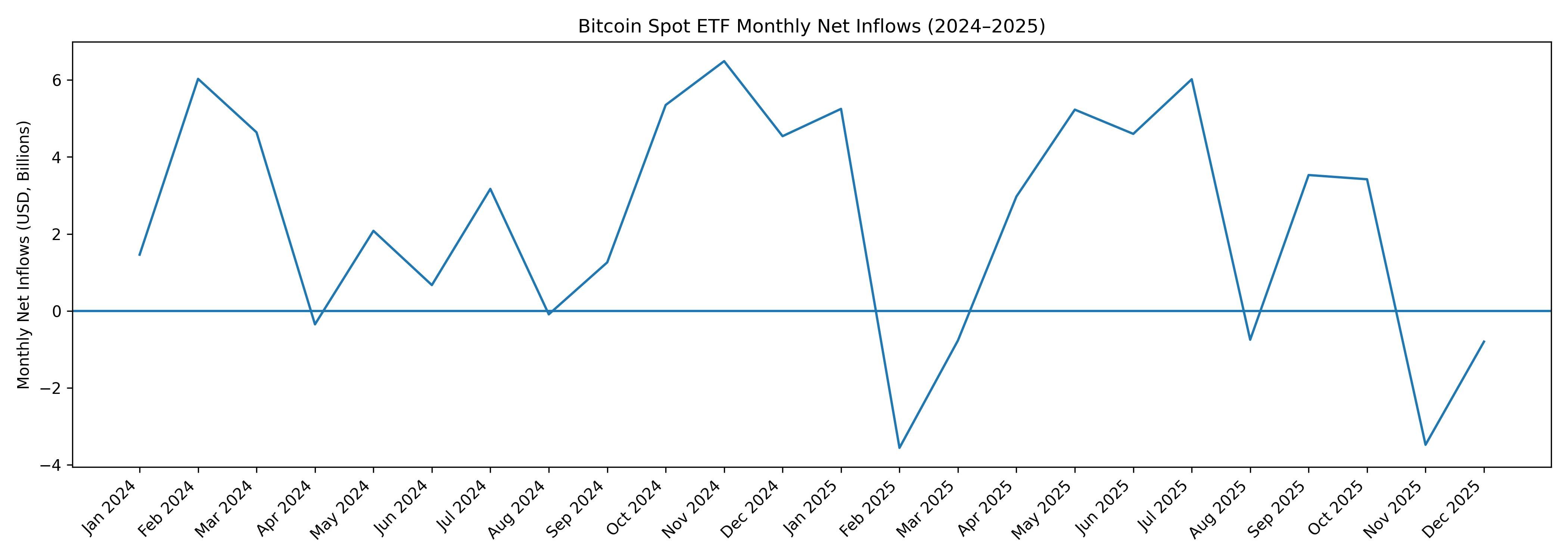

In 2024, spot Bitcoin ETFs attracted approximately $35.2 billion in net inflows. In 2025, inflows into Bitcoin ETFs slowed to $22.16 billion according to SoSoValue data. This divergence suggests that the growth in ETF offerings may have coincided with a redistribution of capital across products rather than an expansion of total crypto exposure.

Inside the Trump Family’s Crypto Empire

Although Donald Trump’s influence on the market is clear, he has also become directly involved in the crypto space. In January, the president introduced a meme coin, soon followed by a closely resembling token launched by Melania Trump.

In March, US President Donald Trump’s sons, Eric Trump and Donald Trump Jr., partnered with Hut 8 to launch American Bitcoin Corp.

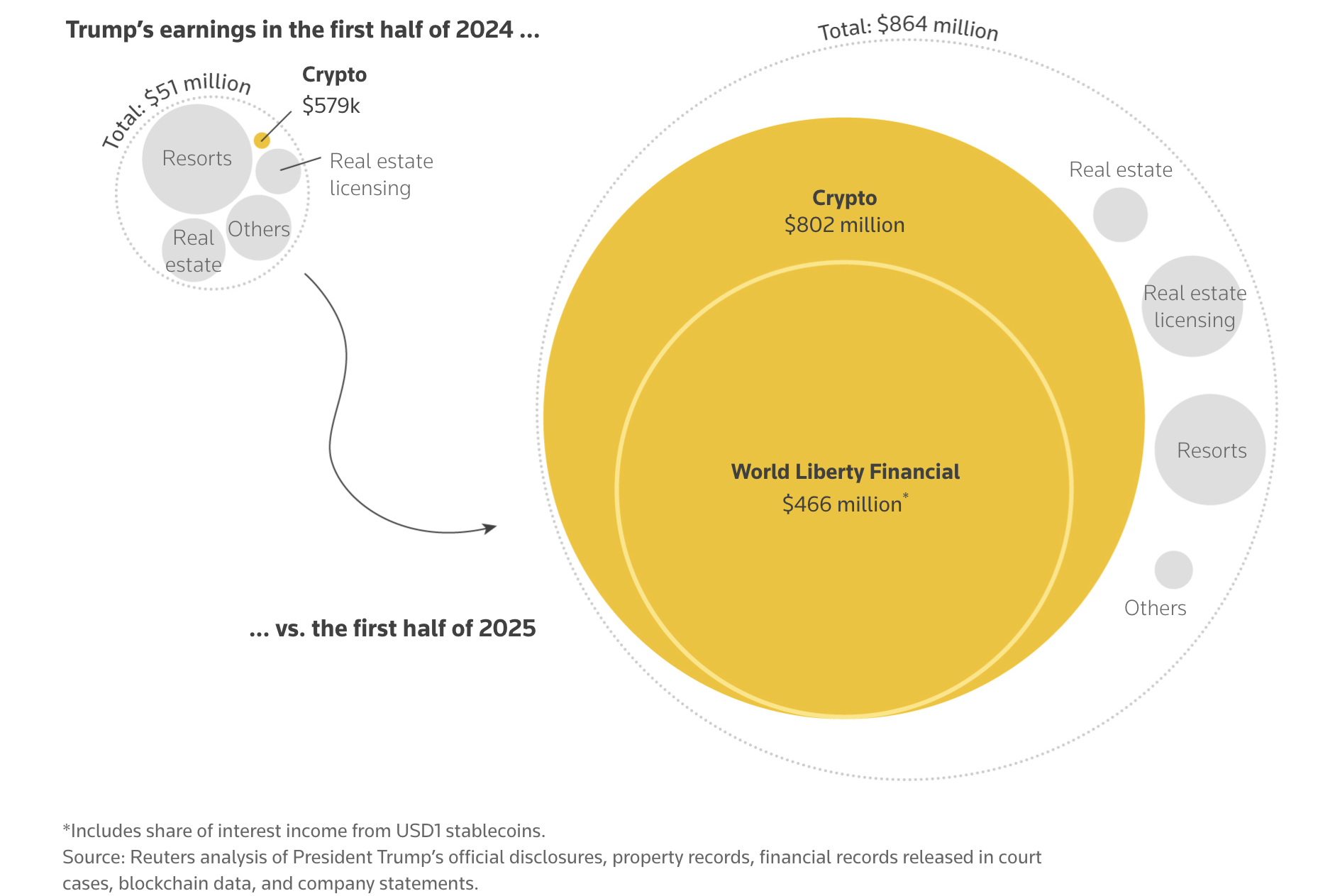

These ventures have generated significant wealth for the US president and his family. According to a Reuters analysis, they earned more than $800 million from crypto asset sales in the first half of 2025 alone,

One could argue that these moves helped legitimize the sector and accelerate adoption. Still, Trump’s direct and indirect involvement in crypto-related ventures raises concerns around optics, governance, and market integrity. While meme coins are not new to the crypto space, their association with a sitting US president is unprecedented.

These activities have also drawn sharp criticism from regulators and users alike. The Trump meme coin, WLFI, and American Bitcoin Corp have all suffered steep declines, resulting in significant losses for supporters.

Conclusion

Taken together, the data suggest that the answer to who helped crypto the most depends on how “help” is defined. Under Trump, crypto has benefited from a friendlier regulatory tone, reduced enforcement pressure, and faster approval of new investment products.

These changes lowered barriers for issuers and expanded market access.

However, market performance tells a different story. Bitcoin’s strongest gains occurred earlier, during Joe Biden’s presidency.

Meanwhile, Trump’s first year back in office has been marked by heightened volatility.