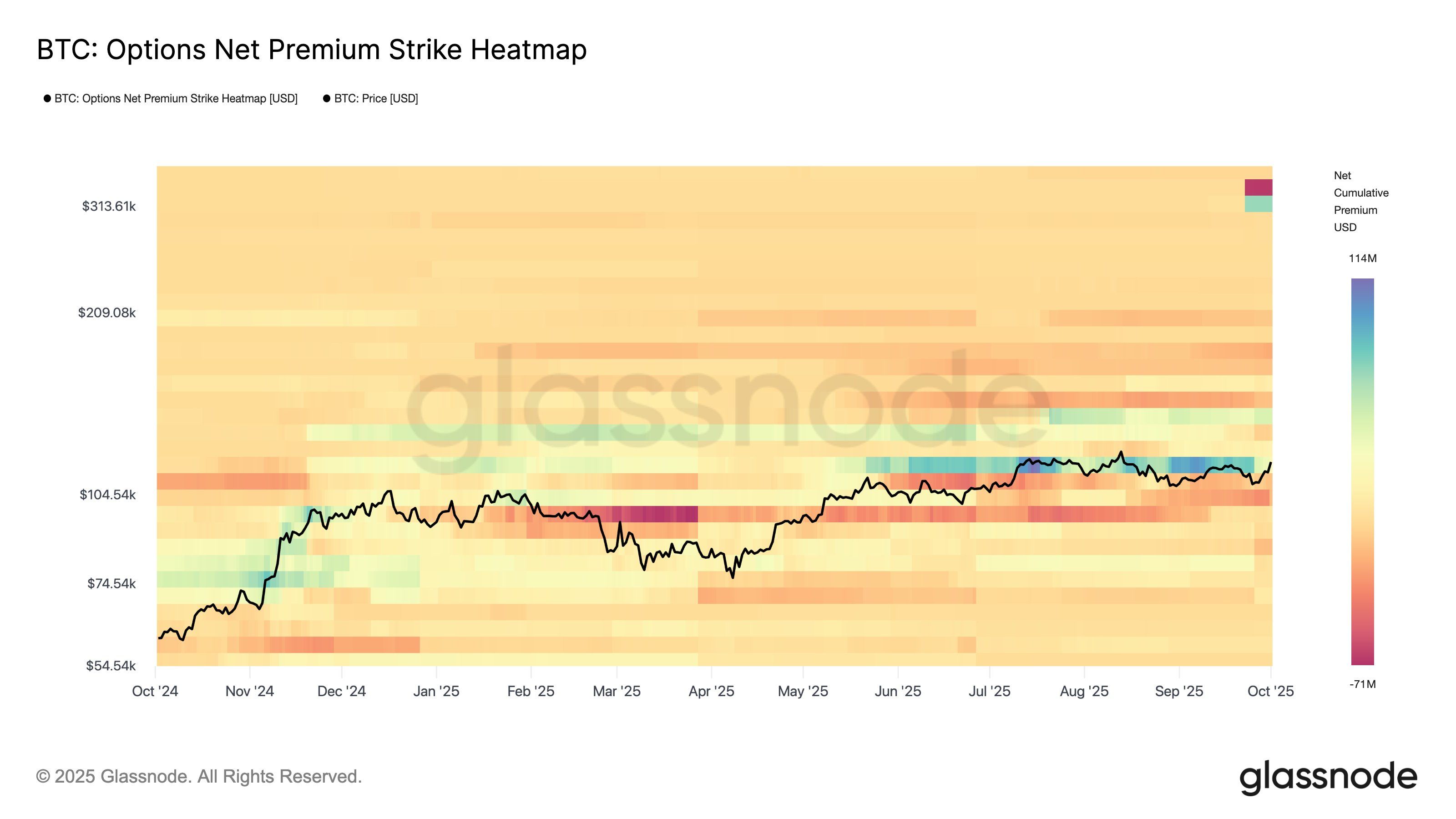

Bitcoin option investors are taking modest long positions after the asset’s price broke above $120,000, signaling that while there is optimism for an increase, it is not a strong conviction.

Glassnode shared this market sentiment on Friday via a post on X, complete with on-chain data.

A Bet on ‘Uptober’ in BTC Option Market

According to the firm’s post, Bitcoin options flows are clustering between the $100,000 and $120,000 strike prices, with only light call interest observed at $130,000.

This indicates two key developments in the Bitcoin options market. First, there is increased activity in call options within the $100,000–$120,000 range, suggesting that traders are positioning for potential upside beyond $100,000.

A call option gives the holder the right to buy an asset at a specific price, so elevated interest in this range typically reflects bullish sentiment or hedging against a significant price rally.

However, the relatively low volume of call options at $130,000 shows that expectations for a move far beyond $120,000 remain limited, at least for now. In other words, while there is optimism in the market, it comes with measured conviction.

The second phenomenon is an increase in very long-term call options in the $300,000 range. Out-of-the-Money (OTM) options are those with a strike price well above the current price. The $300,000 level Glassnode mentioned is a very high price range compared to Bitcoin’s current price of around $120,000.

This rising investor interest in these ultra-high-priced call options can be interpreted as “cheap convexity bets.” Convexity is a structure where profits increase dramatically as the price rises. In other words, investors are taking a strategic position to gain massive returns with a small investment in the event of a huge Bitcoin price surge.

These moves are not a firm directional bet that Bitcoin’s price will actually rise to $300,000. Instead, they show that a strong sentiment-driven desire to gain exposure to potential upside is driving the market.

Meanwhile, the Ethereum options market shows a completely different pattern. A large number of traders are selling ETH puts set to expire on October 10 and BTC $120,000 calls, preparing for continued consolidation in Ethereum’s price.

This strategy allows traders to collect premiums by betting that neither asset will see a significant, short-term price increase. With Bitcoin’s dominance growing in the options market, much of the activity is shifting away from Ethereum.

A Historical Look at Bitcoin’s October

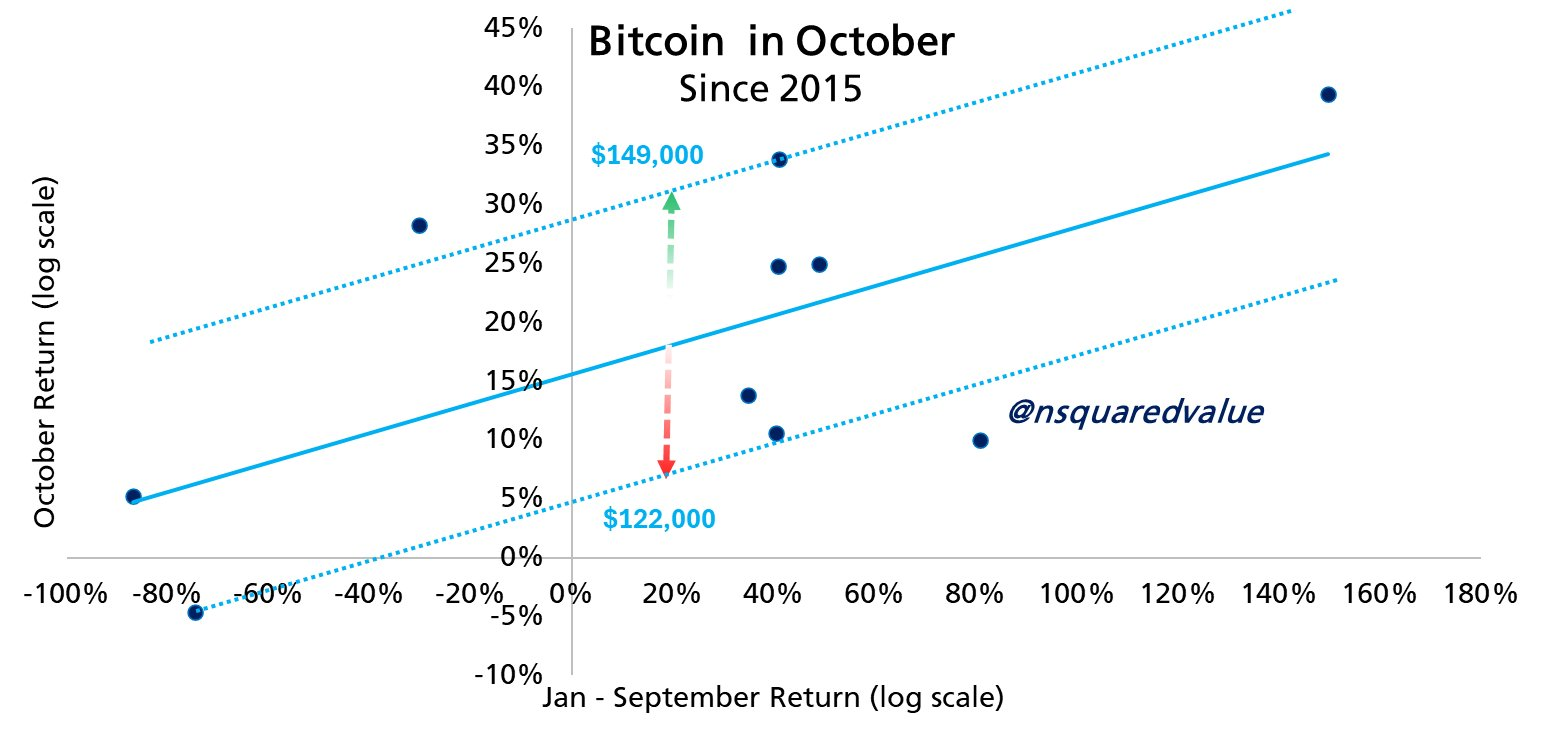

So, how high can Bitcoin’s price go? Bitcoin analyst Timothy Peterson addressed this question in a post on X, where he used historical data to forecast a potential price range for BTC in October.

“Bitcoin’s performance in October isn’t “set up” by September, its set up throughout the entire year,” the analyst said.

He explained that while Bitcoin has historically been strong in October, the strength of its rally is heavily influenced by the momentum of the first nine months of the year. The price increase from January to September determines the intensity of that year’s “Uptober.”

A chart comparing the January-to-September returns with October returns since 2015 shows that Bitcoin has historically amplified its preceding momentum. When year-to-date returns are high, October sees a bigger rally; when they are weak, October remains subdued.

In 2025, the January-to-September return was about 20%, marking the weakest bull market year on record. The data suggests October may deliver a weaker performance than in previous years.

Timothy Peterson said that from a historical perspective, the expected price range for this October’s rally is +7% to +31%. This would translate to a price range of $122,000 to $149,000.