The cost of producing a Bitcoin is taking a toll on Bitcoin miners whose machines are struggling to yield profits due to the flagship digital asset’s price difficulties.

According to data platform MacroMicro, the average cost of mining a single BTC at the start of June soared to $83,668 but slightly declined to around $72,000 as of July 2.

Bitcoin Mining Machines Becoming Unprofitable

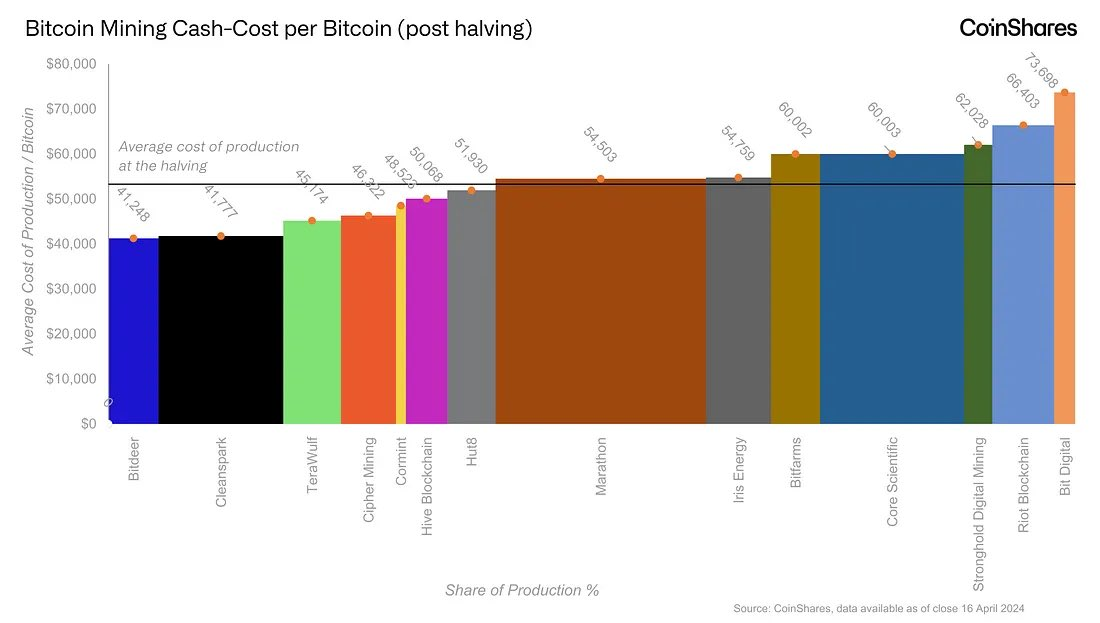

James Butterfill, CoinShares’ head of digital research, shared data showing that Bitcoin price was hovering around the average production cost during the April halving event. Per the data, half of the 14 identified miners, including Bit Digital and Riot Platforms, spend above the average cost to produce their BTC, while Tether-backed Bitdeer and Hut8 spend below average.

Read more: Making Passive Income From Crypto Mining: How to Get Started

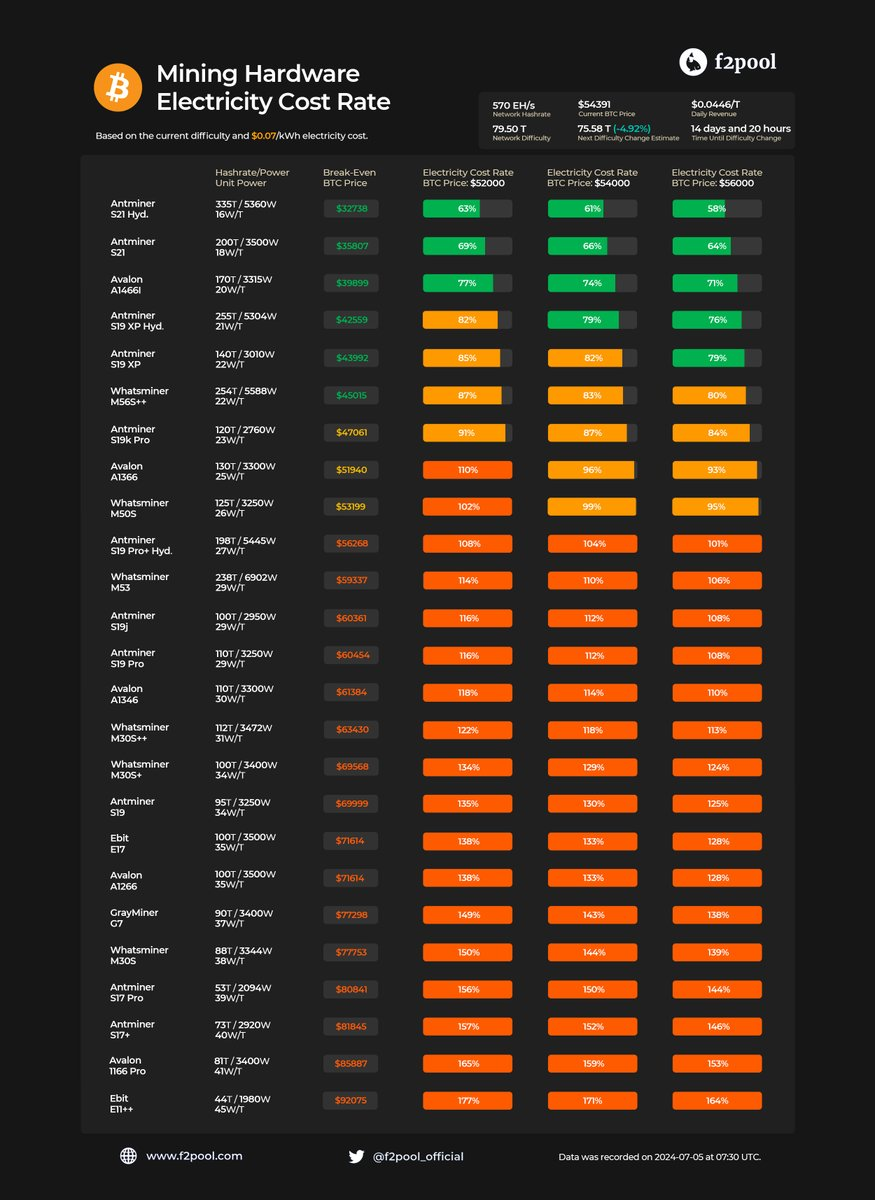

This situation was further confirmed by F2Pool, a Bitcoin mining pool operator. It stated that only ASIC machines with more than 23 W/T efficiency were profitable as of July 4.

According to F2Pool data, only six Bitcoin mining machines, including Antminer S21 Hydro, Antminer S21, and Avalon A1466I, are profitable at break-even Bitcoin prices of $39,581, $43,292, and $48,240, respectively. Similarly, other machines like the Antminer S19 XP Hydro, Antminer S19 XP, and Whatsminer M56S++ are profitable, with Bitcoin prices exceeding $51,456, $53,187, and $54,424, respectively.

However, Bitcoin mining difficulty dropped significantly on July 5, marking one of the most notable declines since the FTX collapse. F2Pool explained that this could make more machines profitable. They stated that at a BTC price of $54,000, ASICs with unit power of 26 W/T or less would become profitable. They added that they estimate energy costs at $0.07 per kWh.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Last week, BeInCrypto reported that Bitcoin miners were nearing capitulation levels last seen during the FTX exchange collapse. Consequently, Miners switched off unprofitable machines and intensified selling activities, offloading approximately 30,000 BTC, valued at $2 billion, last month.

“All the miners operating well below their profit points are finally decommissioning their inefficient machines or exiting the industry entirely. […] Presumably many held on for much longer than expected because they anticipated a significant price rise in bitcoin that more than compensated,” explained Con Kolivas, the admin of Solo CKPool.