The Bitcoin miners are in trouble as the bear market intensifies, whereas the shrimp addresses hit a new high.

After a new all-time high of $69,000 in Nov. 2021, Bitcoin (BTC) has been in a continuous downtrend for the last year. The recent FTX collapse has sent the price of Bitcoin to a new low below $16,000; BTC is down more than 75% from its all-time highs.

Bitcoin Miners are Capitulating

The energy prices are rising, and so is the Bitcoin mining difficulty. The only thing that is not on the rise is the Bitcoin prices. According to research from Glassnode and Cryptoslate, the production cost model is trading at $17,008, which is more than 5% higher than the current Bitcoin spot prices.

The production cost model estimates how much it costs miners to get 1 BTC in reward. As per the current prices, Bitcoin miners are making more than a 5% loss for every Bitcoin they produce. Due to these factors, Bitcoin miners are selling at the fastest rate in seven years. Miner selling crossed 400% this year.

Shrimp Addresses are Accumulating BTC While Whales Dump

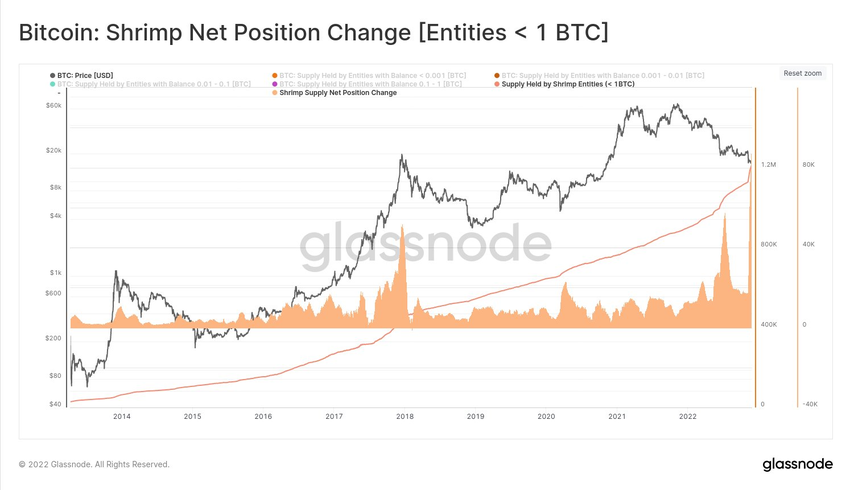

According to a Glassnode Twitter thread, Bitcoin shrimps have accumulated 96,200 BTC since the FTX collapse. Bitcoin shrimps are wallets that hold less than 1 BTC. The Bitcoin holding by shrimps has reached an all-time high.

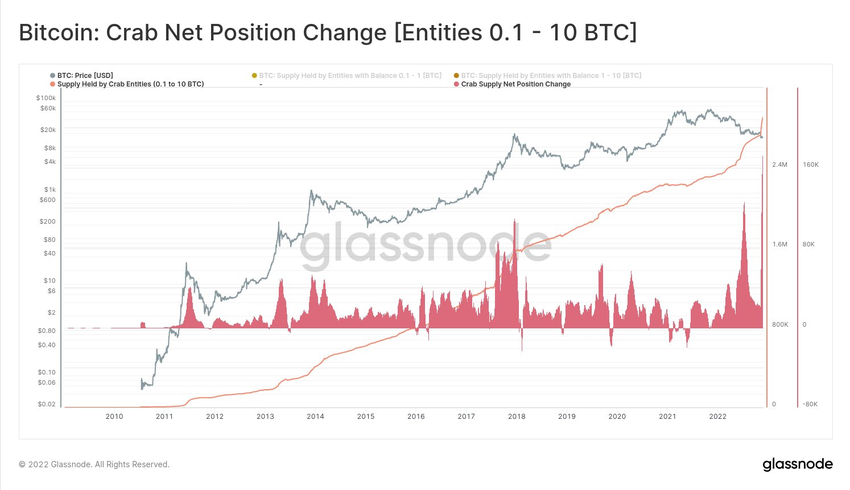

The BTC holding by Bitcoin Crabs is also at all-time highs as they accumulated over 191,600 BTC in the past 30 days. The wallets that hold up to 10 BTC are classified as Bitcoin Crabs.

The whales are surprisingly dumping their BTC holdings. Whales are wallets that hold more than 1,000 BTC. They have released approximately more than 6500 Bitcoin over the last month.

Many miners come in the category of whales as they accumulate the BTC they produced over the years. Is the whale dumping due to the miners’ capitulation we discussed above?

The Market just Dodged yet Another FUD

Today, a whale alert report of a wallet transferring over $2 billion worth of Bitcoin from Binance to some unknown wallet was the center of discussion. The community questioned if their funds on Binance were safe.

Changpeng Zhao (CZ), the CEO of Binance, cleared the air by tweeting that it was a part of the Proof of Reserve audit. He explained that “the auditor require us to send a specific amount to ourselves to show we control the wallet.”

The community calls this an irony because, two weeks ago, CZ tweeted that exchanges moving a large amount of crypto is a clear sign of a problem. A crypto auditor tweeted that they won’t ask clients to move such large amounts of funds to prove control over an address. What do you think, is it just a FUD?

Got something to say about Bitcoin miners, Binance FUD, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here