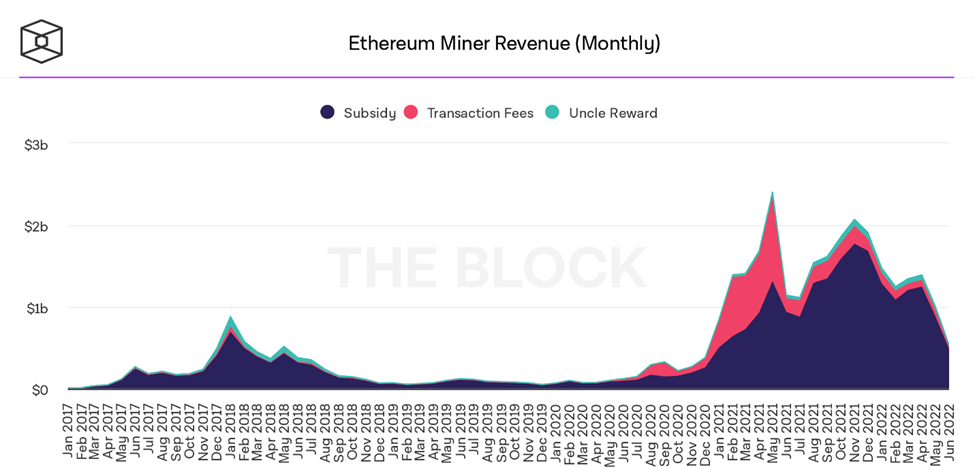

Bitcoin and Ethereum miners saw a further decline in revenue as bears from May carried on throughout June and led to sinking prices of both cryptocurrencies.

June proved to be the worst month for Ethereum miners in 2022. According to Be[In]Crypto Research, ETH miners were able to generate around $549.58 million in revenue in the sixth month of the year.

Ethereum miners’ revenue for June was down $460.42 million from May 2022’s value of around $1.01 billion.

The total profitability of Ethereum over the past year was also down by 51% since June 2021, which saw $1.14 billion in revenue recorded.

Bitcoin outpaces Ethereum mining revenue

Bitcoin surpassed Ethereum mining revenue for the first time since December 2020. In the last month of 2020, Bitcoin miners’ revenue was approximately $692.32 million while Ethereum’s was in the region of $380.88 million.

While Ethereum miners managed $549.58 million in June revenue, Bitcoin miners generated approximately $667.94 million.

Like Ethereum, Bitcoin’s revenue dipped by 26% from May. May 2022 saw Bitcoin mining bring forth total revenue of $906.19 million. Bitcoin mining also saw a year-over-year monthly decline in June. June 2021 saw around $839.09 million in revenue generated, while 2022’s figure dropped by 20%.

Miners moved away from Ethereum in June 2022

Despite the overall market capitalization of the crypto finance space shedding more than $1.3 trillion in the first half of the year, Ethereum remains the second-largest cryptocurrency by market value.

With that said, miners benefited more from Bitcoin than Ethereum to close out the second quarter of 2022.

Overall, Bitcoin miners’ revenue outpaced Ethereum by $118.36 million.

Aside from June, Ethereum miners had the lion’s share of revenue in the first five months of the year.

In January, ETH outpaced BTC by $260 million. Due to the geopolitical events that arose from Russia’s invasion of Ukraine, mining revenue dropped but ETH still surpassed BTC by $190 million. ETH miners shared $130 million more in revenue than BTC miners in March. In April and May, miners of the ETH coin earned $230 million and $103 million more than BTC miners respectively.

What caused the plunge in mining revenue?

To understand the plunge in mining revenue, we should consider how mining revenue is calculated.

Miners’ revenue is calculated by multiplying the total number of coins earned by contributing to the validation of transactions by the price of coins (in this case, BTC and ETH) within a given period.

With this in mind, we can conclude that the steep decline in the prices of digital assets can be credited as the cause for the plunge in mining revenues.

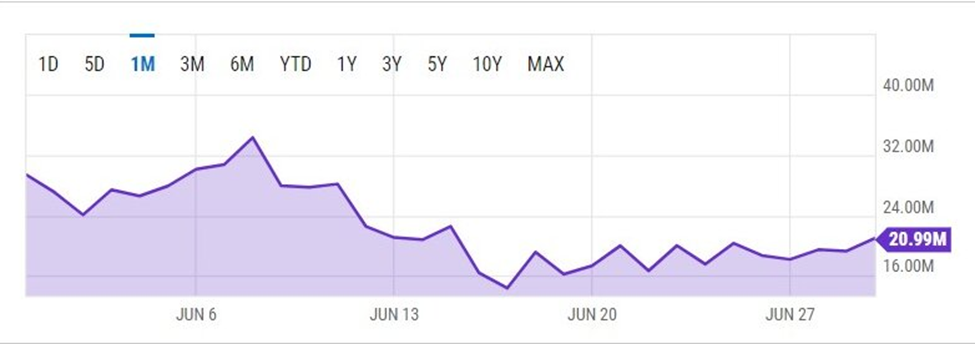

Throughout June, Ethereum traded between $896.11 and $1,965. When we compare this to June 2021, Ethereum traded in the price range between $1,707 and $2,891.

In June, Bitcoin traded in the price range between $17,708 and $31,957. In June 2021 miners made more from revenue while BTC traded between $28,893 and $41,295.