Bitcoin mining giant Marathon Digital has shown extremely strong hands through this bear market, having yet to sell any Bitcoin (BTC) since Oct 2020.

The company revealed its finances and current status in a production and mining operation update. Despite the broader Bitcoin miner exodus, Marathon reported that it had produced 707 BTC in the second quarter of 2022, an increase of 8% year-on-year from the second quarter 2021.

It also revealed that the company now holds 10,055 BTC, worth an estimated $222.5 million at current prices. It has not sold any of the assets since October 2020.

Marathon chairman and CEO, Fred Thiel, said that the firm “continued to work through several operational obstacles as we progressed with installing miners in Texas in preparation of energization.”

Production dropped in June to just 140 BTC, its lowest month since March 2021. The dip was caused by a severe storm that passed through the Hardin, Texas, region on June 11. The weather event damaged the power generating facility, leaving 30,000 Marathon miners in the region without power.

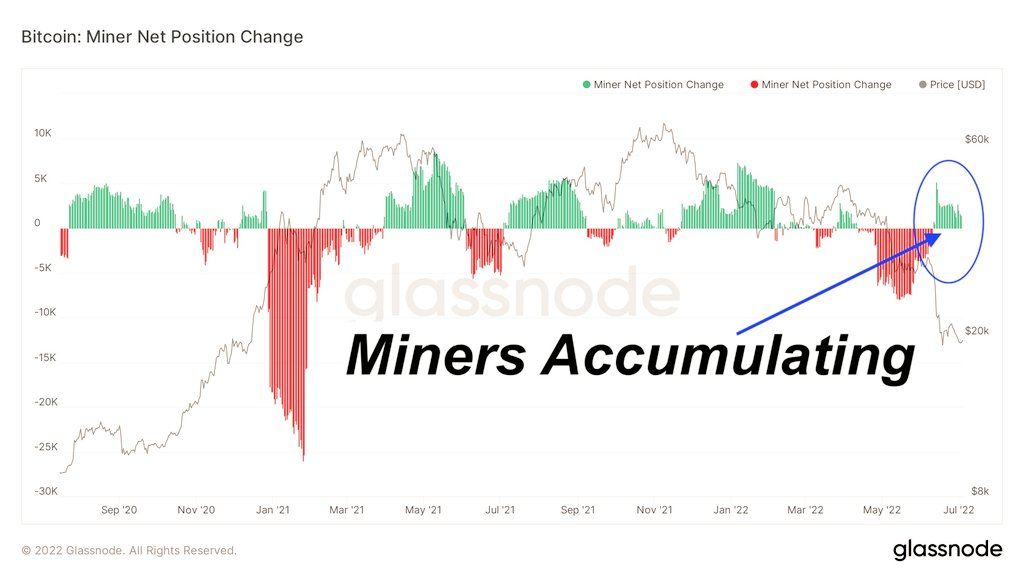

Bitcoin miners back accumulating

Year-to-date through June 30, Marathon has produced 1,966 BTC, which is a 132% increase over the same time period in the prior year, it added.

It is one of the few mining companies that have battled through the bear market without powering down or selling assets. According to analysis from Arcane Research, several publically listed mining companies sold 100% of their entire output earlier this year. These include Bitfarms, Riot Blockchain, and Core Scientific.

The research also noted that Marathon has the most cash outflows for remaining machine payments this year with an estimated $260 million, however it has a very healthy balance sheet.

On-chain analytics provider Glassnode has reported that Bitcoin miners are back in accumulation mode after several months of heavy selling. The net position change for miners is back in the green again now.

However, miners’ BTC balance has just reached a one-month low of 1.8 million, it reported on July 8.

BTC reclaims $22K

The asset has made a gain of 7.9% on the day enabling it to reclaim the $22K price level during Friday morning’s Asian trading session.

The bears are not out of the woods yet, however, as BTC remains within its range-bound channel and needs to break resistance just above current levels to get out of it.

Several key dates for macroeconomic factors are still looming large in July which could send crypto markets back south once again.