Data from an on-chain analysis firm suggests that Bitcoin (BTC) miners’ capitulation may be ending, signaling the onset of a potential bull market for Bitcoin.

As Bitcoin shows signs of recovery, currently trading at $60,456 with an approximate 2.8% increase in the last 24 hours, the overall market sentiment is turning positive. With miners no longer under severe pressure to sell, the market conditions are increasingly conducive to growth.

Bitcoin Might be at the Early Stages of a Bull Run

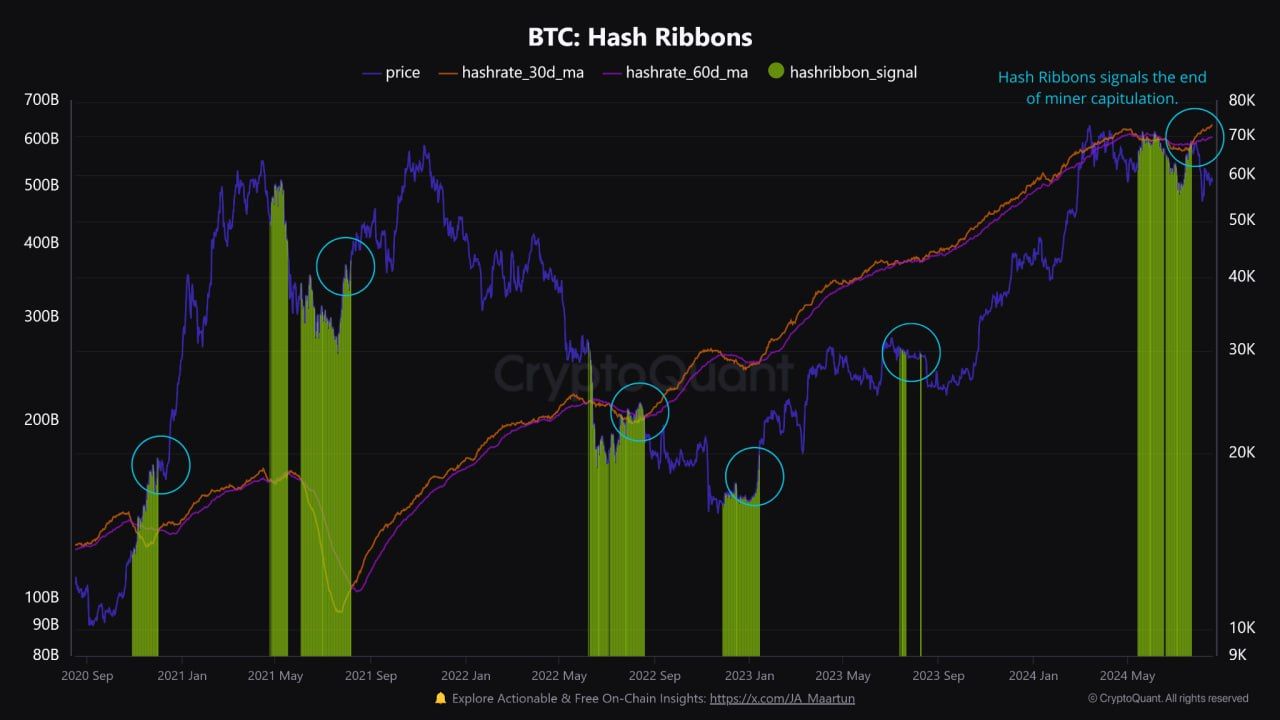

CryptoQuant highlights the Hash Ribbons indicator, which observes the 30 and 60-day moving averages of the Hash Rate. This tool has just signaled the end of miner capitulation, coinciding with the Hash Rate reaching a new peak of 638 exahash per second (EH/s).

The development is notable as it marks the first such rebound since the Bitcoin halving, which reduced the block reward for miners to about 3,125 BTC, or roughly $185,000.

“Although the indicator isn’t meant to pinpoint the exact price bottom, it often precedes higher prices by signaling a reduction in selling pressure from miners,” CryptoQuant explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

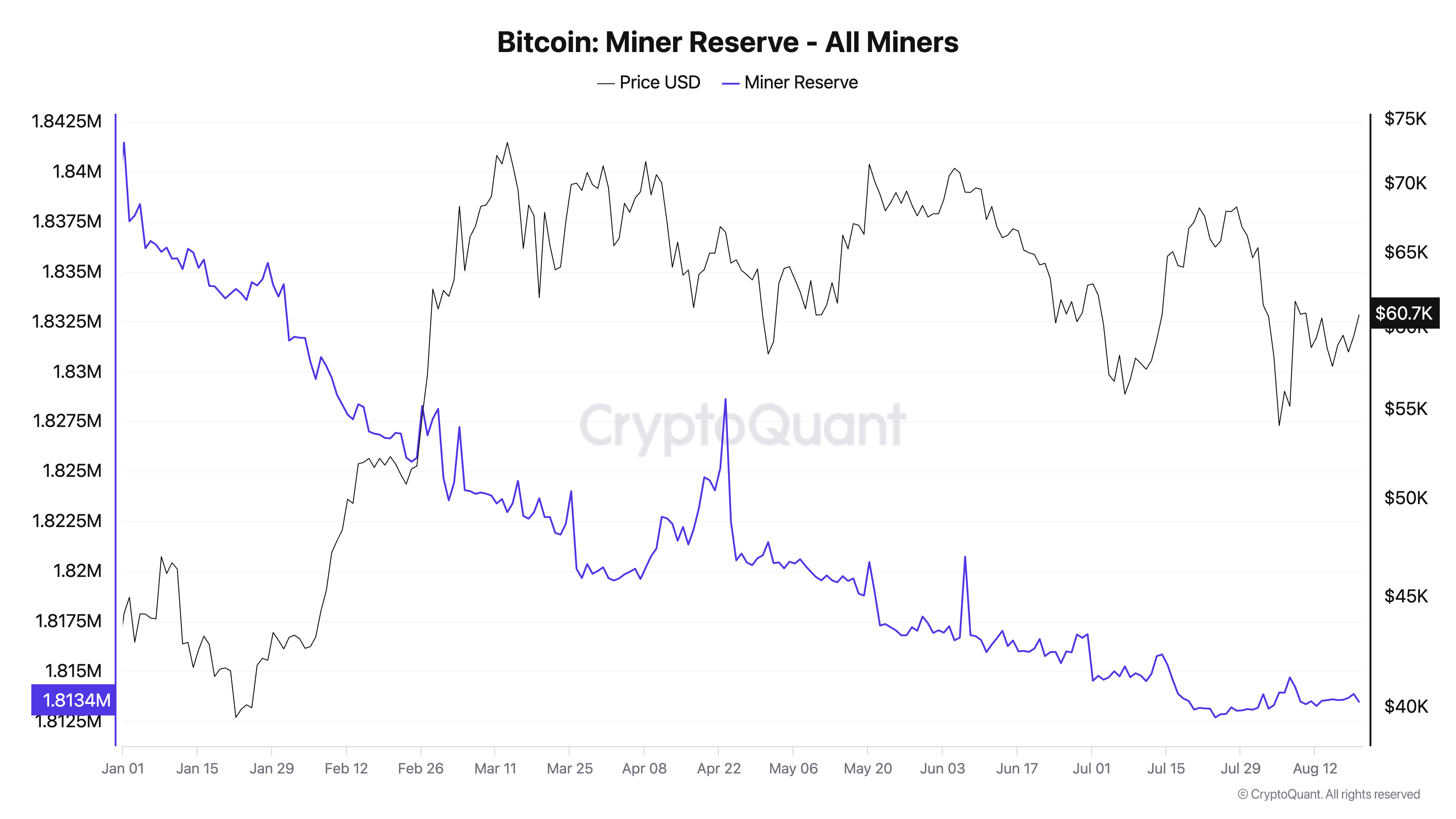

In late June, BeInCrypto reported levels of miner capitulation comparable to those seen during the FTX collapse. This was due to high operational costs surpassing the revenue from mining the cryptocurrency. According to data from CryptoQuant, from January to August 2024, miners sold around 28,018 BTC, valued at $1.68 billion at current market prices.

In an interview with BeInCrypto, Maartunn, an analyst at CryptoQuant, discussed that with the economic pressures on miners decreasing, there is a reduced necessity for selling mined Bitcoin.

“Despite the lower mining rewards, mining company’s have found a way to keep running their business and deliver hashrate to the network. This means that they can hold their Bitcoin reserve and don’t have to sell to cover mining costs such as new machines, electricity, or staff,” Maartunn told BeInCrypto.

Additionally, the on-chain demand for Bitcoin suggests that the BTC consolidation phase may be nearing its end.

“After Bitcoin reached the $57,000 mark, there was an increase in the average daily token transfer volume from $650,000 to $765,000. This coincides with Bitcoin’s price stabilization in the local consolidation range of $57,000-$68,000,” Axel Adler Jr., another analyst, observed.

This surge in transfer volume is largely due to panic selling by holders. However, Bitcoin’s price has shown resilience, indicating that the market has effectively absorbed the selling pressure.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

The stable price range during this period points to a solid demand for Bitcoin, which investors view as attractively priced. Hence, Adler Jr. believes that BTC is approaching the final phase of the market consolidation. Moreover, the typical pattern following a Bitcoin halving supports an outlook for the impending bull market.

“The average cycle starts 170 days after the Bitcoin halving. We’re currently at day 121,” crypto analyst Quinten pointed out.