Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and put the charts away because something unusual seems to be happening across crypto markets. Price swings, institutional whispers, and uneasy macro signals are blending into a narrative that traders are only beginning to fully grasp in real time.

Crypto News of the Day: Rumors of Institutional “10 AM Dumps” Collide with Bearish Macro Warnings

Bitcoin’s recent price action is being interpreted through two competing lenses:

- Growing macroeconomic caution as reported in a recent US Crypto News publication.

- Rising speculation about institutional trading behavior.

On the one hand, some analysts argue that broader financial conditions are becoming less supportive of risk assets. On the other hand, others question whether large market participants are actively shaping short-term volatility.

The result is a market narrative increasingly driven by distrust and uncertainty about how modern crypto markets function, not just by charts and liquidity.

Macro Signals Suggest Risk Assets Face Pressure

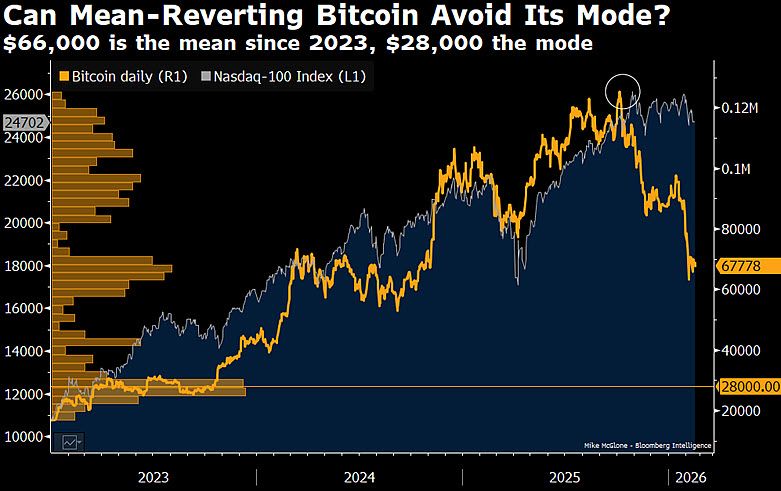

Macro strategist Mike McGlone recently warned that Bitcoin’s price behavior may reflect bigger structural risks across financial markets.

McGlone argued that the pioneer crypto has reverted to a long-term mean near $66,000, while historically clustering closer to $28,000.

“This Chart Suggests Why NOT To Buy Bitcoin or Most Risk Assets,” McGlone wrote, adding that the data highlights the heavy dependence of markets on continued strength in the Nasdaq-100.

He also suggested that declining crypto prices may be “front-running a bit of reverse wealth effect.” This implies that falling asset prices could precede a tightening of liquidity and a reduction in investor risk appetite.

Such conditions have historically weighed on speculative assets, including cryptocurrencies and growth equities.

Rumors of Coordinated Selling Gain Traction

At the same time, a separate narrative has been circulating widely in crypto trading circles. Milk Road analysts and market commentators have discussed persistent rumors that certain institutional trading desks may be triggering sharp selloffs shortly after the US stock market opens.

According to these claims, large sell orders hitting Bitcoin and related ETFs around 10 a.m. Eastern Time may trigger panic, liquidate leveraged positions, and expose thin liquidity pockets.

Traders allege that the same firms could then accumulate positions at lower prices.

While these allegations remain unverified rumors, similar patterns have been observed repeatedly since late 2025, drawing increasing scrutiny from market observers.

ETF Accumulation Raises Questions

The speculation has intensified following disclosures showing that Jane Street has become one of the largest buyers of BlackRock’s iShares Bitcoin Trust (IBIT). Figures widely cited by analysts suggest the firm accumulated more than 20 million IBIT shares by late 2025.

If this is any guide, then Jane Street is already a significant institutional holder of Bitcoin exposure.

The discussion has fueled debate about whether institutional flows are primarily supportive for Bitcoin’s long-term outlook or whether short-term trading strategies may be amplifying volatility.

Even so, persistent speculation about coordinated trading tactics could undermine retail confidence. This is particularly true in a market where leverage, thin liquidity, and automated liquidations can accelerate price swings.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Analyst claims $5 billion XRP selling flow on Upbit: What it means for price

- Hyperliquid taps famous crypto lawyer for CEO in $28 million US policy initiative.

- Strategy’s latest Bitcoin buy drops average by $25 —Why MSTR stock could drop more.

- Base loses $1.4 billion in TVL amid growing rift over vision, culture, and execution

- Bitcoin Cash sets multiple records in February amid extreme market fear

- AI takes over markets and social media: Why crypto AI tokens are missing the rally?

- $870 million in Solana supply unlocks — Does it ‘flag’ SOL price risk?

- Peter Thiel cuts ties with ETHZilla as treasury firms face mounting pressure

Crypto Equities Pre-Market Overview

| Company | Close As of February 17 | Pre-Market Overview |

| Strategy (MSTR) | $128.67 | $129.11 (+0.34%) |

| Coinbase (COIN) | $166.02 | $166.80 (+0.47%) |

| Galaxy Digital Holdings (GLXY) | $21.30 | $21.26 (-0.19%) |

| MARA Holdings (MARA) | $7.51 | $7.50 (-0.13%) |

| Riot Platforms (RIOT) | $14.65 | $15.29 (+4.37%) |

| Core Scientific (CORZ) | $17.23 | $17.20 (-0.17%) |