Bitcoin’s price rally appears to have stalled after a week of all-time highs (ATHs), with the cryptocurrency now facing significant challenges.

The bullish momentum that propelled BTC to $93,242 has slowed, raising concerns about potential corrections as market conditions begin to shift.

Bitcoin Faces Potential Reversal

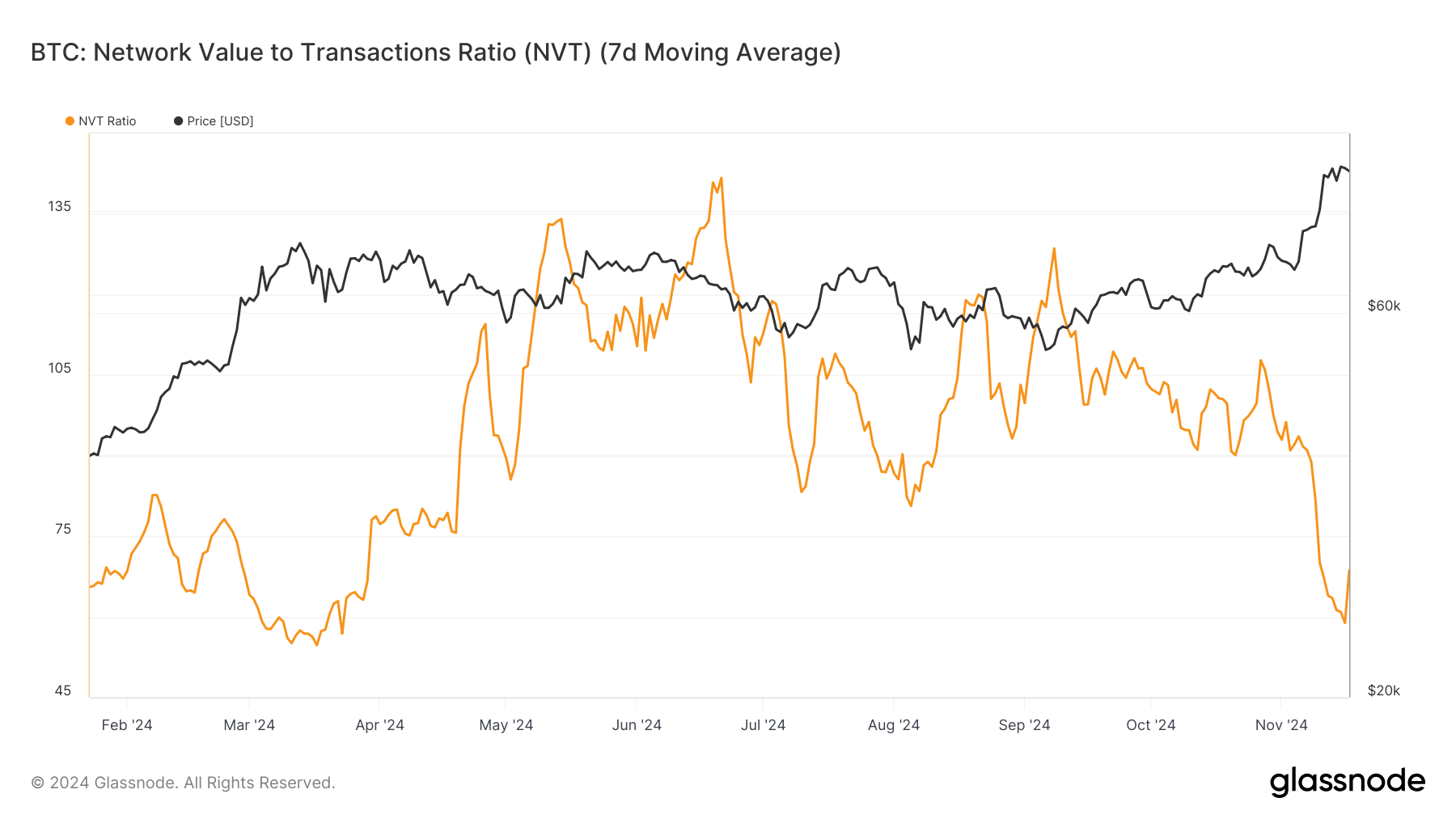

The NVT (Network Value to Transactions) Ratio, a critical metric for analyzing Bitcoin’s value, has spiked after recently hitting an eight-month low. A low NVT ratio typically indicates that the network’s transactional activity is aligned with its value, signaling a balanced and sustainable market.

However, the current uptick suggests that Bitcoin’s network value may be outpacing its transaction activity. Historically, such scenarios have preceded corrections, highlighting the importance of closely monitoring this metric. If the trend persists, it could contribute to downward pressure on BTC’s price.

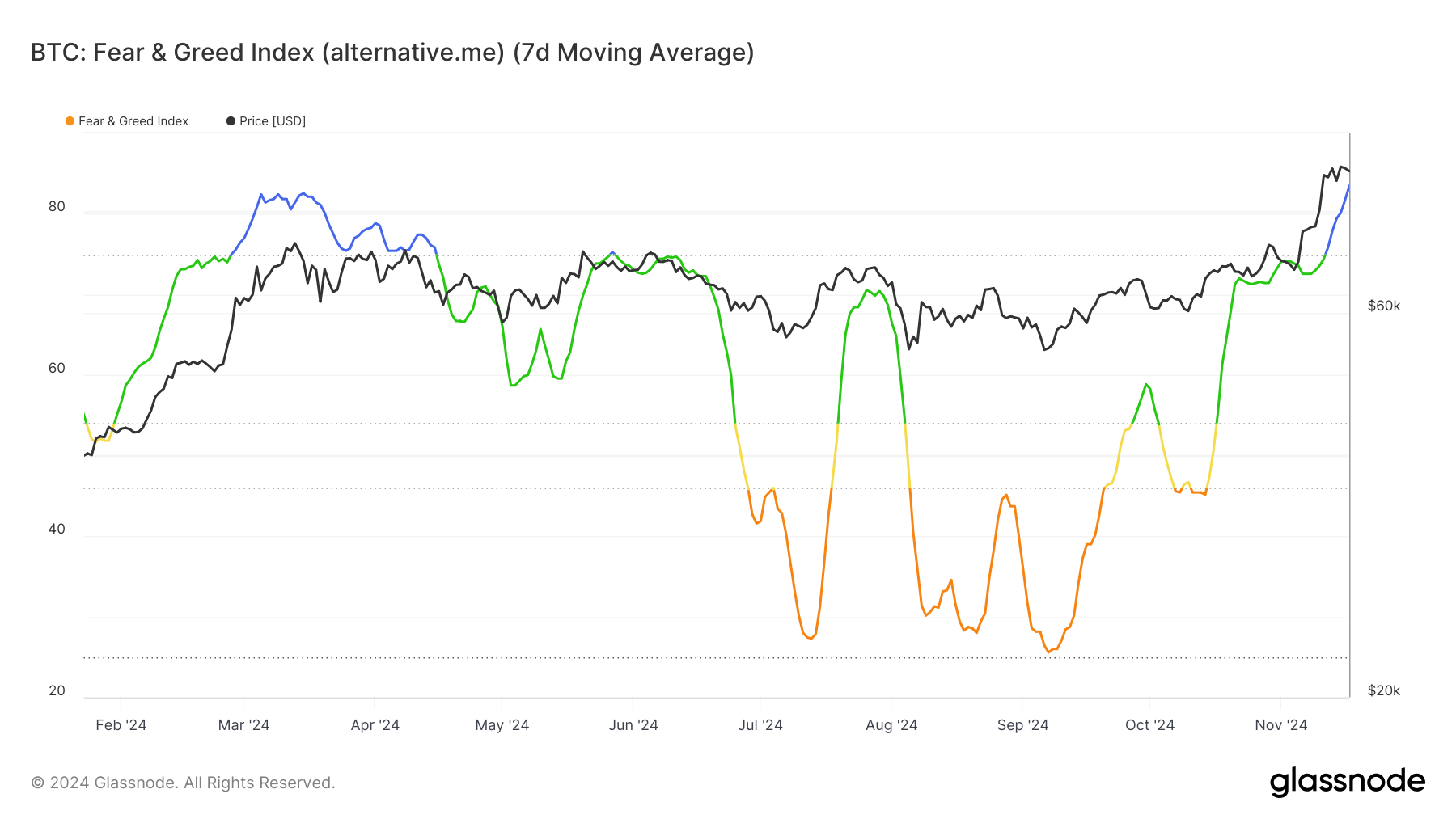

The Fear and Greed Index, a barometer for market sentiment, is now in the “extreme greed” zone, which has historically signaled potential reversals in Bitcoin’s price. Extreme greed often indicates that investors are overly optimistic, leaving the market vulnerable to sudden sell-offs.

While Bitcoin has demonstrated resilience during similar conditions in the past, this heightened sentiment could mark a tipping point. Combined with declining transaction activity, BTC’s macro momentum may face increasing challenges in sustaining its current price levels.

BTC Price Prediction: Finding Support

Bitcoin is currently trading at $90,673, holding above the critical support of $88,691 while facing resistance at $92,000. If BTC consolidates within this range over the next few days, it could fend off a broader correction and maintain stability.

However, a break below the $88,691 support could trigger a decline toward $85,000. If this level fails to hold, Bitcoin risks falling further to $80,301, exacerbating bearish sentiment.

Conversely, a bounce off $88,691 and a successful breach of the $92,000 resistance could revive bullish momentum. This would allow Bitcoin to aim for a new ATH above $93,242, effectively invalidating concerns of a reversal and reinforcing its long-term upward trajectory.