Bitcoin price has once again shown its resilience by navigating through a volatile period known as the “Danger Zone.”

This phase follows Bitcoin’s halving event, which significantly impacts its price. Emerging stronger, Bitcoin is now drawing investors’ attention.

Bitcoin Price Moves From Danger to Accumulation

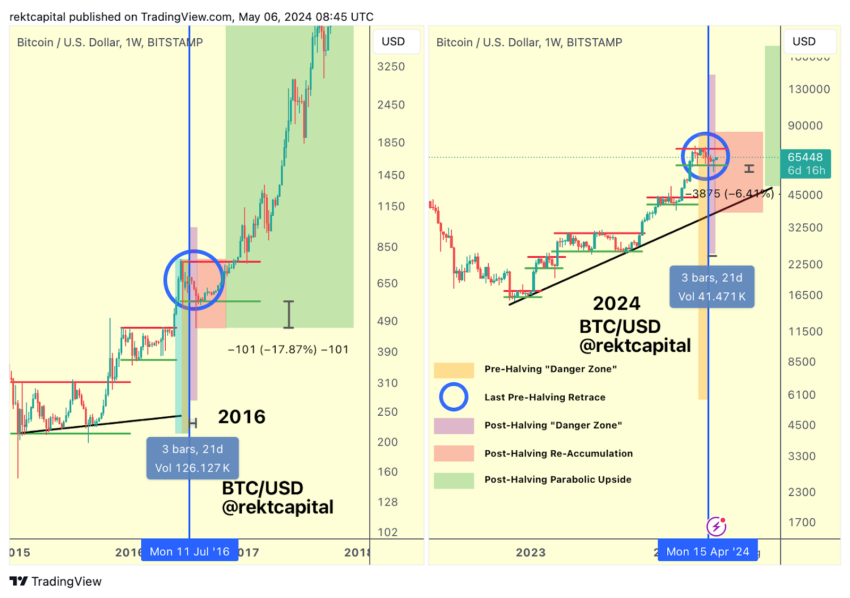

Technical analyst Rekt Capital describes the “Danger Zone” as three weeks of potential downside volatility after Bitcoin’s halving, a recurring cycle in its history.

In the past, this phase saw sharp price drops, like the 17% decline in 2016. However, the latest cycle experienced a milder 6.5% dip, indicating a maturing market. This downturn was brief, as Bitcoin soon rallied by 15%, confidently exiting the lower bounds of its re-accumulation range.

Bitcoin’s resilience underlines its consistent cycle post-halving. Despite expected volatility, the accumulation phase started earlier than predicted, with a strong support level that investors quickly leveraged.

“Time-wise, however, it isn’t – so we’ll need to wait a week for the confirmation of this zone being over for it to be official, but it’s a mere formality at this point,” Rekt Capital said.

As a result, the market’s response has preemptively quelled fears, suggesting that the period of significant price corrections might already be over.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The broader economic environment bolsters Bitcoin’s positive prospects, especially the weakening US dollar. Notably, macroeconomist Henrik Zeberg recently highlighted a downturn in the US Dollar Index (DXY), which tracks the dollar against six major currencies.

Zeberg links this trend with falling yields on government bonds, creating a prime environment for cryptocurrencies.

This observation is crucial, given Bitcoin’s historical inverse correlation with the US dollar. When the DXY hit a two-decade peak in September 2022 amid aggressive Federal Reserve policies, Bitcoin fell to about $16,000. With the Fed pausing rate hikes as inflation eases, the DXY has dropped 2% since the month began, enhancing conditions for Bitcoin’s rise.

“Market participants were expecting a 75 to 100bps cut in interest rates during 2024, but the Federal Reserve has kept interest rates stable in response to the on-going inflation. Current expectations are for a 25 to 50bps cut during Q4 2024, with the first 25bps cut potentially occurring in October or November 2024 if inflation data don’t worsen in the coming months,” Matteo Greco, Research Analyst at Fineqia, told BeInCrypto.

This scenario is particularly relevant as Bitcoin surpasses 1 billion on-chain transactions. It is marking its growing adoption and integration into the global financial system. The favorable macroeconomic conditions and inherent market strength suggest Bitcoin may see sustained growth.

“1 Bitcoin is about ten times more scarce than 1 kilo of gold and is similarly priced. It should probably get repriced this cycle so that Bitcoin flips gold, passing gold parity at around 10 kilos per Bitcoin,” said Adam Back, Blockstream CEO.

Read more: Bitcoin Price Prediction 2024/2025/2030

As Bitcoin exits its “Danger Zone,” the road ahead is ripe with growth potential, driven by macroeconomic trends and its innate market resilience. With historical patterns as a guide and current economic indicators favoring cryptocurrencies, Bitcoin‘s post-halving path looks set for a bullish continuation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.