Bitcoin has seen some price fluctuations in recent days, trading slightly below $43k at the time of this writing after dropping 1% over the last 24 hours.

While bullish momentum has slowed down recently, some analysts remain optimistic about Bitcoin’s long-term prospects, especially heading into 2024.

In the nearer term, the crypto market appears poised for an altcoin run while Bitcoin trades sideways. Recent tweets from prominent crypto analysts point to ample room for altcoin growth even if Bitcoin enters a corrective phase. As we examine these perspectives in more detail, an emerging project called Bitcoin Minetrix (BTCMTX) also warrants a closer look as a way to earn passive Bitcoin mining rewards.

Bitcoin Price Action and Market Outlook

After breaking through crucial resistance at $40k in early December, Bitcoin had traded solidly above that level for most of this month. However, bulls have struggled to extend the rally much beyond $45k.

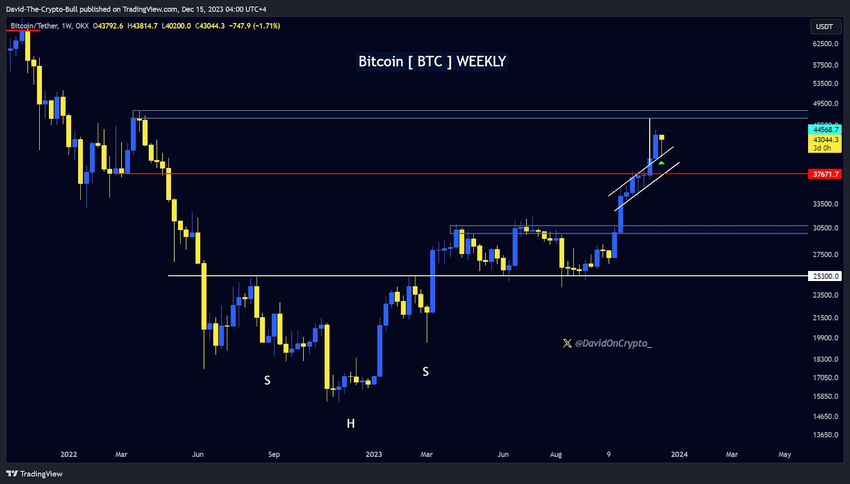

According to crypto analyst David, who goes by The Crypto Bull on Twitter, historical patterns suggest new all-time highs may not arrive until Q4 2024 based on previous market cycles. David tweeted that the current corrective phase should begin in Q1 2024 and last approximately three months. In his view, any dips in altcoins during this period will likely be short-lived until March.

Going into Q1 2024, David expects the next correction to potentially occur around the $47k level for Bitcoin. As he explained, “Makes no sense being heavy on $BTC up here before halving is why I sold 60% on Dec 10 at $43,900 into Altcoins.” Among those altcoin picks is $INJ, which David added more to his portfolio around $18 right before it rallied to $43. With Bitcoin rangebound over the coming months, he anticipates “more fireworks on Alts in Q1.”

Meanwhile, crypto trader CrediBULL remains cautiously optimistic about the current market structure. In a recent tweet, he noted that Bitcoin is “Not showing the strength I would have liked to have seen by now.” As a result, he thinks “we may go for a quick push lower here before we are ready to move back up.” CrediBULL closed part of his long position and is looking to buy the dip if Bitcoin drops briefly under $41.7k.

So while short-term uncertainty lingers, the long-term picture still appears bullish. And based on history, altcoins could significantly outperform Bitcoin in the year leading up to the next halving event.

Promising Altcoin Setup Emerging

Renowned crypto analyst Rekt Capital recently highlighted a retest of key levels in the total altcoin market cap that could propel substantial gains. Historically, when this set of conditions occurs the altcoin market cap rises considerably.

After this latest retest finished successfully, Rekt Capital noted the total altcoin market cap has already expanded by over 40%. With Bitcoin trading sideways for now, assets like Ethereum and smaller cap gems appear positioned to continue rallying.

The recent analyses and tweets from David, CrediBULL, and Rekt Capital all seemingly point to an optimal setup for altcoins for early 2024 and beyond. While short-term fluctuations in either direction can certainly occur, the confluence of historically bullish patterns and structures hints at strong upside potential.

Bitcoin ETF News

While some crypto traders such as CrediBULL remain cautiously optimistic about price action in the near-term, an exciting development on the regulatory front could propel Bitcoin higher in 2024. FOX Business recently confirmed that the SEC has set a date of December 29th for final amendments to spot Bitcoin ETF applications. The SEC clarified that fully completed filings submitted by this Friday will be included as part of the first wave under consideration.

Furthermore, as a reminder, the SEC has opened a public consultation window spanning January 5-10, 2024. During this short window, the SEC will either approve or disapprove the Bitcoin ETF applications. With analysts generally anticipating approvals at that stage, Bitcoin ETFs coming to market could remove regulatory uncertainty and incentivize renewed institutional investment flow into Bitcoin.

Bitcoin Minetrix Poised to Capitalize on BTC and Crypto Growth

Against this backdrop of intrigue surrounding both Bitcoin and altcoins, an emerging project called Bitcoin Minetrix (BTCMTX) offers a way to passively earn BTC rewards. Having smashed several presale milestones already, including over $6 million raised, Bitcoin Minetrix allows staking a native token to gain cloud mining power. This grants users Bitcoin profits without expensive hardware or expertise.

The model provides simplified access to Bitcoin mining, which has traditionally been limited to those able to invest in specialized gear and handle considerable energy demands. Bitcoin Minetrix removes these barriers through an innovative staking and mining credits system.

By staking BTCMTX tokens, holders receive mining credits enabling them to tap into cloud mining capacity. This lets anyone start earning Bitcoin passively without operating actual ASIC miners or dealing with complicated setups.

The presale has steadily marched through stages, filling up fast as it goes. Post-presale, plans are quickly progressing for exchange listings to boost liquidity along with a supporting mobile app and ramped up mining power.

The impressive progress by Bitcoin Minetrix grabbed the attention of popular crypto analyst No Bs Crypto. He projects BTCMTX has sizable upside potential with the capability to “100x” if impressive momentum continues. Fellow YouTuber Connor Kenny also commented recently about Bitcoin Minetrix, highlighting exceptional income generation through its staking and mining rewards structure.

Conclusion

With cryptocurrencies potentially on the verge of major moves bullishly in 2024 and beyond, Bitcoin Minetrix emerges as an intriguing option. By merging staking rewards with Bitcoin mining credits, BTCMTX unlocks simplified passive income generation.

The vast presale success and community excitement around Bitcoin Minetrix signals genuine promise. As exchange listings and supporting development unfolds in the coming months, BTCMTX may capture substantial upside on its way to realizing a streamlined crypto mining vision centered on rewards for all.