Crypto traders and investors will witness approximately $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Expiring options tend to cause notable price volatility, meaning crypto market participants should monitor today’s developments closely and possibly adjust their trading strategies around 8:00 UTC.

$2.95 Billion Bitcoin and Ethereum Options Expiring

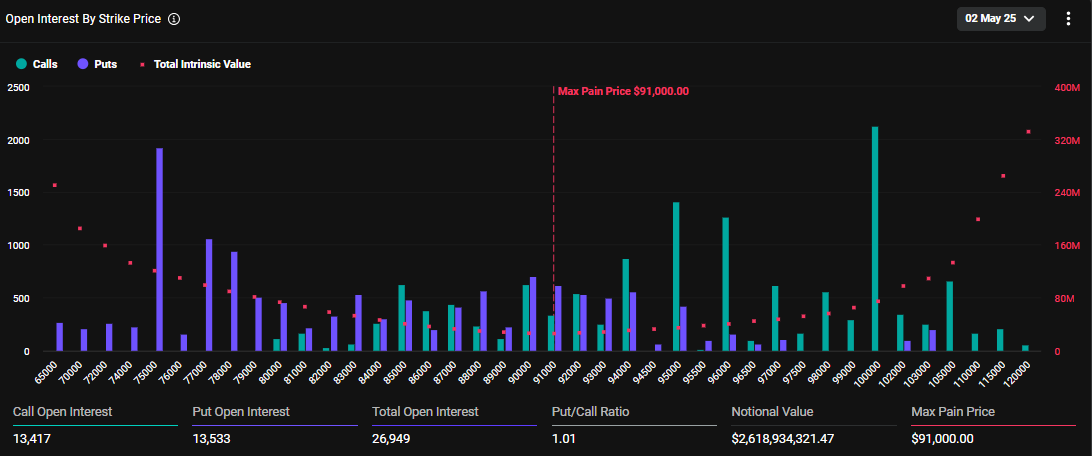

Data on Deribit shows that 26,949 Bitcoin contracts will expire today. The expiring options have a notional value of approximately $2.6 billion.

The maximum pain point at which the asset will cause financial losses to the greatest number of holders is $91,000. At this point, most contracts will expire worthless.

Bitcoin’s put-to-call ratio is 1.01. This suggests a bearish sentiment as investors make more sales (Put) than purchase (Call) orders.

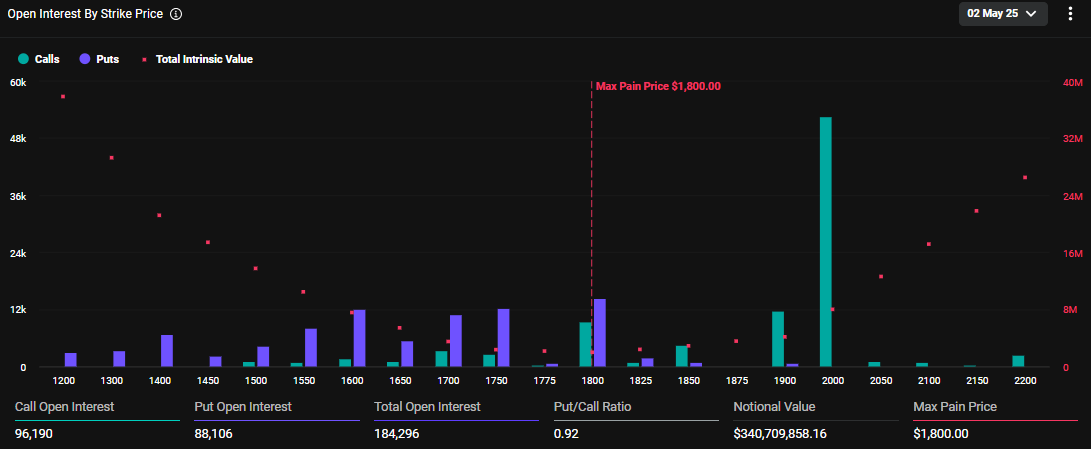

In contrast, Ethereum’s put-to-call ratio is 0.92, indicating a generally bullish market outlook for ETH. Based on Deribit data, 184,296 Ethereum contracts will expire today. These expiring contracts have a notional value of approximately $340.7 million and a maximum pain point of $1,800.

Ethereum has seen a modest increase of 2.27% since Friday’s session opened, to trade at $1,848 as of this writing.

Despite Bitcoin sales calls exceeding purchase calls, analysts at Greeks.live cite a predominantly bullish sentiment in the market. They also note that many traders expect a push toward $100,000, citing low volatility and market structure.

“Key levels being watched include the $96,000 NPOC [Naked Point of Control] that was just hit and the $94,400 rolling VWAP [Volume-Weighted Average Price], though some express concerns about sell in May and go away seasonality,” wrote Greeks.live.

With low volatility, traders see opportunities for long positions. According to Greeks.live, market makers are selling calls at 30% implied volatility (IV) to collect gamma, while leverage remains low. This suggests a potential upside with traders anticipating more rate cuts.

Collecting gamma means selling options to profit from stable prices, managing small price moves, and earning premiums in a low-volatility market.

With ETH underperforming compared to BTC, some traders are shorting it. Meanwhile, others focus on BTC’s steady rise and consider July volatility positions for vega gains. This reflects a strategic split in market focus.

Vega gains happen when option prices rise due to increased market volatility, benefiting traders holding options with higher Vega sensitivity.

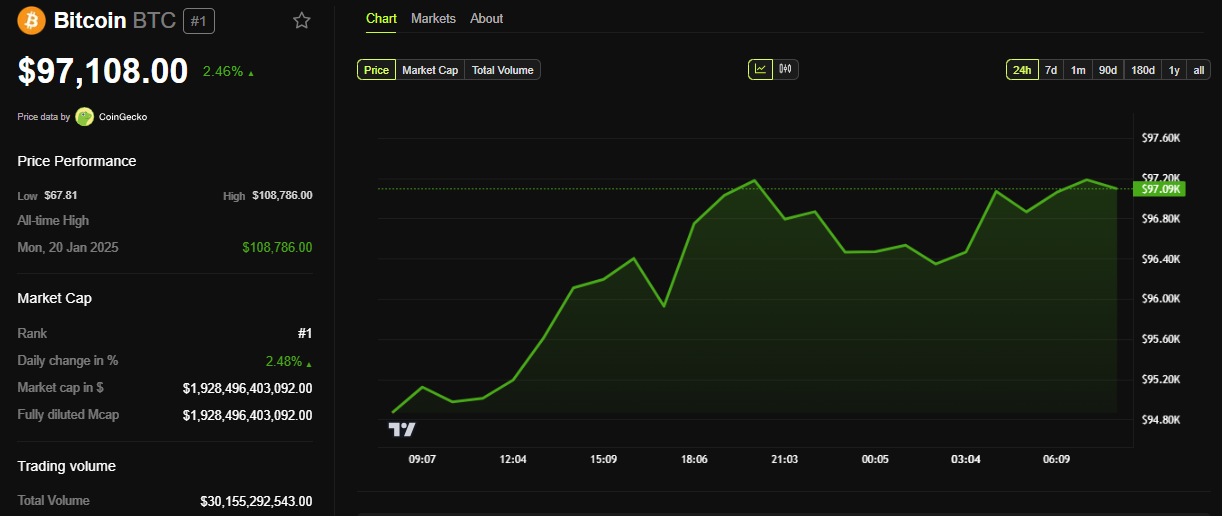

Meanwhile, analysts at Deribit agree that some traders are focusing on Bitcoin’s steady rise. Against this backdrop, there is significant BTC stacking above $95,000.

“Market shows strong BTC call stacking above $95K, what impact will the expiry do?,” Deribit analysts posed.

As of this writing, Bitcoin was trading for $97,108, with gains of almost 3% over the last 24 hours.

Therefore, heavy Bitcoin call options stacking above $95,000 points to trader optimism for a price surge.

Notwithstanding, it is imperative to note that options expiring can trigger volatility, as seen with last week’s $8.05 billion options expiry, which caused short-term price consolidation. Nevertheless, volatility around options expiry tends to ease down once the contracts are settled around 8:00 UTC on Deribit.