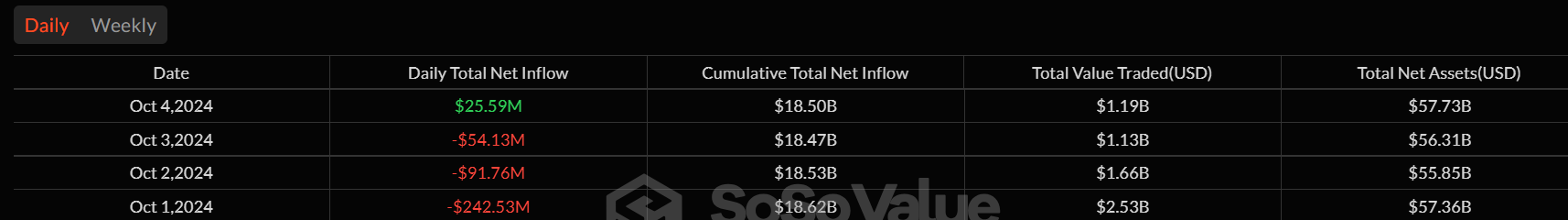

On October 4, US spot Bitcoin exchange-traded funds (ETFs) recorded their first inflow of the month, rebounding from outflows totaling $400 million in the initial three trading days.

This uptick coincides with the release of a significant upgrade to Bitcoin Core, the open-source software that underpins the leading cryptocurrency.

Bitcoin ETF Sees First Inflow in October

According to SoSoValue data, Bitwise’s Bitcoin ETF (BITB) led the inflows with a positive net flow of $15.3 million, followed by Fidelity’s FBTC with $13.6 million. Ark 21Shares’ ARKB and VanEck’s HODL each saw inflows of $5.3 million.

In contrast, Grayscale’s GBTC reported outflows of $13.9 million. Other issuers — such as BlackRock’s iShares Bitcoin Trust (IBIT) and Franklin Templeton Bitcoin ETF (EZBC) — recorded no inflows during this period. Meanwhile, IBIT remains the leading Bitcoin ETF in the market, boasting over $21 billion in cumulative net inflows.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

This development comes after a turbulent start to October for Bitcoin. The top asset’s price briefly fell below $60,000 during the week but recovered to around $62,000 amid geopolitical tensions in the Middle East.

Despite the volatility, market observers remain optimistic about Bitcoin’s outlook for the fourth quarter. The analysts cite the top asset’s strong macroeconomic support and rising institutional investments as reasons for their bullishness.

“When you zoom into Bitcoin price seasonality by weeks instead of months, you can see that Uptober starts on the second week of October & it’s the strongest period of the year. We are in week 40. The rocket takes off on week 41, next week, if the pattern holds,” crypto analyst Gally Sama wrote.

Network Undergoes Key Core Update

On October 5, Jameson Lopp, co-founder of the self-custody solution Casa, announced the launch of Bitcoin Core version 28.0. This version brings significant security enhancements and functionality improvements. It also fixes bugs and introduces better privacy features for users.

The release follows a warning last month from Bitcoin developers about a high-risk vulnerability that affected one in six Bitcoin nodes. This flaw allowed malicious actors to carry out denial-of-service (DoS) attacks, overloading nodes with excessive data requests and risking system crashes.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Core 28.0 addresses these issues and adds further security protections. A key addition is support for reproducible builds, enabling advanced users to compile identical binaries directly from the Bitcoin Core website. This measure increases transparency and trust within the Bitcoin community.

Node operators upgrading to version 28.0 should exit their current software version and back up their files before installing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.