US spot Bitcoin ETF buyers are essentially the very investors expected to provide a stable, long-term bid for the pioneer crypto. However, data shows that these players are now sitting on mounting unrealized losses, with little sign of fresh demand stepping in to reverse the trend.

Against this backdrop, Bitcoin’s slow grind lower is exposing a fault line at the heart of its post-ETF era.

ETF Investors Underwater as Bitcoin Slips Below the $84,000 Cost Basis

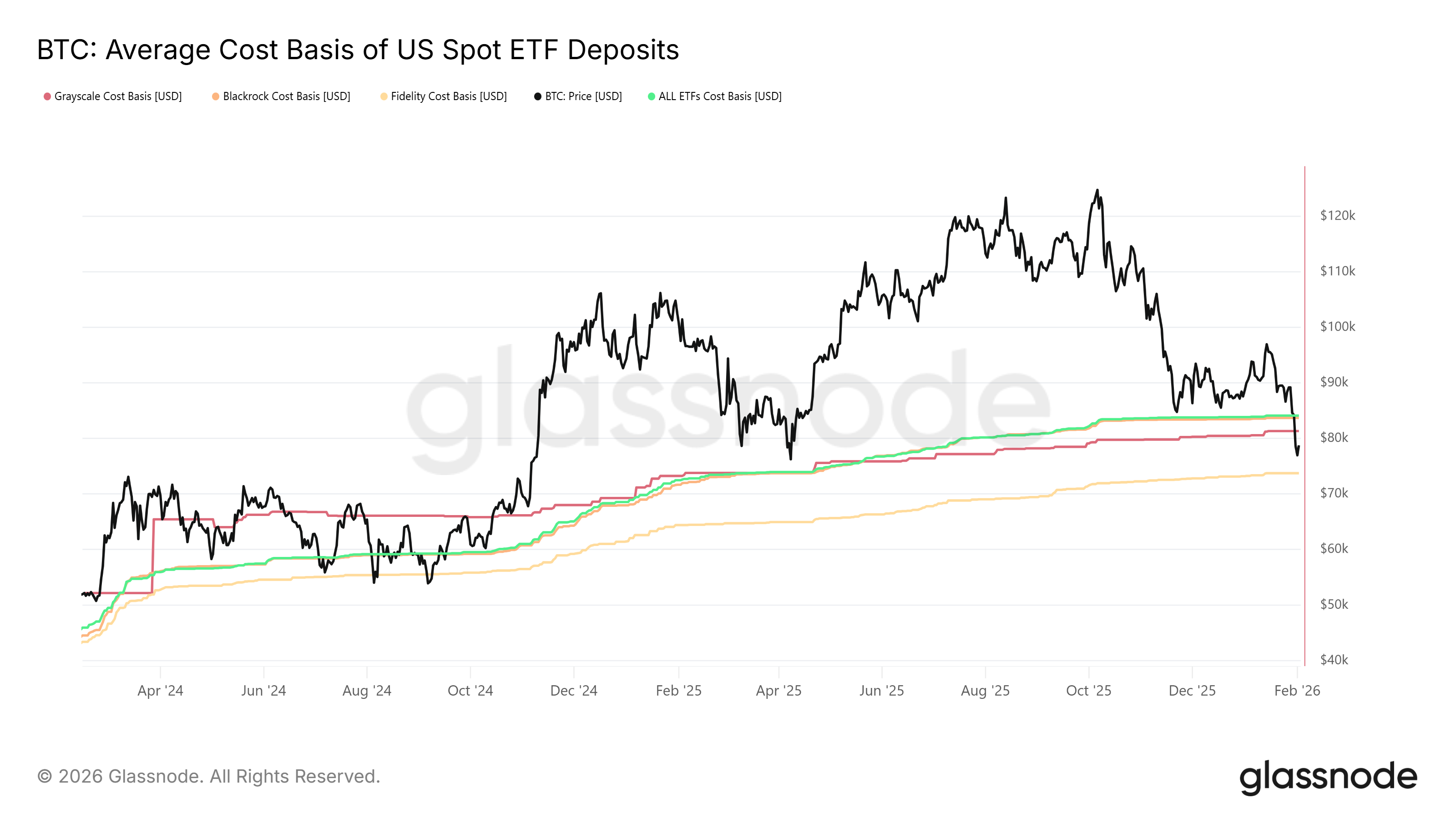

According to on-chain data from Glassnode, the average entry price for US spot Bitcoin ETF investors stands at roughly $84,100 per BTC.

With Bitcoin trading near $78,657 as of this writing, after briefly dipping below $75,000 over the weekend, this cohort is facing paper losses of approximately 8% to 9%.

For mainstream investors who entered via regulated products, the drawdown has become a quiet but persistent test of conviction.

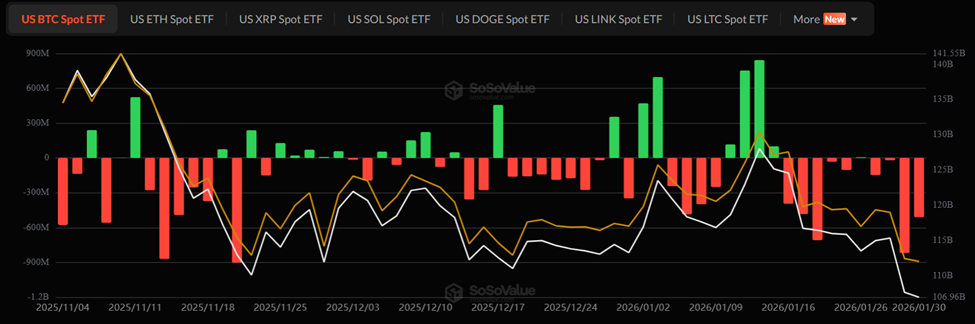

This underwater position is already translating into accelerating outflows. After strong inflows in early January, momentum flipped sharply. Over the past two weeks alone, nearly $2.8 billion to $3 billion has been pulled from US spot Bitcoin ETFs.

Weekly redemptions of $1.49 billion and $1.32 billion have pushed cumulative flows back into negative territory. This has erased much of the optimism that defined the start of the year.

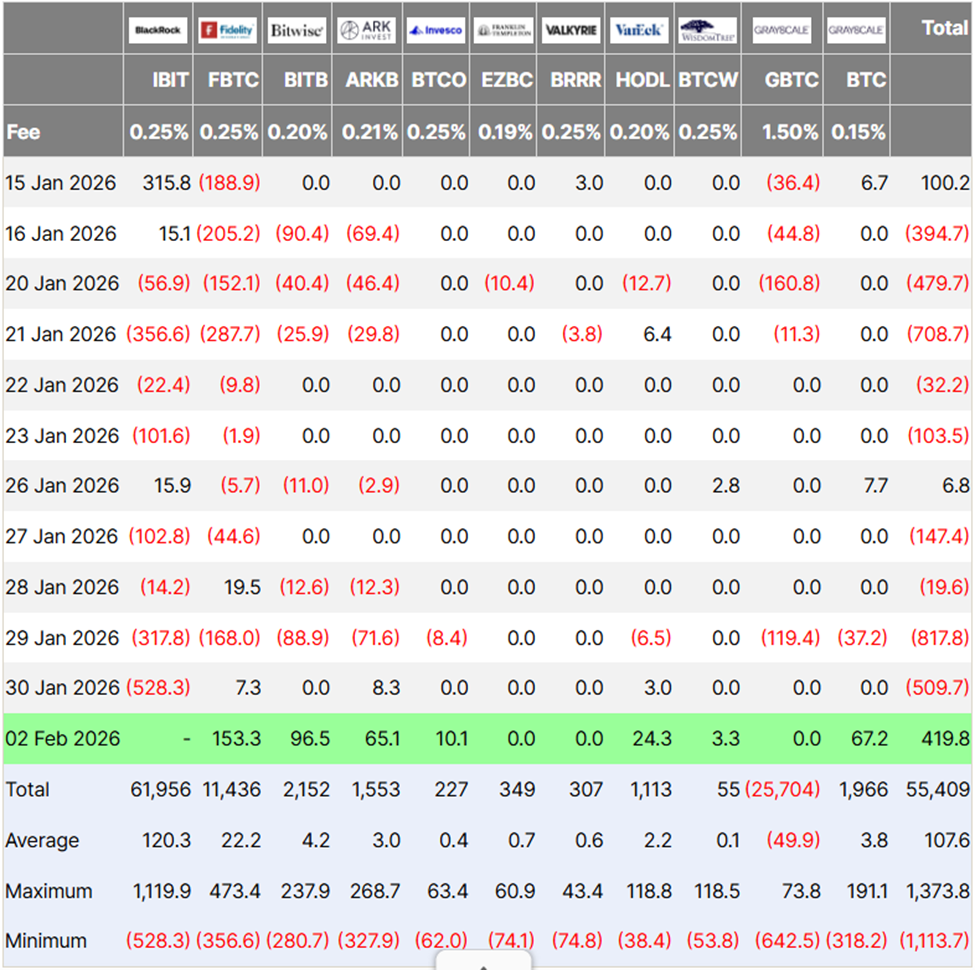

Daily flow data highlights the pressure, with net outflows dominating trading sessions, including -$708.7 million on January 21, -$817.8 million on January 29, and -$509.7 million on January 30.

Heavy selling has been concentrated in the largest products, led by BlackRock’s IBIT, which alone saw outflows of roughly $528 million on January 30, and Fidelity’s FBTC.

A single-day inflow of about $419.8 million on February 2 provided only fleeting relief in an otherwise persistent downtrend.

“Aggregate ETF flows are not buying the dip. Net institutional demand is coming almost entirely from a shrinking group of Treasury-style buyers with remaining balance-sheet capacity,” said analyst Jamie Coutts.

According to Jamie, this is not sustainable under continued pressure, with a durable Bitcoin bottom likely requiring these actors to reverse their positioning —not just slow their selling.

Vanishing Demand and Fading Macro Narratives Leave Bitcoin ETFs in a Holding Pattern

At the core of the selloff is a decline in demand, with Bitcoin down more than 35% from its 2025 peak near $126,000. Similarly, the macro narratives that once supported higher prices have faded.

Analysts point to shrinking liquidity, tighter financial conditions, and Bitcoin’s apparent decoupling from traditional hedges.

Unlike prior cycles, the asset has failed to rally on dollar weakness or heightened geopolitical risk, leaving it directionless as speculative interest wanes.

This is not the first time ETF investors have slipped into the red. In November 2025, when Bitcoin briefly fell below the then-average ETF cost basis near $89,600, analysts flagged a similar stress test.

The difference now is tone. Rather than panic selling, the market is characterized by apathy. Investors are not rushing to exit en masse. Instead, they are also not buying.

“Investors appear more selective, waiting for clearer signals on macro conditions, liquidity, and whether Bitcoin can sustainably hold above prior highs before adding exposure,” Bloomberg reported, citing Sean Rose, senior analyst at Glassnode.

He added that slowing accumulation among public and private companies mirrors the trend in ETFs.

Without a fresh catalyst, be it renewed ETF inflows, easing liquidity, or a compelling new narrative, the feedback loop could persist. This could result in falling prices discouraging buyers, sidelined capital deepening weakness, and conviction eroding further.

Still, US spot Bitcoin ETFs collectively hold an estimated $104.48 billion in assets, representing a substantial base of long-term capital.