A hotter-than-expected Producer Price Index (PPI) report for July has sent a ripple of concern through markets. It suggested that inflationary pressures may be more persistent than anticipated and dimming hopes for a series of aggressive interest rate cuts from the Federal Reserve.

Bitcoin, which had been rallying on expectations of looser monetary policy, fell sharply in response.

Unexpected PPI Jump Sends Bitcoin Prices Lower

The July US Producer Price Index (PPI) surged by 0.9% month-over-month and 3.3% year-over-year, figures that significantly outpaced market forecasts across the board, including headline and core measures. The data, released on Thursday, indicates a widespread increase in wholesale prices and production costs for American businesses.

This spike in producer prices is a classic precursor to broader inflation. As businesses face higher costs, they will likely pass these on to consumers. Then, it could lead to a subsequent rise in the Consumer Price Index (CPI) and prolong the inflationary cycle beyond current projections.

Tuesday’s July CPI report showed no similar jump, suggesting companies are currently absorbing higher production costs. Some of these costs stem from the Trump administration’s tariff policies. Analysts believe this absorption is temporary and will reach consumers.

This development is a significant headwind for the Federal Reserve, complicating any plans for monetary easing and reinforcing a more cautious stance on interest rate cuts.

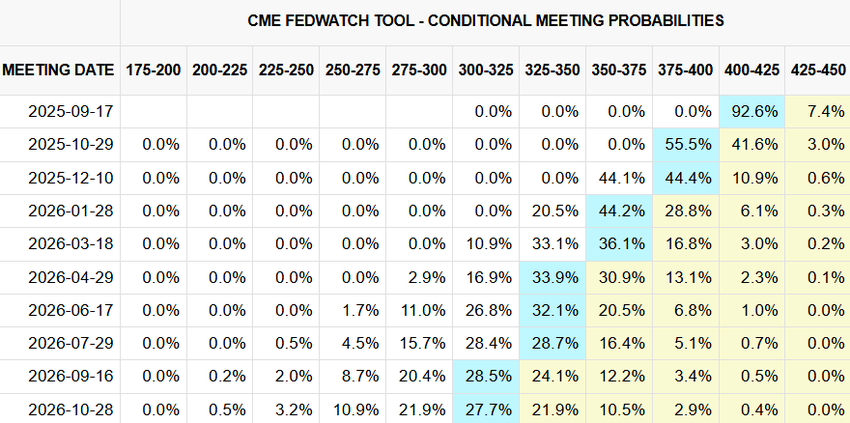

This shift in sentiment was immediately reflected in market expectations. The CME FedWatch Tool, which had previously indicated a strong possibility of three rate cuts within the year, has now revised its forecast to just two. The prospect of a “big cut” in September has effectively been eliminated.

Retail Sales Data Looms, Posing Further Risk for Bitcoin

All eyes are now on the US retail sales figures, which are set to be released later tonight. As a key leading indicator that directly reflects consumer spending habits, a strong retail sales report could further fuel inflation fears.

An increase in retail sales would suggest robust consumer demand, a condition under which inflation is unlikely to be tamed. Furthermore, strong spending could indirectly counter recent concerns about a weakening labor market, which had been fueling hopes for rate cuts. The logic is straightforward: individuals worried about job security are less likely to spend lavishly. Thus, healthy retail sales figures would provide another pillar of support for the Fed’s “higher for longer” interest rate policy.

The recent bullish momentum in Bitcoin’s price began in earnest on August 3rd, following a surprisingly weak July Non-Farm Payrolls (NFP) report. That report had ignited hopes for swift Fed rate cuts, propelling the cryptocurrency’s price upward.

Should the upcoming retail sales data come in strong, following the unexpectedly high PPI, expectations for Fed easing are likely to continue to wane.

As of 11:00 am UTC on Friday, Bitcoin was trading at approximately $118,900 on the Binance exchange, reflecting the market’s reassessment of the macroeconomic landscape.