On late Monday, Bitcoin (BTC) plummeted to an astonishing $8,900 on the BitMEX crypto exchange. Meanwhile, other platforms showed its value well above $60,000.

However, the drop was transient, with Bitcoin quickly recovering to $67,000 by 23:00 UTC.

Why Did Bitcoin Crash on BitMEX

This abrupt decline started around 22:40 UTC. Within minutes, it fell to its lowest point since early 2020. During this incident on BitMEX, Bitcoin’s global average price remained around $67,400.

Speculation abounded on social media, particularly on platform X. Observers attributed the Bitcoin crash to massive sell-offs by a crypto whale. Crypto researcher Syq provided insights, noting that an anonymous crypto whale sold over 977 BTC in increments of 10–50 BTC within two hours.

Concurrently, BitMEX had restricted withdrawals for certain accounts under scrutiny. Despite this, the exchange confirmed that its operations were normal and all funds were secure.

“We are investigating unusual activity in the past few hours involving a user selling large orders on our BTC-USDT Spot Market,” BitMEX said.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Moreover, economist Peter Schiff sounded an alarm, hinting at a more significant downturn. He reminisced about the market’s overconfidence when Bitcoin hit $69,000 in November 2021.

A year later, Bitcoin had fallen below $16,000, a decline of nearly 80%. Schiff suggested that the current bullish sentiment could foreshadow an even greater crash.

Furthermore, market sentiment has veered towards extreme greed, indicated by a Fear and Greed score of 79. This index, measuring emotions from 0 to 100, signals the market’s current avarice.

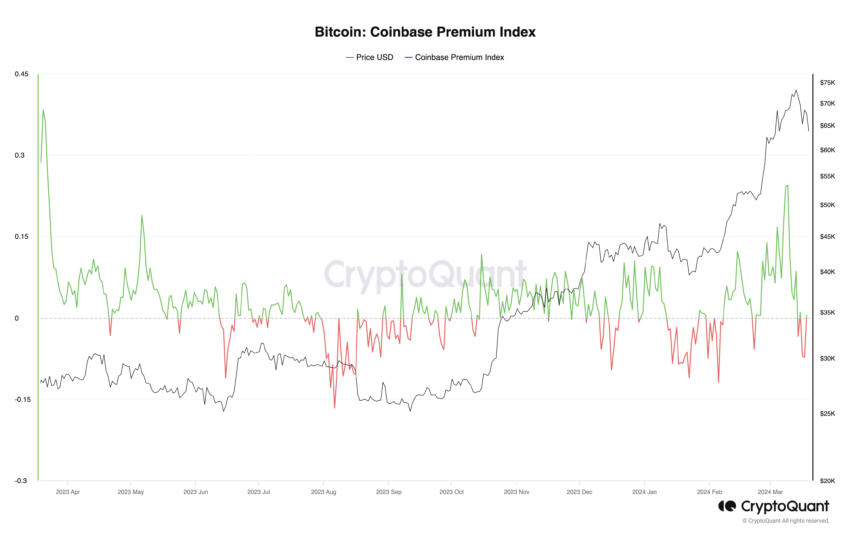

Additionally, the dynamics that propelled Bitcoin to record highs have shifted, pointing to reduced US demand. The so-called Coinbase Premium indicator, comparing Bitcoin prices on the US-listed Coinbase and Binance, has turned negative.

CryptoQuant’s data suggests a drop in Bitcoin prices on Coinbase, historically a gauge of US investor interest. Notably, Coinbase acts as custodian for the majority of the new US spot ETFs.

Read more: What Is the Crypto Fear and Greed Index?

This shift in dynamics is highlighted by a deceleration in US spot ETF inflows. Grayscale’s ETF, for instance, saw $642.5 million in outflows.

At the same time, the Coinbase premium had reached a 12-month peak during Bitcoin’s recent surge, hinting at strong previous demand from US investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.