The Bitcoin (BTC) price has reached a bullish weekly close well above the previous long-term resistance area.

BTC is currently consolidating just below $24,000 and is expected to break out once more.

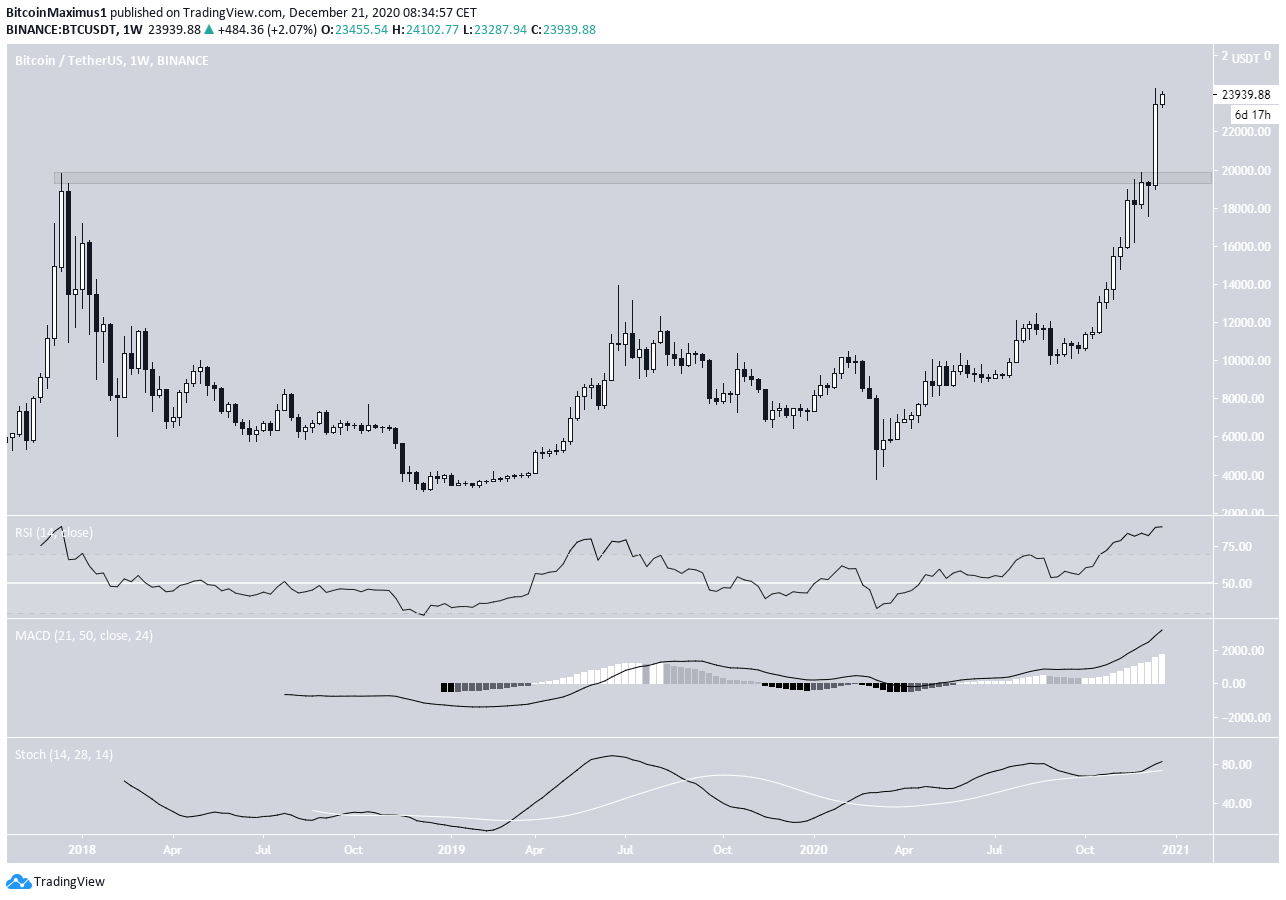

Bitcoin Long-Term Movement

During the week of Dec 14-21, BTC created a massive bullish candlestick, convincingly breaking through the $19,500 area to reach a high of $24,295. BTC is now in price discovery, having no resistances left to clear above the current price.

Technical indicators are still bullish, despite showing that the rally is extremely overbought.

The daily time-frame supports the view from the weekly chart.

BTC has been consistently making higher highs and had created eight successive bullish candlesticks before a small bearish close yesterday. However, today’s candlestick is shaping up to be bullish and could engulf the candle from yesterday.

Similar to the weekly time-frame, technical indicators do not show any weakness, despite the fact that the RSI and MACD are overbought. On the contrary, the Stochastic oscillator is close to making a bullish cross, which would further solidify that the trend is still bullish.

Possible Retracement?

Once BTC broke through $24,000, the two-hour chart began to show weakness. The RSI generated a bearish divergence (red line) while the MACD was decreasing. This suggested that a decrease towards the 0.5 Fib retracement level at $21,785 could occur.

However, the RSI generated a hidden bullish divergence (blue line) shortly after, invalidating the previous bearish divergence, and suggested that BTC is likely to go higher once more. This is also supported by the MACD, which is moving upwards.

BTC Wave Count

The wave count suggests that BTC is currently in sub-wave 5 (shown in black below) of wave 3 (orange), after completing an irregular flat correction in sub-wave 4.

A likely target for the top of wave 3 is found between $25,871-$26,000, the 2.61 Fib extension of wave 1 (orange) and the 4.61 fib extension of sub-wave 1 (black) respectively. So, BTC is expected to correct before moving upwards yet again.

A decrease below the wave 1 high of $19,918 would invalidate this particular wave count.

Conclusion

Bitcoin is expected to break out once more and move towards $26,000 before correcting. A decrease below $19,918 would invalidate the bullish count.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.