Bitcoin Cash (BCH) price noted a remarkable 90% rally in the span of just ten days, bringing the altcoin up from $358 to $678.

However, this rally will likely halt for some time, and BCH will note corrections for this reason.

Bitcoin Cash Investors Look to Sell

Bitcoin Cash’s price crossing $650 was a momentous occasion, and this also instilled the sentiment of profit-taking among holders. This is evident in the change in their conviction, as noted in the Mean Coin Age.

Mean Coin Age measures the average age of all coins in circulation, reflecting the level of market activity and potential selling pressure based on the time coins have been held. Incline signals conviction, whereas dips in this metric hint at the coins moving among addresses.

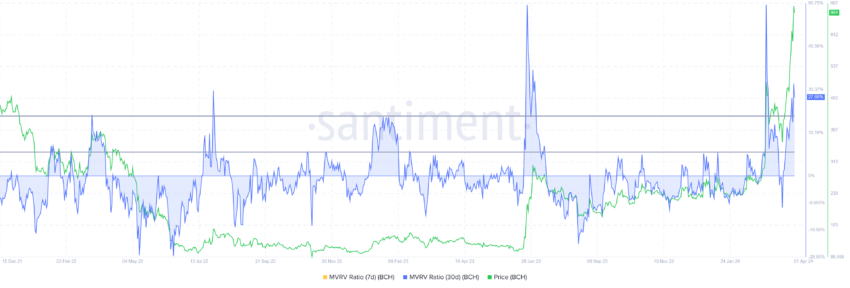

Such is the case of BCH, too, which is further substantiated by the Market Value to Realized Value (MVRV) ratio.

Read More: Bitcoin Cash: A Complete Guide to What It Is and How It Works

The MVRV ratio gauges investor profit/loss. Bitcoin Cash’s current 30-day MVRV of 27.65% suggests profit for recent buyers, possibly leading to selling. Historically, BCH corrections happen within 10%-21% MVRV, termed a danger zone.

This zone has historically seen corrections, which could likely be the case with BCH as well.

BCH Price Prediction: A 14% Correction Is Possible

Bitcoin Cash price is correcting after a good run, but considering the aforementioned factors, the decline will also be substantial. Trading at $665, the cryptocurrency following profit taking will fall to lose the support of $650, falling to $625.

Slipping through this support will send BCH to $572, which is in confluence with the 50-day Exponential Moving Average (EMA), marking a 14% drawdown.

Read More: How To Buy Bitcoin Cash (BCH) and Everything You Need To Know

However, the $650 and $625 support levels could cushion this decline and minimize the downfall. This could also provide BCH with the opportunity to bounce back and invalidate the bearish thesis, potentially giving the altcoin the necessary boost to tag $700.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.