Bitcoin (BTC) has been increasing since Jan 24 and made its fourth breakout attempt from a descending resistance line on Feb 4. The price is expected to eventually break out above this resistance.

Bitcoin has been decreasing underneath a descending resistance line since reaching an all-time high on Nov 10. The line has rejected the price four times (red icons), most recently on Feb 4. However, since resistances get weaker each time they are touched, an eventual breakout from this line would be likely.

The closest horizontal resistance area is at $40,800. If BTC is successful in moving above it, there would be resistance at $46,800 and $51,000. These are the 0.382 and 0.5 Fib retracement resistance levels, respectively.

An important bullish signal could soon transpire in the MACD, which is an indicator created by short and long-term moving averages (MA). After being negative for 82 days, the MACD is very close to moving in positive territory. This would mean that the short-term MA is faster than the long-term average, and is a staple of bullish trends.

Historical overview

A look at the previous history shows that when the MACD moves into positive territory, significant upward movements usually follow (green icons). This has occurred four times since December 2020.

In June 2021, the signal initially led to a short-term drop, however, BTC increased considerably shortly after.

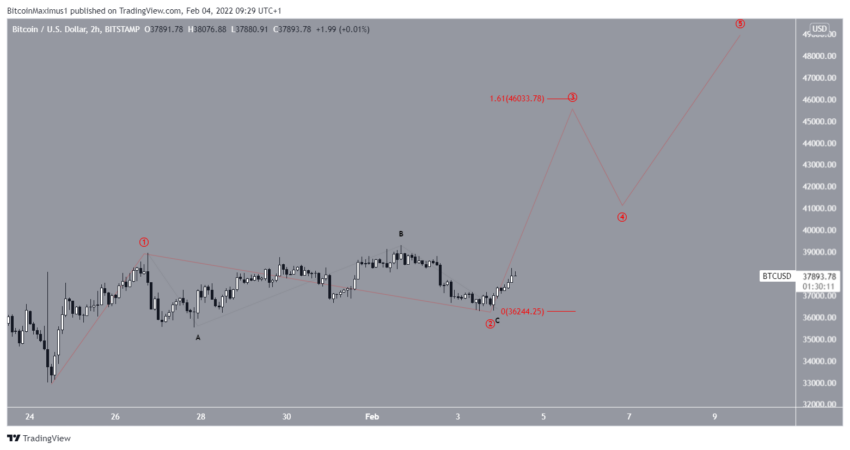

A look at the two-hour chart shows that BTC has already broken out from a short-term descending resistance line. In addition to this, the MACD has nearly crossed into positive territory.

The closest resistance is at $38,650. A breakout above this level would also cause a breakout above the aforementioned long-term descending resistance line and likely cause the increase to accelerate.

BTC wave count analysis

There are two main possibilities for the short-term count, both of which indicate that a considerable upward movement is expected in the short term.

The first is that BTC is in the Y wave of a W-X-Y corrective structure. The first potential target for the top of this movement would be at $40,000, giving waves W and Y a 1:0.618 ratio. The next target above that one would be found at $42,300, giving said waves a 1:1 ratio.

The most likely long-term count suggests that BTC has bottomed. This would mean that the ongoing upward movement is part of a bullish impulse instead of being a corrective phase.

The closer BTC gets to the 1.61 level at $46,000, the more likely this count becomes.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.