The Bitcoin (BTC) price decreased considerably last week but has broken out from a short-term bullish reversal pattern.

Bitcoin is expected to continue increasing towards the resistance areas outlined below.

Bearish Weekly Bitcoin Close

Bitcoin decreased from a high of $57,508 to a low of $43,000 last week, creating a bearish engulfing candlestick in the process.

While the RSI generated a bearish divergence prior to the drop, it has invalidated it with a hidden bullish divergence. This is a strong sign of upward trend continuation.

Furthermore, the MACD has yet to make a lower momentum bar (though it’s close this week) and the Stochastic oscillator has yet to make a bearish cross.

There have been five prior instances of bearish engulfing candlesticks following a significant upward movement since 2015.

Two of them led to new highs immediately afterward (green arrows), two led to slight bounces and lower lows (yellow), while one followed up with a bounce but was the beginning of a two-year correction (red).

Nevertheless, all five led to bounces in the following week, making it likely that this week we will also see some upward movement.

Current Movement

The daily chart shows that BTC is currently trading above the minor $44,800 support area. It validated the level for the second time and created a lower wick.

Nevertheless, technical indicators are bearish. This is evidenced by the MACD histogram crossing into negative territory and the Stochastic oscillator making a bearish cross.

The two-hour chart is a bit more bullish. It shows a breakout from a descending wedge and a very significant bullish divergence in both the RSI and MACD.

If BTC continues to increase, the closest resistance area would be found between $50,670-$52,480. This range is the 0.5-0.618 Fib retracement levels when measuring the entire downward movement.

This would also fit with the possibility of a bounce as outlined in the weekly chart.

A breakout and validation of the aforementioned $50,670-$52,480 area as support would confirm that the trend is bullish.

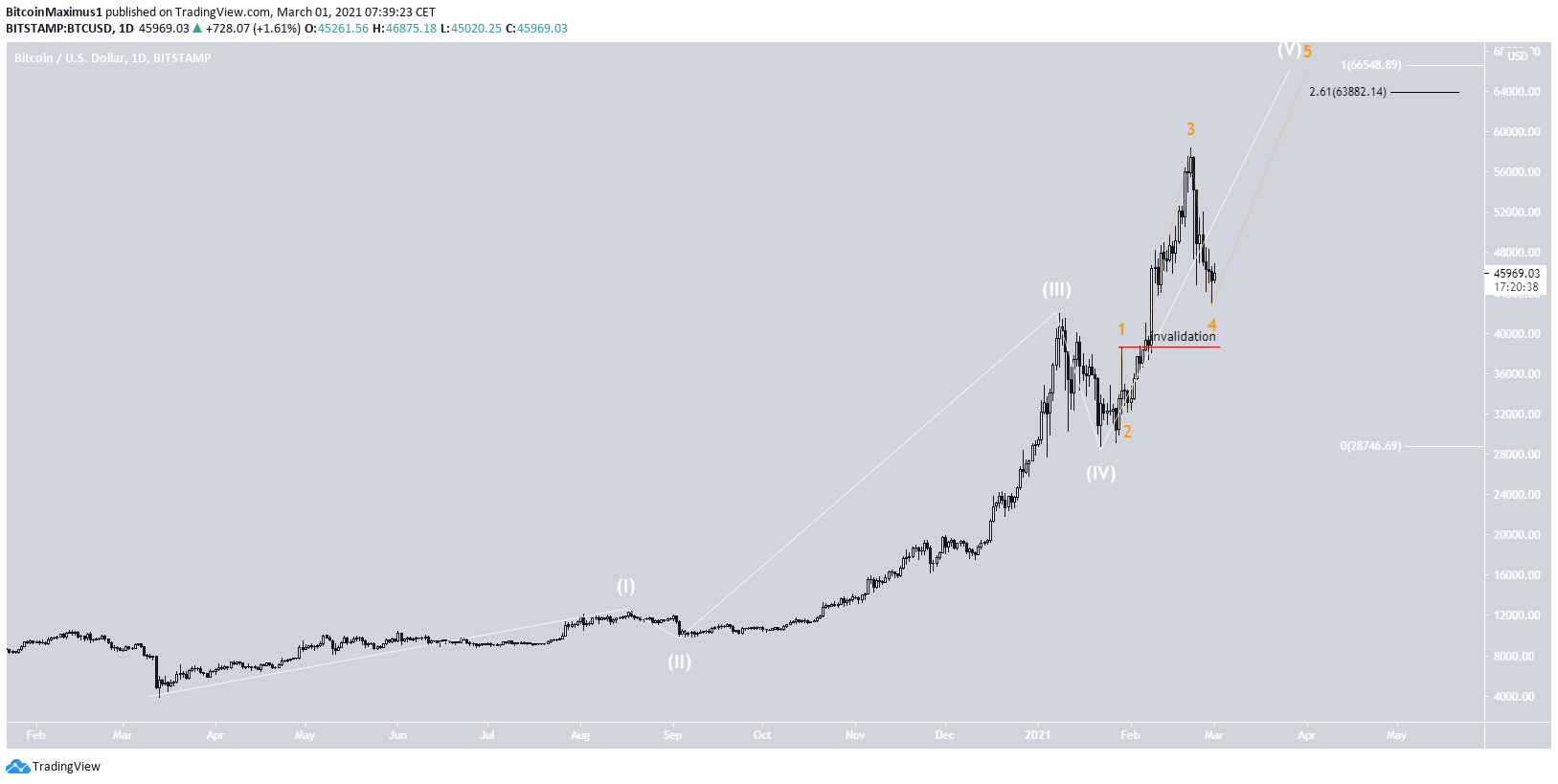

BTC Wave Count

The most likely wave count suggests that BTC just completed wave four of a five-wave bullish impulse (orange).

As long as the invalidation level at $38,620 is not reached, it’s likely that BTC is still bullish and will lead to a new all-time high

The longer-term wave count is given below.

Conclusion

Bitcoin is expected to continue to break out from the descending wedge and gradually move towards the range of $50,670-$52,480.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.