The cryptocurrency market is undergoing a highly contradictory phase in mid-2025, marked by a significant decline in global interest yet accompanied by potential opportunities from rising liquidity.

Looking ahead, Q3 2025 could prove to be a pivotal moment, presenting investors with both challenges and hopes.

Bitcoin Faces Global Indifference

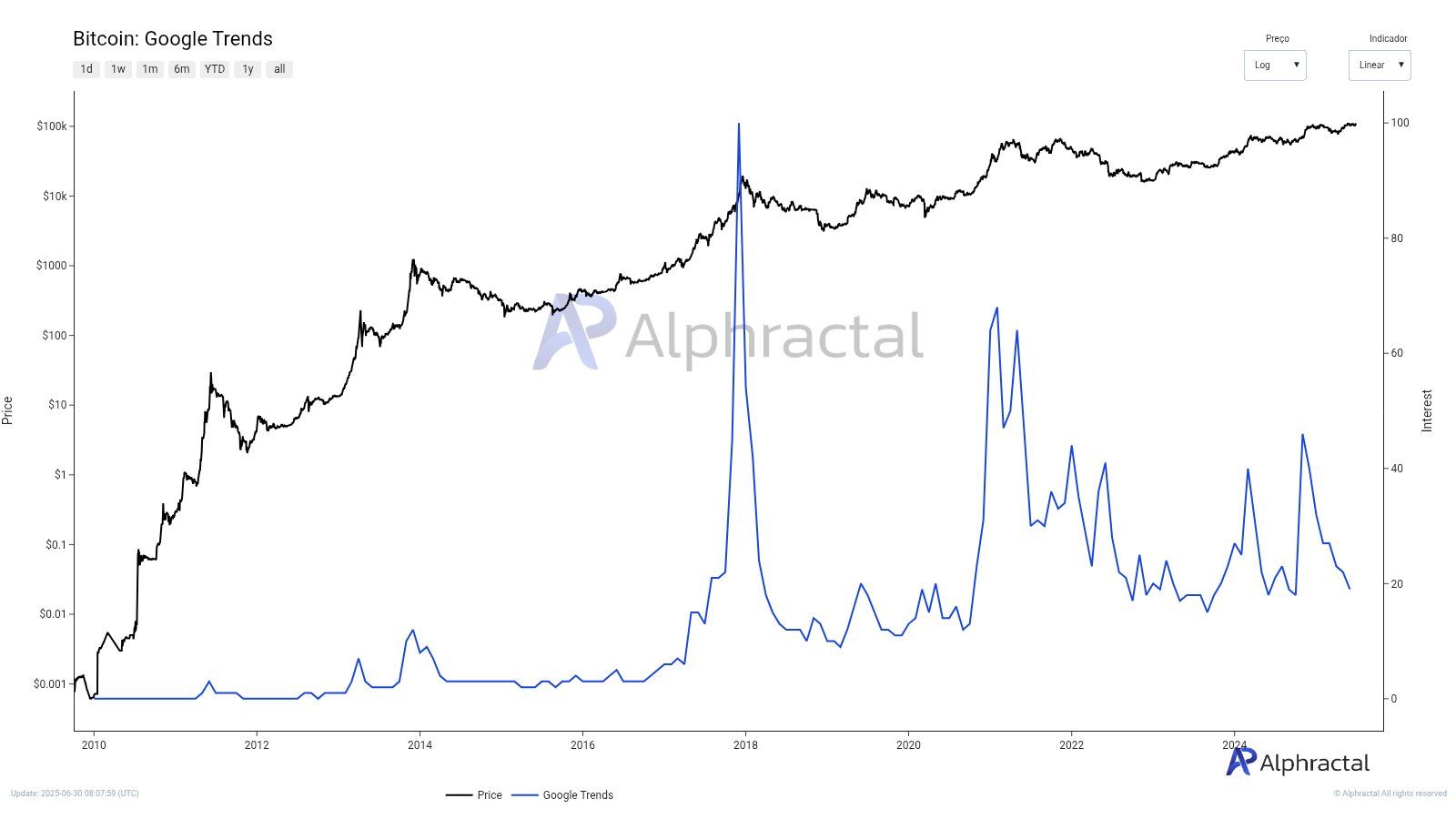

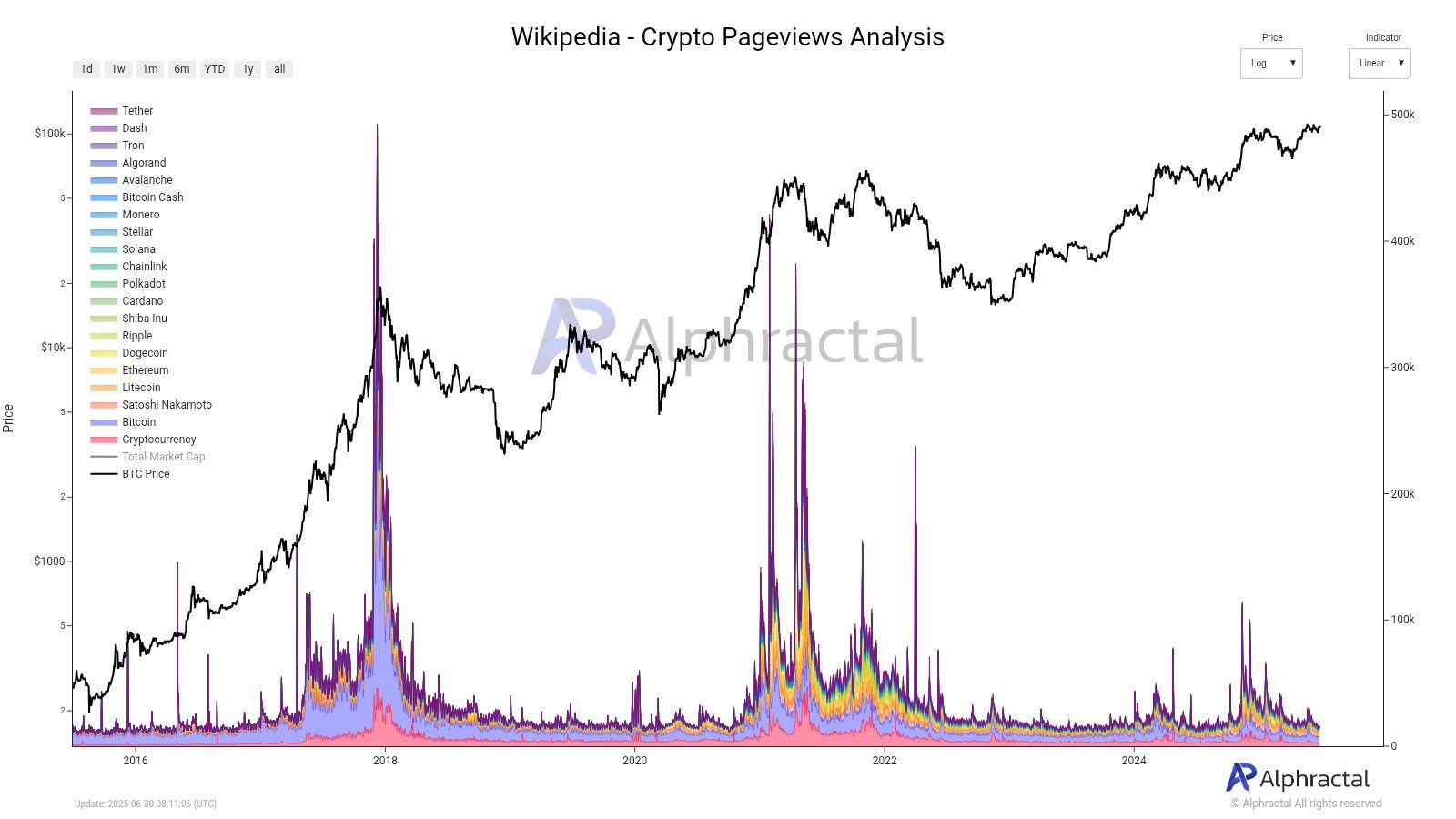

Despite Bitcoin (BTC) maintaining stability above the $100,000 mark, global apathy toward it is undeniable. Google searches for Bitcoin and Wikipedia page views related to various cryptocurrencies and blockchains have dropped to levels seen during previous Bitcoin cycle bottoms.

“The truth is, very few people are interested in crypto right now. Most are just sitting back, waiting to see what happens…” CEO of Alphractal, Joao Wedson, noted.

This chart reveals a gradual decline in interest peaks over the years, particularly from 2021 onward, reflecting the exhaustion of retail investors following intense market volatility. This scenario has historically paved the way for major recoveries, such as the 2018-2019 period when Bitcoin surged from $3,000 to $14,000. However, this lack of attention also poses risks, potentially causing the market to stagnate unless a new catalyst emerges.

Previously, at the end of April 2025, Bitcoin search volume on Google Trends remained low despite BTC’s price surging past $90,000 in 2025. Shifts in information behavior and Bitcoin’s market maturity contribute to declining search volumes on Google.

Positive Signal from Global Liquidity

In contrast, a promising signal is emerging from global liquidity, which is expanding at the fastest rate since 2021. Rising liquidity typically drives capital into risk assets like cryptocurrencies, especially as global interest rates show signs of declining amid the 2025 economic landscape.

A report from Bitfinex Alpha indicates that Bitcoin continues to trade within a well-defined range between $100,000 and $110,000, exhibiting signs of consolidation after an explosive near-50 percent rally from the April low of $74,634. Q3 has historically been BTC’s weakest quarter, with just +6 percent returns instead of over 31% in Q2. Price action tends to remain range-bound during this period.

“This suggests the market is gearing up for a potential shift. However, the current investor indifference toward Bitcoin might lead them to “arrive too late, becoming liquidity for the whales,” as CEO Joao Webson cautioned.

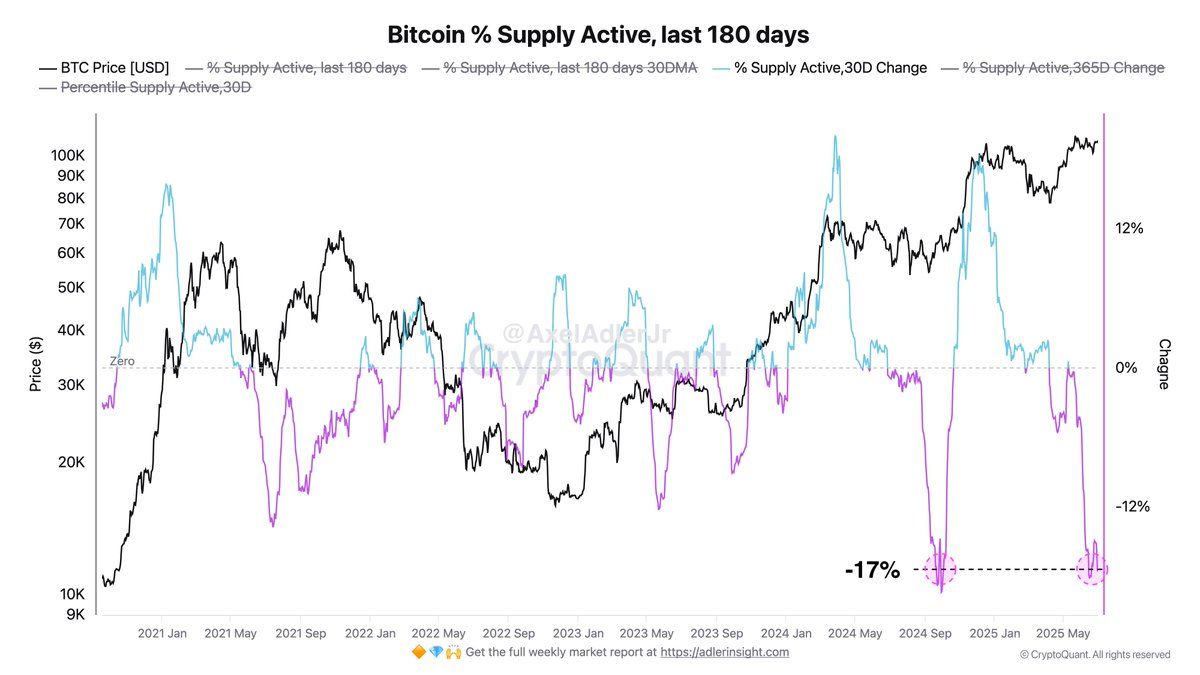

Additionally, the % Supply Active 30D Change index, which dropped 17% according to analyst Axel AdlerJr Jr., signals accumulation—a trend often preceding a bull run, similar to historical cycles.

“Current values are -17%. In September 2024, this was enough to start a new rally,” Axel AdlerJr shared.

Conditions for an Explosive Surge

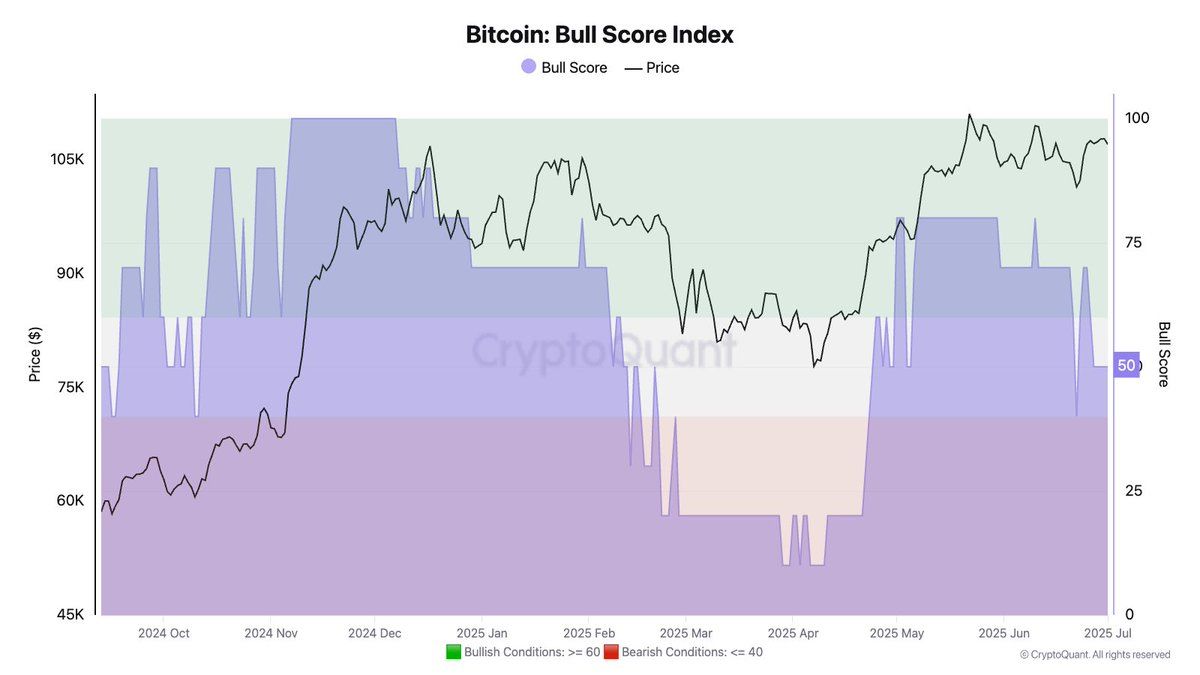

Nevertheless, not all signals support an immediate breakout. According to analyst Julio Moreno, the Bitcoin Bull Score currently stands at 50, indicating a neutral market that needs to surpass the 60 threshold to trigger a genuine rally.

This implies that investors must exercise patience, awaiting catalysts such as macroeconomic news or actions from major institutions.