Since the beginning of the year, Bitcoin’s price has been unable to revisit its $108,230 all-time high. This has reduced the profitability of the coin’s short-term holders (STHs), putting more downward pressure on its price.

As demand leans further, BTC’s price could see new declines. Here is why.

Bitcoin Short-Term Holders Count Their Losses

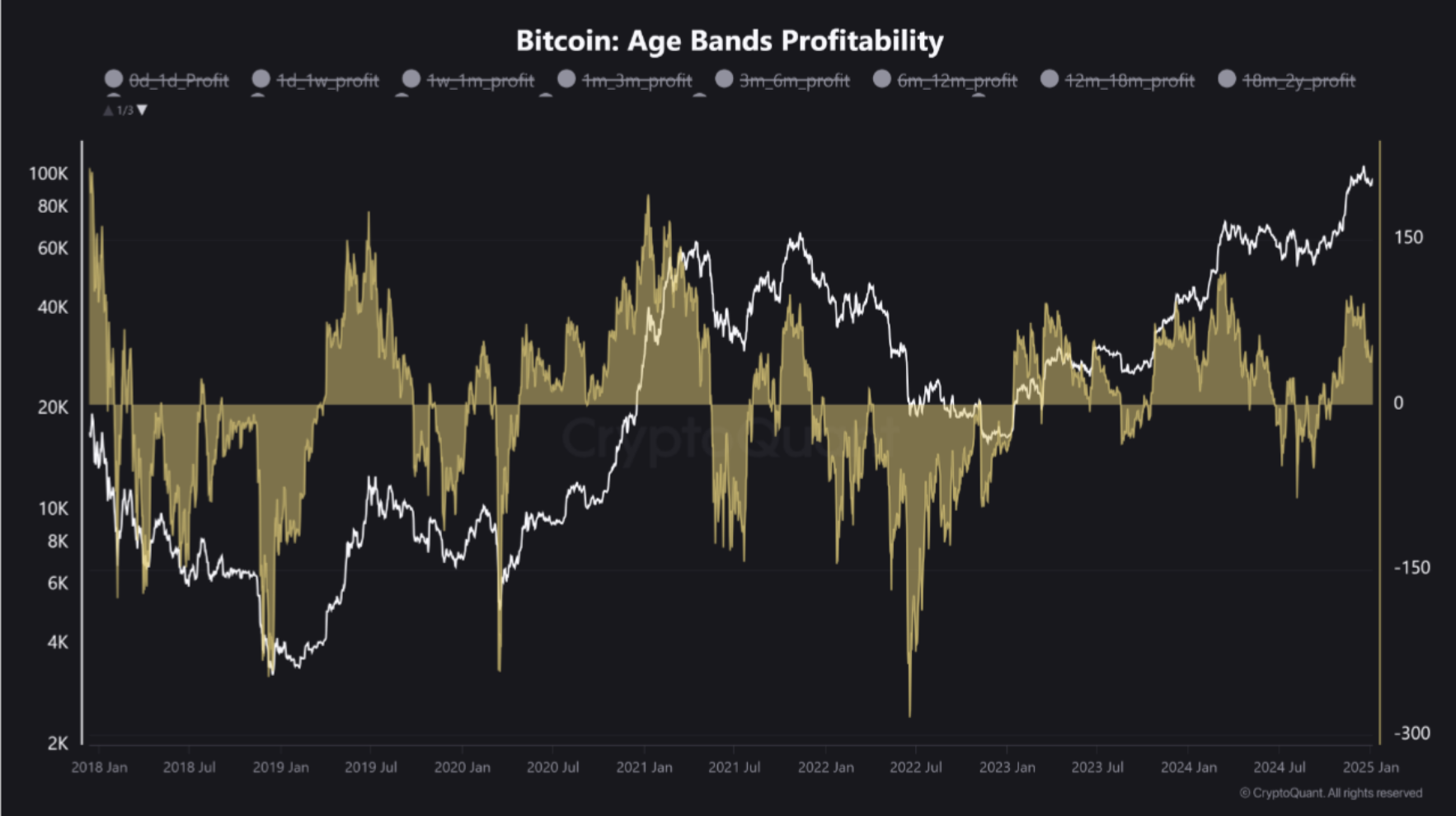

In a new report, pseudonymous CryptoQuant analyst Crazzyblockk noted a decline in the profitability of BTC investments for short-term holders (those who have held their coins for less than 155 days).

The analyst assessed the profitability levels for all Bitcoin age bands and found that “following Bitcoin’s rally to the $108,000 level and the subsequent failure to reclaim this critical price point, the profitability margin for short-term holders has declined substantially.”

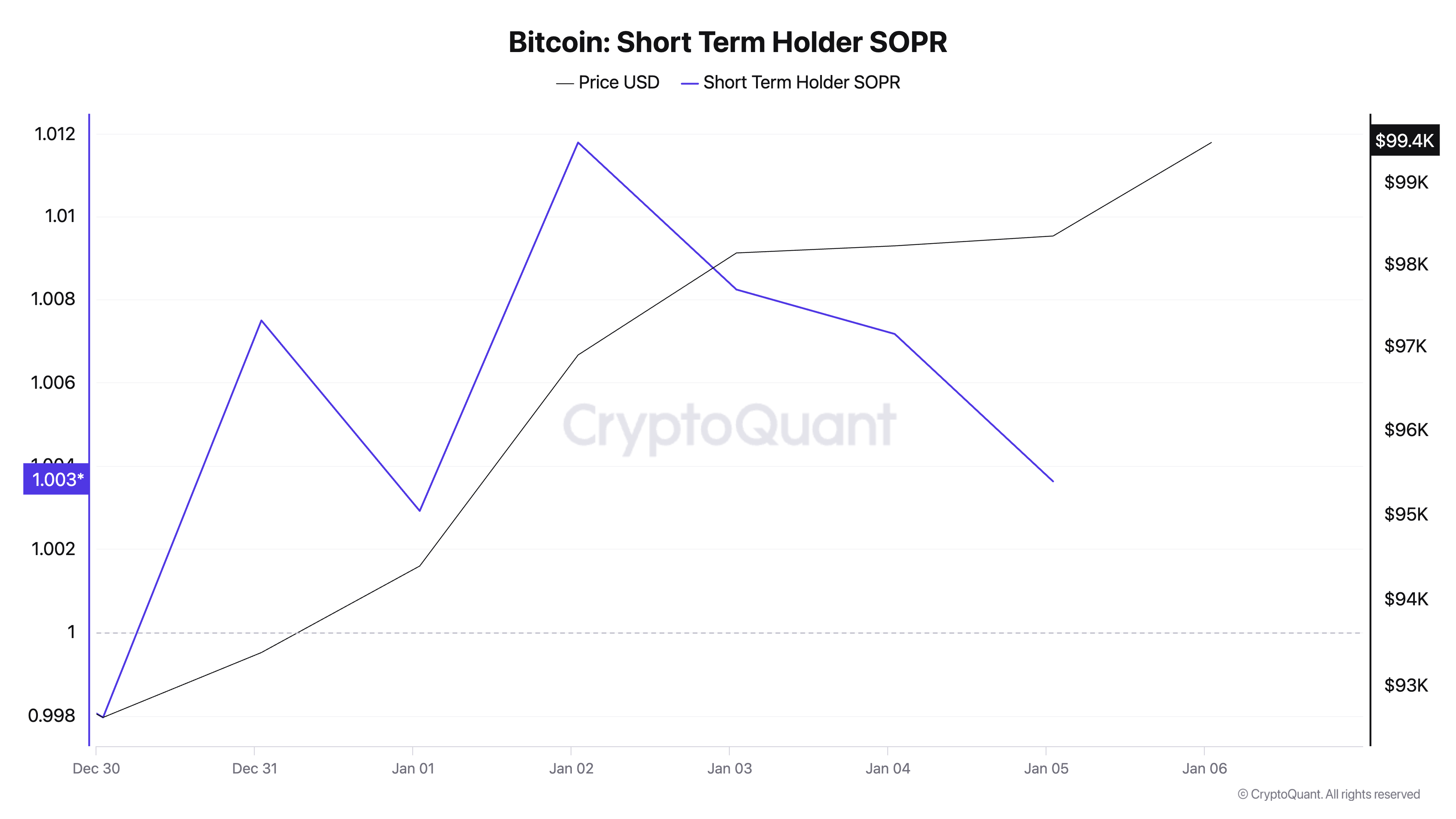

BeInCrypto’s assessment of the coin’s Spent Output Profit Ratio for its STHs confirms the analyst’s position. According to CryptoQuant, this has maintained a downward trend since January 2.

The Short-Term Holder Spent Output Profit Ratio (STH-SOPR) gauges the profitability of short-term holders of a particular crypto asset. It generally offers insights into whether investors who have held a particular asset for less than 155 days are in a profitable or unprofitable position.

When its value declines, short-term Bitcoin holders are increasingly selling at a loss rather than at a profit. This reflects declining market confidence among recent buyers, suggesting weaker demand for the leading coin.

On how this may impact BTC’s price, Crazzyblockk said:

“A drop in profitability for short-term holders often provides a clear signal of weakening market demand and bearish sentiment over the short and medium term. Therefore, under current conditions, this suggests an elevated likelihood of price corrections driven by reduced demand and subdued performance.”

BTC Price Prediction: Is a Decline to $91,000 Imminent?

BTC is currently trading at $100,943. If selling pressure intensifies due to short-term holders (STHs) facing increased losses, the price could drop to $91,488.

However, if sentiment shifts and BTC witnesses a resurgence in new demand, this may propel the Bitcoin price past the $100,000 level and toward the all-time high of $108,230.