The Bitcoin price hit a new 2023 high today, and one analyst explains his case for why BTC will not return to its cycle low again.

Bitcoin and crypto market momentum is increasing despite an ongoing war on crypto in the United States.

As another American banking crisis begins to unfold, financial regulators are scrambling to patch the holes in the leaking vessel. Part of their strategy is to attack one of the few viable alternatives – cryptocurrencies.

This has been clearly evident this year with several major enforcement actions taken against the industry’s biggest players. However, Bitcoin and crypto markets have remained resilient so far in 2023.

One analyst believes that Bitcoin prices will never return to their previous cycle low. This was just below $16,000 in late November following the FTX collapse. Since then, the asset has gained around 80% to today’s intraday peak.

Bitcoin Halving Narrative Strengthening

On March 30, analyst Jesse Myers presented his case on why he thinks Bitcoin prices are unlikely to be this low again.

He added that most people miss the bottom because they freeze up and watch it go by. This was in November 2022 when crypto markets crashed to a four-year low.

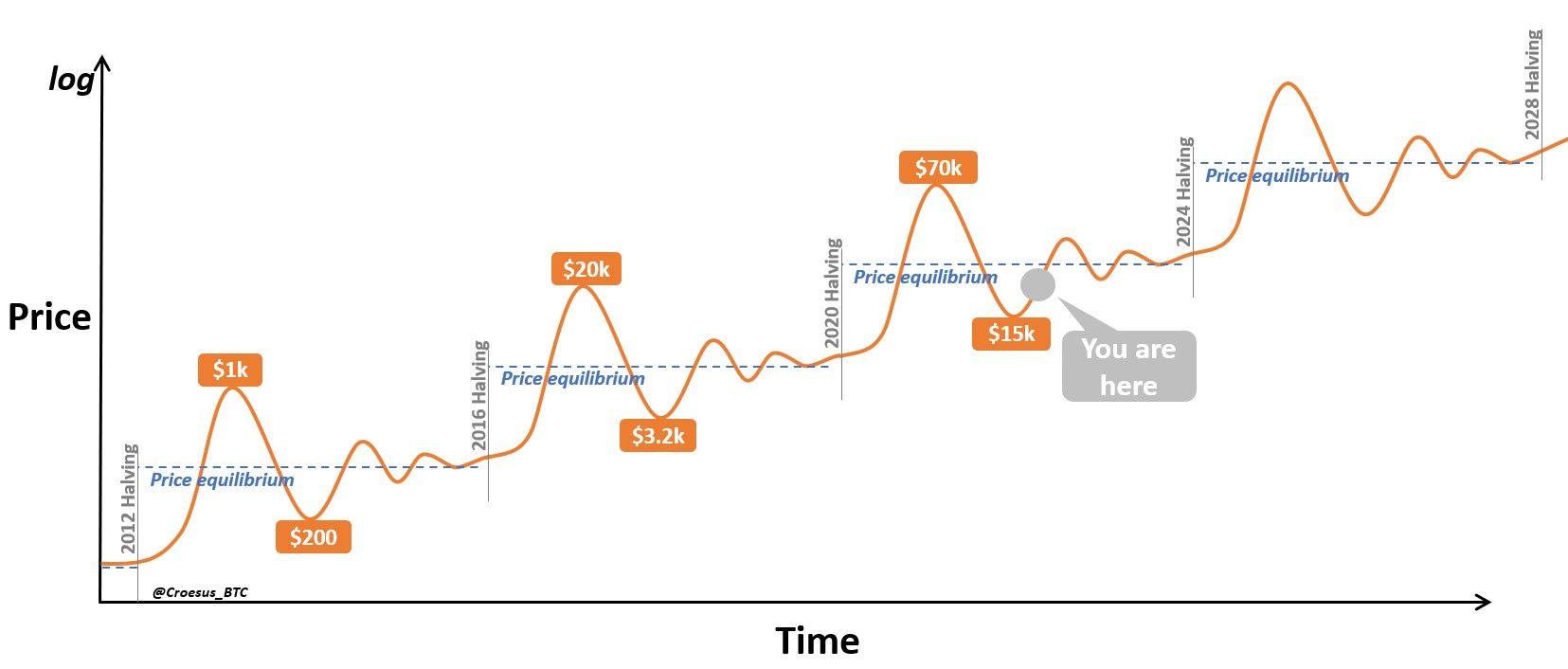

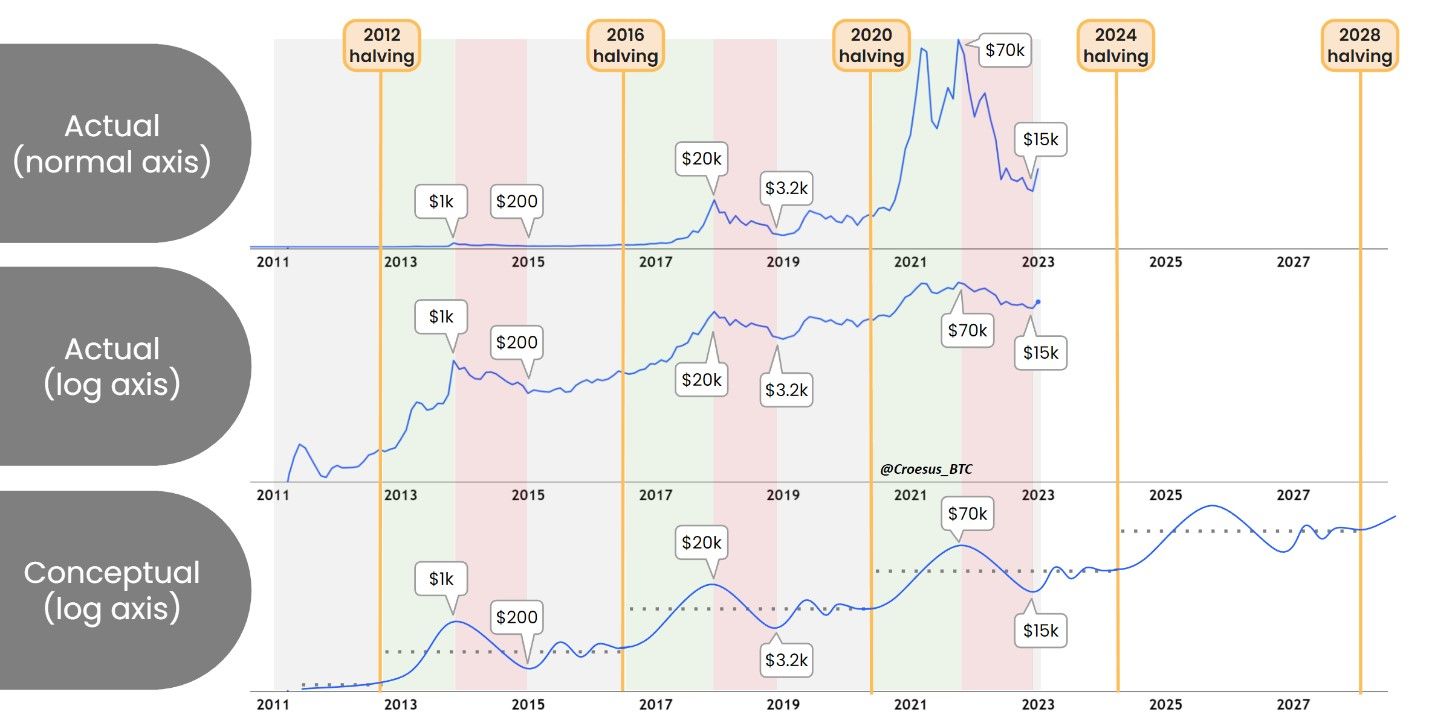

Furthermore, we are still below the ‘price equilibrium’ at current levels.

The Bitcoin halving narrative has been proven in the last three major cycles. A bull market has followed each halving event, and history appears to rhyme again.

“This is the result of a supply shock upending Bitcoin’s supply/demand price equilibrium.”

The analyst said there is a lot of noise in this price action. “That’s a new, free market asset bootstrapping itself from nothing to become a major player in the global asset landscape,” he added.

Underneath that noise is the halving narrative, with the next event around a year away.

BTC Taps $29,000

BTC tapped its highest price for nine months during the early morning hours of March 30. As a result, the top-ranked cryptocurrency by market cap topped $29,000 briefly before pulling back a little.

At the time of press, BTC was trading at $28,621, following a daily gain of 3.7%.

Furthermore, the Bitcoin fear and greed index has moved back into ‘greed’ territory with a value of 60 today.

The $30,000 zone is the next heavy resistance, so it could well reach that soon before any market correction.