Binance confirms its supremacy over Coinbase and other exchanges. In addition to its continued growth, it is now the exchange that holds the most Bitcoins in the world.

The fortunes of Binance and Coinbase were in stark contrast to each other as the bear market hit. Binance and its CEO Changpeng Zhao made headlines in the crypto press through a show of force and continued hiring. Coinbase and its CEO Brian Armstrong on the other hand raised a multitude of concerns. These included waves of layoffs, pauses in recruitment and even rumors of possible bankruptcy.

Binance: unchallenged supremacy?

Binance continues to chart its course and further establish itself as the main player in the crypto industry, with endless influence. Its BNB token is 5th in terms of market cap and its stablecoin is in 6th place.

While most companies are imposing suspensions and payment limits on their users, Binance continues to take measures that show more cost savings than fee disbursements.

Indeed, Binance announced several weeks ago that more than 2,000 jobs were available at the company, with a desire for growth and expansion exacerbated by the current bear market. At the same time, while many companies or exchange platforms suspended certain commercial agreements, Binance multiplied partnerships. This was through a partnership with the Portuguese star Cristiano Ronaldo. Ronaldo has the most followed Instagram account in the world with more than 400 million followers.

Finally, as a first step to celebrating its 5th anniversary, the exchange has decided to make transaction fees free on Bitcoin and to maintain this change afterwards.

Coinbase – still struggling

Meanwhile, the North American exchange is still getting negative press. Even recently, rumors have resurfaced after Coinbase decided to suspend its affiliate program. Subsequently, the failures continued with the collapse of its NFT marketplace and the fall of Coinbase stock on the stock market.

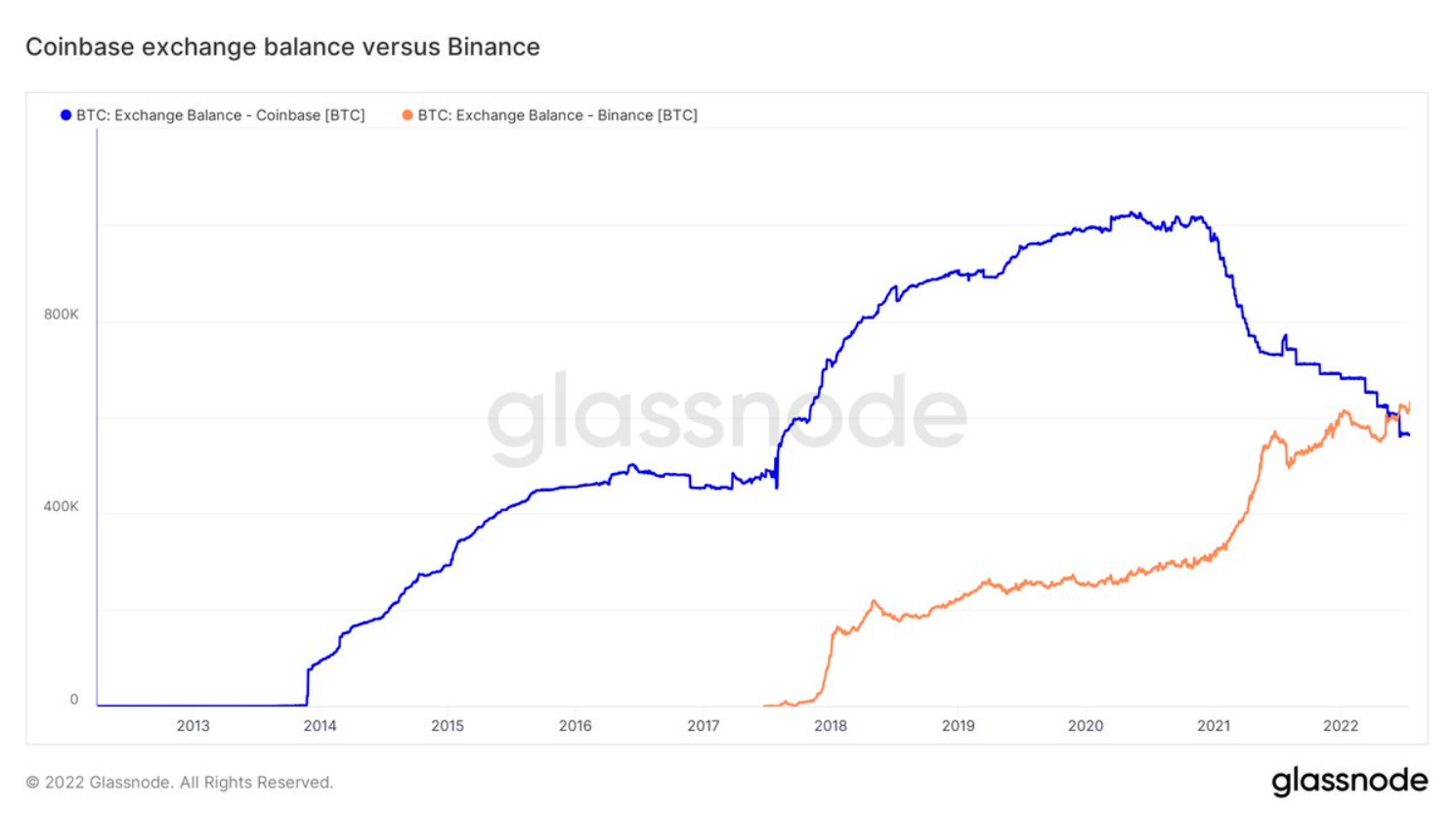

While the Coinbase exchange was the platform holding the most BTC since 2014, the dynamic has been completely reversed since 2021. Previously, both Coinbase and Binance (younger by 5 years), raked in BTC. However, since 2021, Binance has seen its bitcoin holdings rise sharply while Coinbase’s have done the opposite. The crossover finally took place on Monday, July 18.

The graph below, from Glassnode’s analysis, shows a handover that began in 2021, when inflows to Binance were very high.

Now, the transfer of power seems to have materialized, and it is difficult to see how Coinbase could recover “its throne” while Binance continues to grow. In the future, Coinbase could even be overtaken by other exchanges like FTX, which is also growing in the current bear market.

Got something to say about Binance, Coinbase, or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.