Binance has fired at least five members of its compliance investigations team after they internally flagged more than $1 billion in transactions allegedly tied to Iranian entities, according to Fortune.

The transactions reportedly took place between March 2024 and August 2025. As reported, they were routed using Tether’s USDT stablecoin on the Tron blockchain.

USDT on Tron: A Familiar Pattern For Iran?

The firings allegedly began in late 2025. Several of the dismissed staff had law enforcement backgrounds and held senior investigative roles.

Fortune reported that at least four additional senior compliance staff have also left or been pushed out in recent months.

The reported $1 billion in flows were denominated in USDT and moved across the Tron network. That combination has repeatedly appeared in recent sanctions enforcement actions involving Iran-linked activity.

Earlier this month, the US Treasury’s Office of Foreign Assets Control (OFAC) sanctioned two UK-registered crypto exchanges, Zedcex and Zedxion. It’s alleged that the exchanges processed nearly $1 billion in transactions tied to Iran’s Islamic Revolutionary Guard Corps (IRGC).

According to OFAC and blockchain analytics reporting cited by TRM Labs and Chainalysis, much of that activity also involved USDT on Tron.

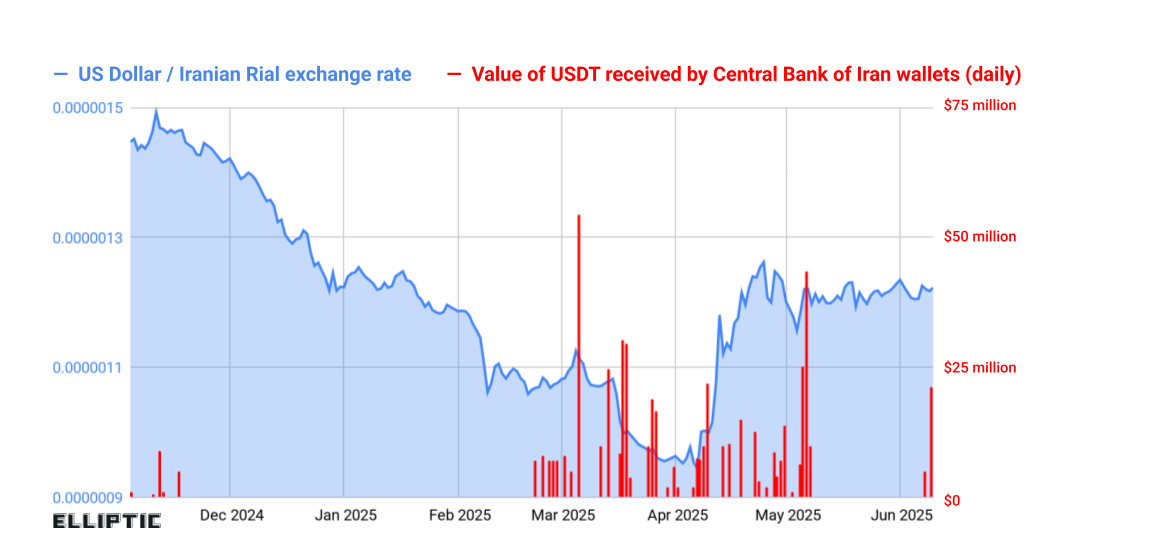

Separately, BeinCrypto reported in January that Iran’s central bank accumulated more than $500 million in USDT amid pressure on the Iranian rial. Blockchain analytics firm Elliptic said the purchases likely aimed to secure hard-currency liquidity outside the traditional banking system, effectively creating a parallel dollar reserve.

Taken together, these cases show how stablecoins—particularly USDT—have become central to Iran-linked cross-border financial flows.

Binance has not publicly confirmed that the alleged Iran-linked transactions violated sanctions laws, nor has any regulator announced new enforcement action against the company related to this reporting.

However, the episode unfolds amid broader scrutiny of stablecoin infrastructure and the role of exchanges in geopolitical sanctions regimes.