After months of tension between Belgium’s Financial Services and Markets Authority (FSMA) and the cryptocurrency industry, the regulator has ordered Binance to cease all crypto exchange services within Belgium.

In a sharply worded announcement on Friday, the FSMA distinguished between virtual and “legal” forms of money. It said that it had discovered that Binance has been offering exchange services in Belgium between virtual and legal currencies. Moreover, Binance has been extending such services to parties in countries that are not part of the European Economic Area (EEA). “The FSMA has therefore ordered Binance to cease, with immediate effect, offering or providing any such services in Belgium,” the announcement stated.

The FSMA Invokes Article 136

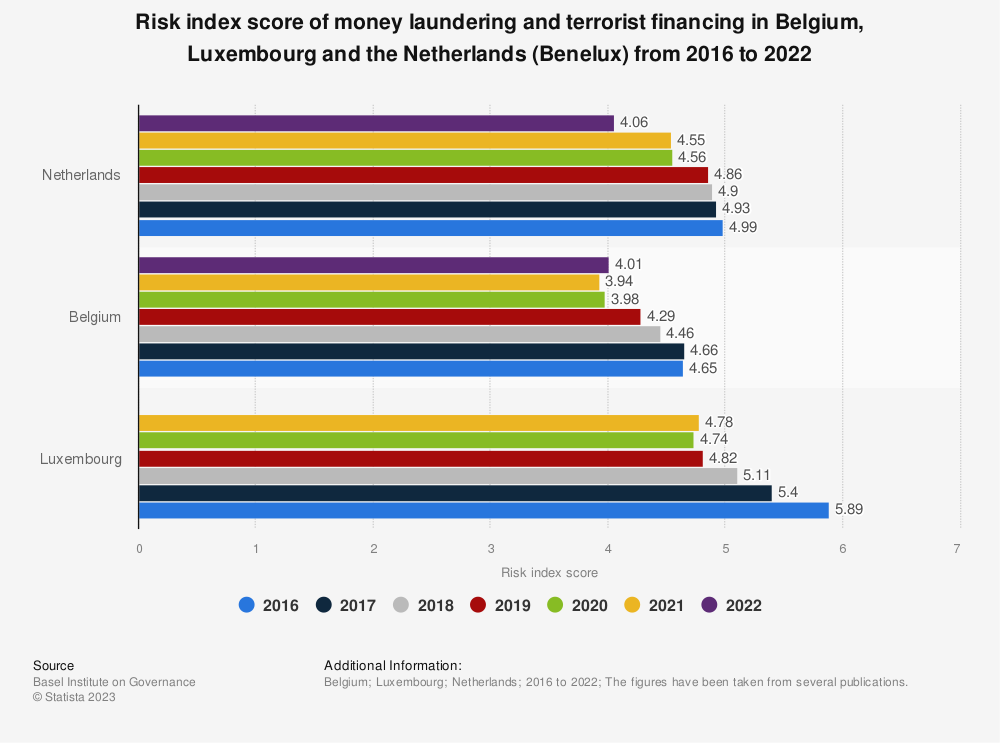

The regulator opposes crypto wallet and exchange services on the grounds that they often play a role in financial crime. In its statement, the FSMA cited Article 136 of the Belgian Law on the prevention of money laundering and terrorist financing. This provision imposes criminal penalties on entities that offer the above-named services in Belgium from non-EEA bases of operations.

The FSMA accuses Binance of knowingly facilitating such services from outside Belgium. It alleges that there are 27 companies playing a role in the operational and/or technical aspects of providing the services inside the country. Of these, 19 are based outside the EEA.

Binance Not Responsive?

The FSMA said it had made repeated requests to Binance for information about the provenance of the services in question. Despite all the requests, Binance has failed to establish to the FSMA’s satisfaction that the entities are operating legally within Belgium.

Besides ceasing activities in Belgium, the FSMA has demanded that Binance take further measures. It must return cryptographic keys and virtual currencies that the exchange holds for Belgian clients. Or, the exchange may hand over those assets to entities operating legally in Belgium or another EEA member state.

If Binance opts for the latter, it must “take every precaution” needed to assure the safety of such transfers, the FSMA stated.

The FSMA Opposes Cryptocurrency in General

The FSMA has framed its newest vendetta against Binance in terms of cross-border regulations. But, looking at the FSMA’s record, its latest action is clearly of a piece with long-running anti-crypto efforts.

In April, the FSMA rolled out new rules for crypto advertising. It now requires ten days’ notice before the launch of an ad campaign for crypto assets.

Worse still, those putting out ads for their products and services would have also to include a disclaimer at the bottom. “The only guarantee in crypto is risk.”

The FSMA’s stance is a source of frustration. Both for challenger banks trying to expand into new markets in Europe, and now, for one of the world’s largest crypto exchanges.

Belgium Joins France in Attacking Binance

This week’s developments in Belgium are of a piece with other recent events hampering Binance’s operations. The decision of the FSMA comes just days after Binance found itself in hot water in France. The exchange came under investigation for alleged “aggravated money laundering” and “illegal provision of crypto services.”

Officials in France objected, in particular, to Binance’s failure to meet know-your-customer requirements. And to ensure that bad actors were not using its platform and services for sneaky dealings.

Moreover, they accused the exchange of failing to obtain necessary approvals from the Financial Markets Authority to advertise to prospective French customers.