May saw increased activity in the cryptocurrency market, with some assets posting gains while others traded sideways.

BeInCrypto reviews the top predictions for June 2024 from leading crypto analysts.

Bitcoin (BTC) To Reclaim All-Time High

In a post on X on June 3, crypto analyst Ali Martinez noted that leading Bitcoin (BTC) was poised to break above the upper line of a symmetrical triangle.

A symmetrical triangle is formed when an asset’s price continues to hit various lower highs and higher lows. It suggests that the asset’s price is consolidating within a tight range. Buyers push prices up to meet resistance, and sellers push them down to find support.

When an asset’s price breaks above this upper line, it signals that it has overcome the previous resistance levels. It suggests that the asset’s buyers are gaining control, and the price may continue to rise.

This led Martinez to opine that a sustained close above the $69,330 resistance level could propel BTC to $74,400.

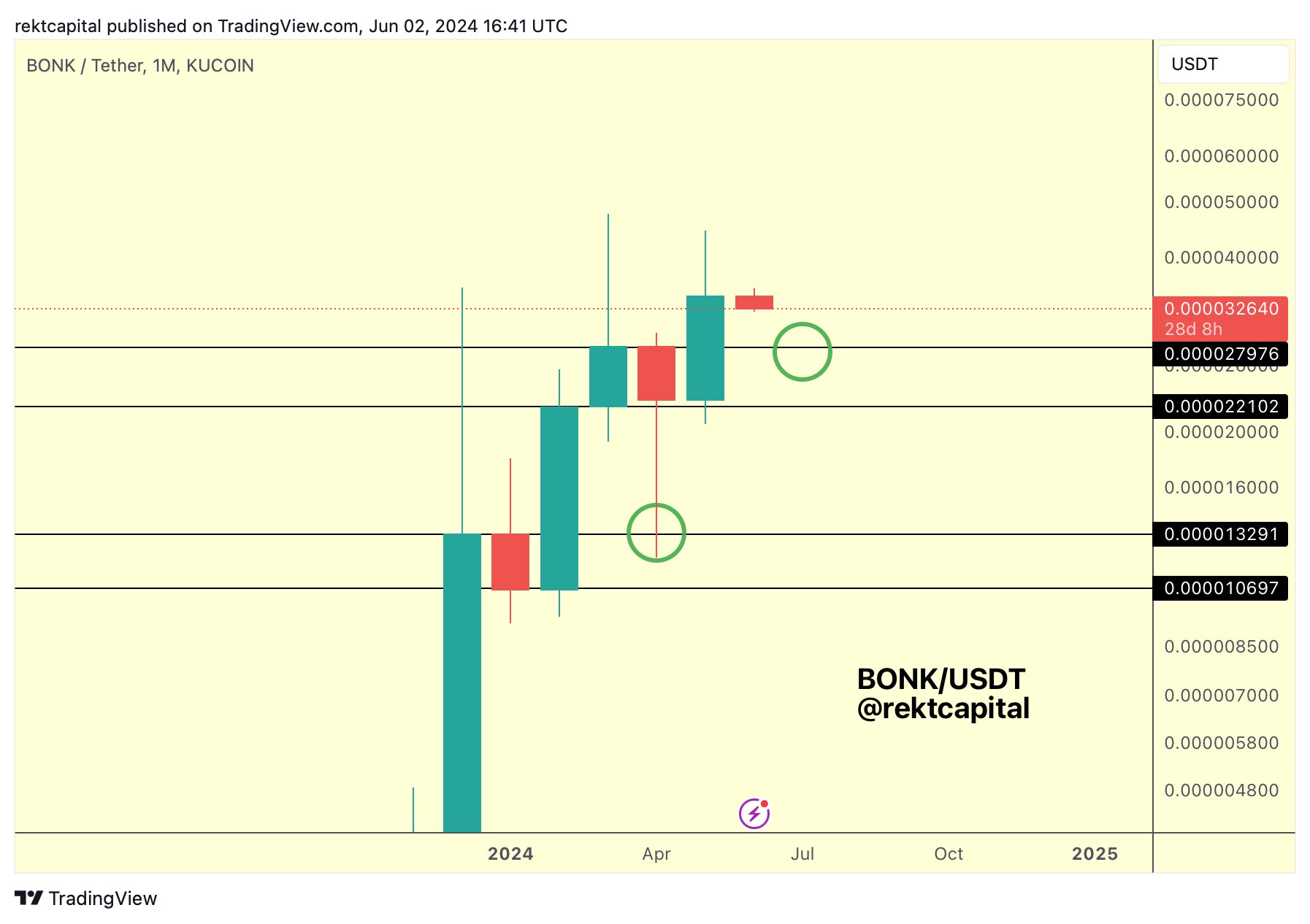

Bonk (BONK) To Retest Old Breakout Range

On June 2, well-known pseudonymous crypto analyst RektCapital tweeted that leading meme coin Bonk (BONK) could suffer a minor price decline to an old Range High in June.

Range High refers to the highest price point within a defined range within which an asset’s price has been moving sideways. It serves as a resistance level.

In an earlier post on May 31, the analyst stated that the old Range High might serve as support. Which the bulls need to defend if the meme coin’s price falls back to that level.

Therefore, it can confirm the breakout if BONK witnesses a price pullback to the old Range High and bounces off it (using it as support). This would signal to traders that the upward trend will likely continue.

The analyst added, however, that this retest only sometimes happens. Sometimes, if there is strong buying pressure in the market, the asset’s price may continue to rise without revisiting the old Range High.

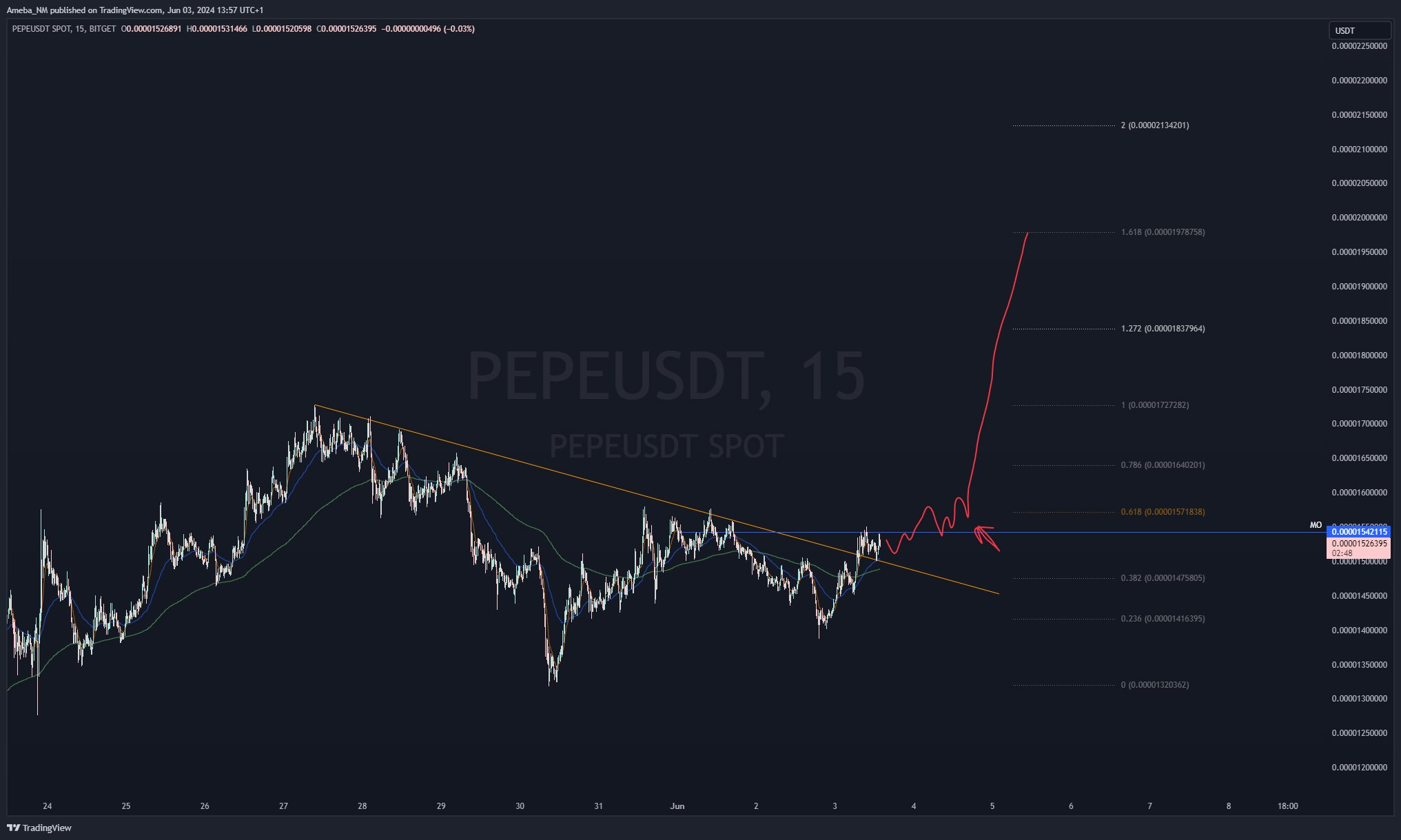

Pepe (PEPE) To Surge As it Breaks Resistance

Popular crypto analyst Ameba posted on X on June 3 a chart depicting that PEPE recently broke above a downward trend line.

“Broke TL (tend line); reclaim MO (monthly open) and it would look good for a leg higher,” the analyst stated.

This trend line often acts as resistance. Therefore, when an asset’s price breaks above it, it is considered a bullish signal. This suggests that the downward momentum is weakening, and buyers are gaining strength.

According to Ameba, PEPE’s price may rise further if it reclaims its moving average. When an asset’s price rallies past a moving average, it confirms the uptick in buying pressure.

It suggests that the asset’s current market value is above its average price during the days assessed by the moving average.

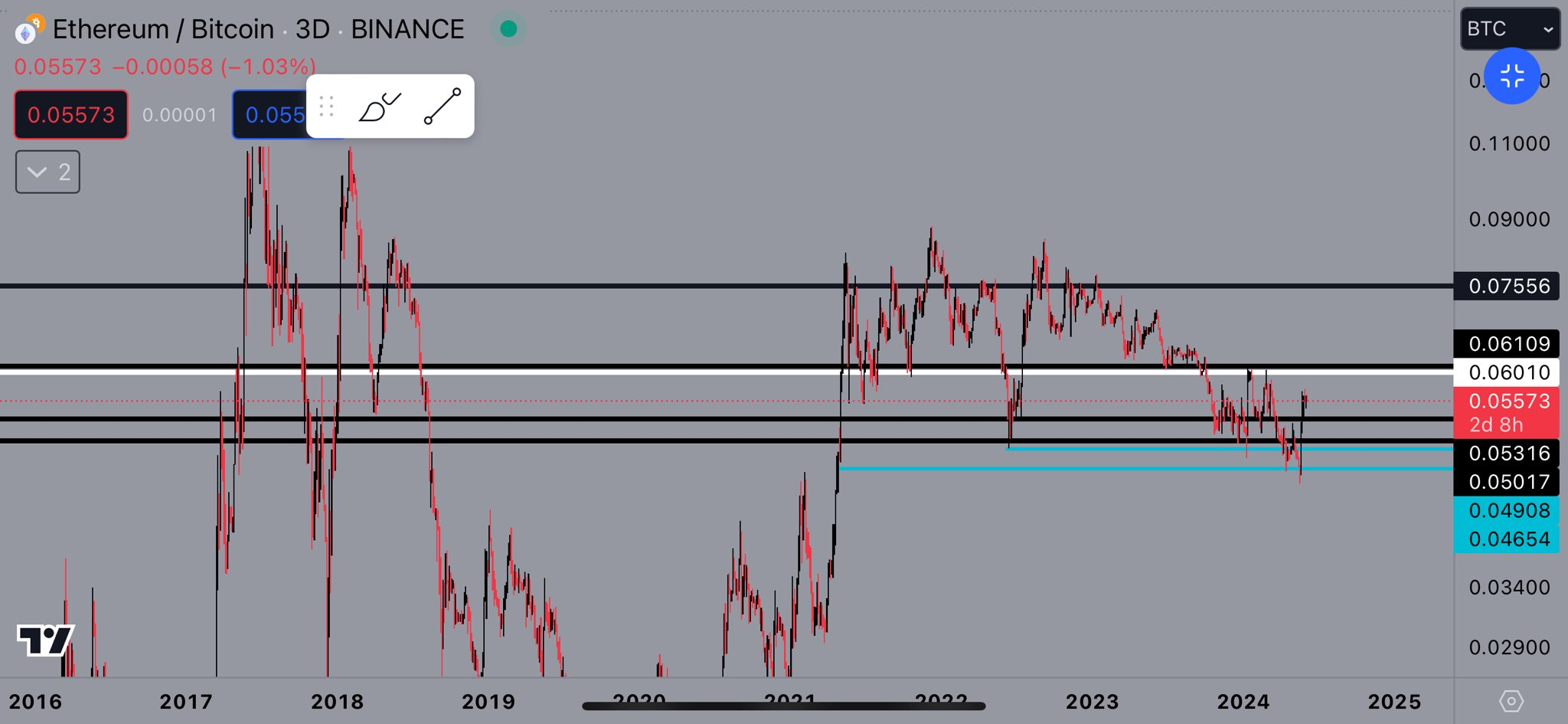

Ethereum (ETH) ETF Is Not Priced In

According to a well-known analyst, CryptoGodJohn, the recently approved spot Ethereum exchange-traded fund (ETF) is not yet priced in. But the leading altcoin’s value will skyrocket in the coming months.

“$ETH is literally setting the stage for a monster rally over the next 3-6 months,” the analyst tweeted

The analyst posted a chart showing ETH positioned near macro range lows on the ETH/BTC pair. This position suggests a strong foundation for a significant uptrend, as ETH might experience a substantial rally if it starts gaining against BTC.

Taking a cue from BTC’s rally post-ETF approval in January from $24,000 to an all-time high of $73,750 in March, CryptoGodJohn opined that ETH may follow a similar trend over the coming months.