A recent preventable exploit relating to Ripple’s XRP on cryptocurrency exchange Beaxy may have cost it some $570,000, according to a new report. The exchange may possibly be insolvent.

A week ago, Beaxy was shrouded in controversy after its XRP/BTC plummeted due to an exploit and coordinated sell-off. The hackers used the “XRP partial payment exploit” to drop the price of XRP -40% in a matter of minutes. Although Beaxy claims other exchanges were targeted, only it suffered which caused many to raise eyebrows. However, apparently, there’s more to the story than was initially thought.

Beaxy May Be Insolvent

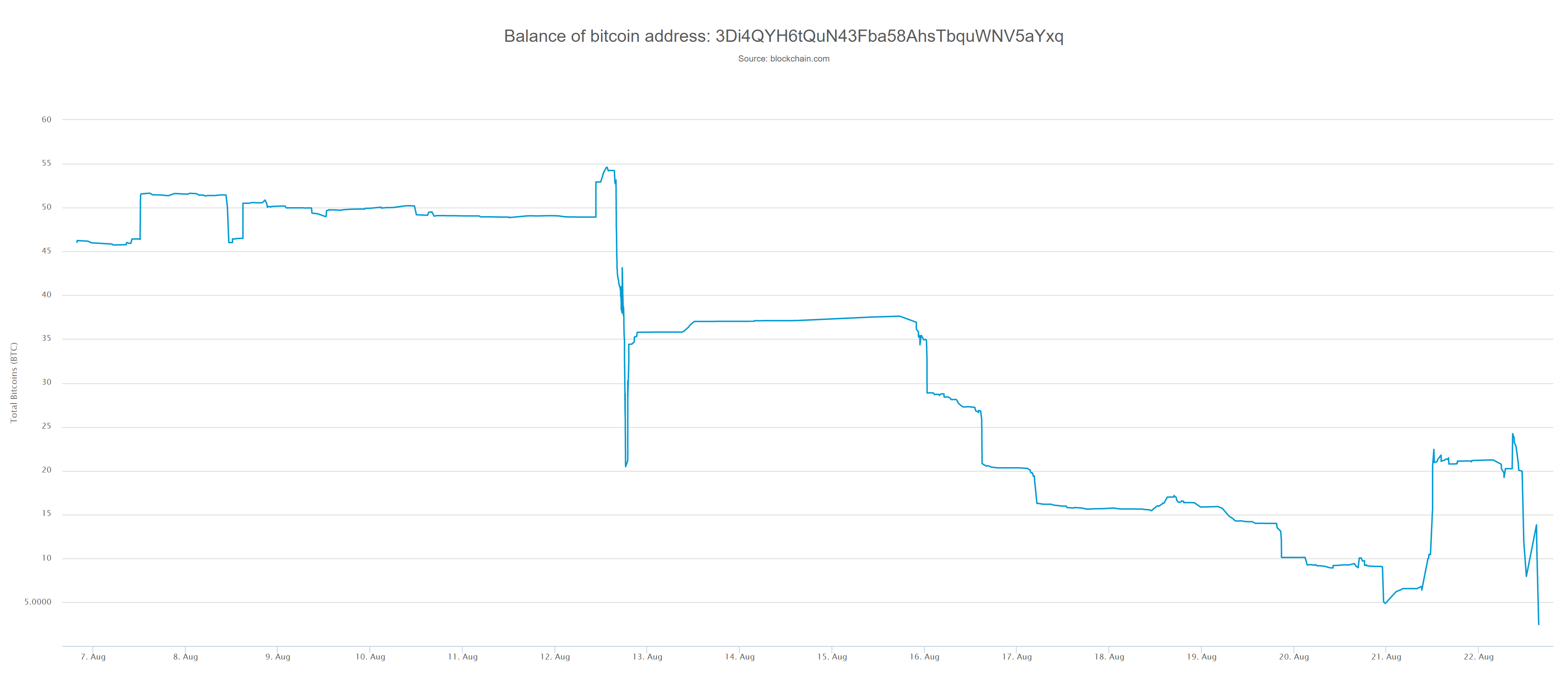

The cryptocurrency exchange is claiming everything is fine, but investigative journalist John Galt prove otherwise. In a piece titled Beaxy — Incompetent. In Denial. Insolvent?, he argues that things are far worse than they seem. In fact, the XRP Partial Payment transaction was sent a full week before the hack took place. By all standards, it should have been caught long beforehand. According to Galt, in just about two hours and four minutes into the hacking attempt, in total around 43.6 BTC and 111,000 XRP was taken. That brings the stolen funds to around $570,000. In total, the coordinated attackers were able to make 35 withdrawals from the exchange before setting off red flags. At first, the team behind Beaxy tried to hush the news and claimed it was still “unclear.” However, now we have proper documentation about the extent of the damages—and, by all estimates, it seems to have hit Beaxy’s bottom line especially hard. The exchange’ cold wallet has plummeted this week and currently holds less than 5 BTC.

An All-Around Failure

What went wrong at Beaxy was multi-fold and the result of largely the exchange’s own negligence.- The Beaxy Partial Payments exploit is, in fact, not a bug. It’s been documented on the XRP Dev Portal since October 2014.

- Despite Beaxy claiming otherwise, no other exchange was affected. It was the result of the exchange’s own negligence.

- The team’s response was painfully slow and the community had to tell the team to halt BTC withdrawals, after forgetting to do so.

- BitcoinBay®, a team leader at Beaxy, seemed to imply that it was happening “all over the place” when, in fact, it was not.

- There is no proof that the stolen funds have been reimbursed, despite the exchange claiming so.

- Finally, Beaxy claims that they have the KYC of the hackers involved as if anyone smart enough to conduct such a hack would provide real identification on Beaxy.

Images are courtesy of Shutterstock, Medium.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored