Avalanche recorded a sharp rise in the last 24 hours, with AVAX price surging more than 11%. The rally was fueled by reports that Avalanche is seeking to raise $1 billion to establish two cryptocurrency-focused investment vehicles in the United States.

This effort is aimed at strengthening Avalanche’s position as a leading digital ledger for capital markets.

Avalanche Picks More Than Just Investors’ Interest

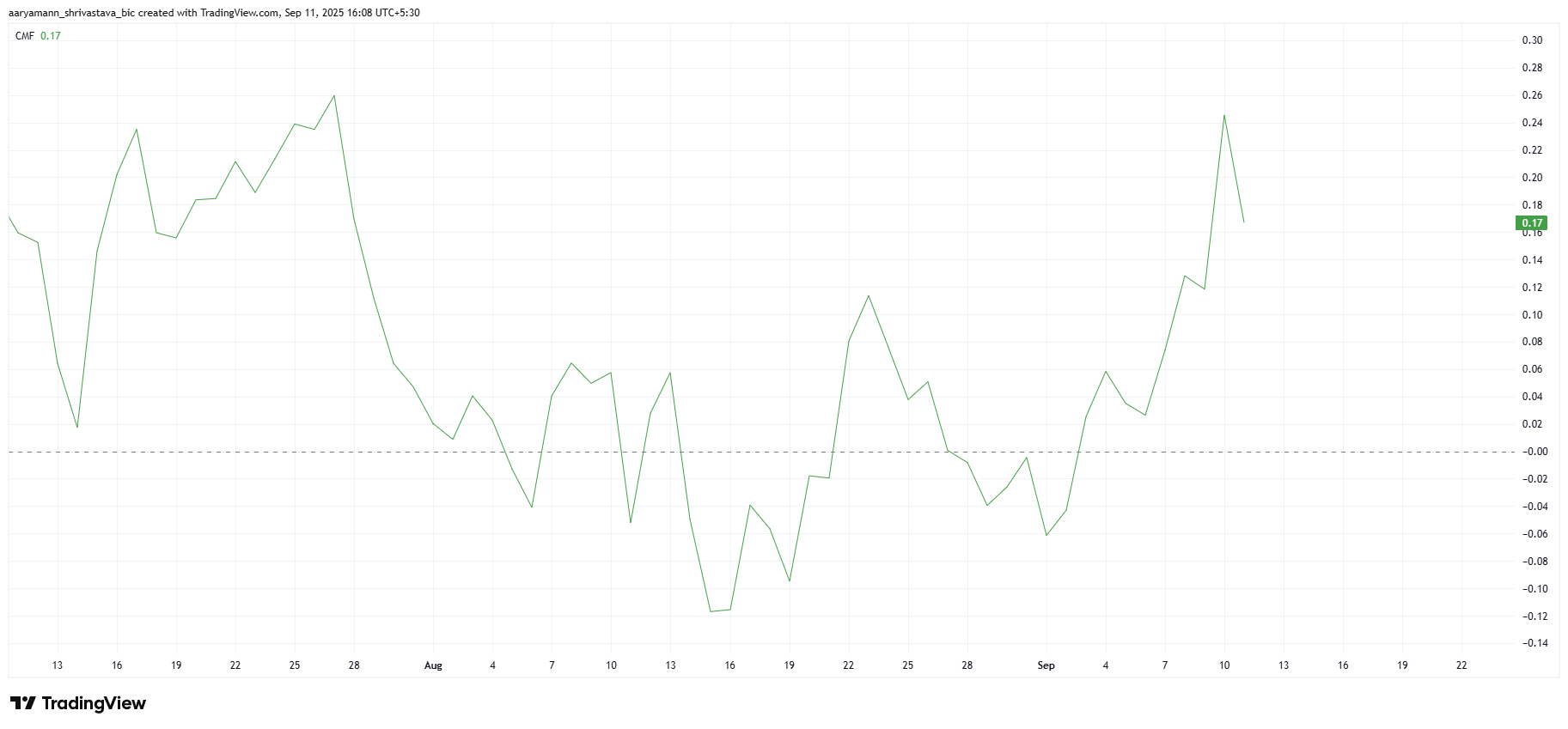

Investor interest is showing signs of renewed strength. The Chaikin Money Flow (CMF) indicator has steadily risen, reaching its highest point in nearly two months. This uptick confirms that capital is flowing into Avalanche as traders anticipate continued gains.

The consistent rise in CMF suggests that AVAX is being viewed as a strong candidate for short-term profits and longer-term accumulation. With momentum favoring buyers, the token has gained an edge, allowing the market to sustain upward pressure despite recent volatility in the broader crypto sector.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

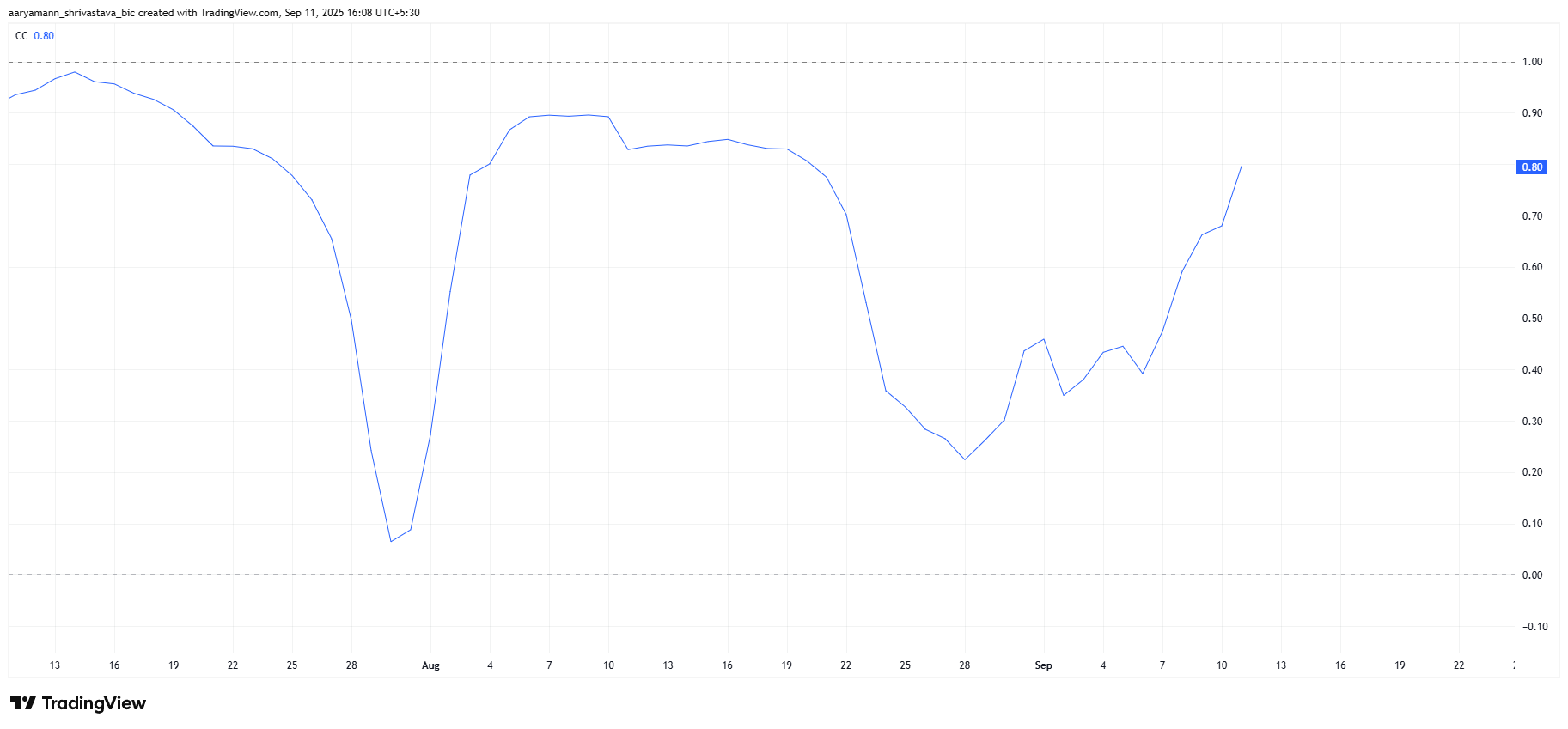

Avalanche’s macro momentum also aligns positively with broader trends. The altcoin’s correlation with Bitcoin now sits at 0.80, a sign of strong alignment. This connection indicates that AVAX will likely mirror Bitcoin’s trajectory if BTC maintains its current uptrend.

Given Bitcoin’s recent recovery, AVAX investors are optimistic that the price will continue to rise. As BTC holds firm above critical support levels, Avalanche is positioned to follow suit, providing further validation for bullish traders betting on higher targets.

AVAX Price Faces Resistance

At the time of writing, AVAX is trading at $29.00 after rising 11.3% in a single day. The surge pushed the token to a 7-month high, though it is currently facing resistance at $30.00.

If investor enthusiasm holds, Avalanche could flip the $30.00 resistance into support, enabling a move toward $31.15 or higher. Sustained inflows and stronger correlation with Bitcoin would reinforce this bullish trajectory.

However, risks remain. If investors begin booking profits at current levels, AVAX could lose momentum. A dip to the $27.00 support or even further to $25.86 would erase much of the recent rally and invalidate the bullish thesis in the short term.