Avalanche (AVAX) is at risk of falling below its yearly lows, a move which could trigger a sharp fall towards $12.50.

Avalanche is a proof-of-stake platform that creates blockchain-specific platforms known as subnets, which act as the database layer for decentralized applications (dApps).

Since GameFi games require constant changes in the blockchain, fast transactions with a low cost are ideal for such an environment. As a result, Avalanche is one of the strongest candidates for builders in the space.

Through its subnet customization feature, Avalanche enables gaming ecosystems to incentivize network contributions and create treasures that create rewards through the use of fee allocations from native tokens.

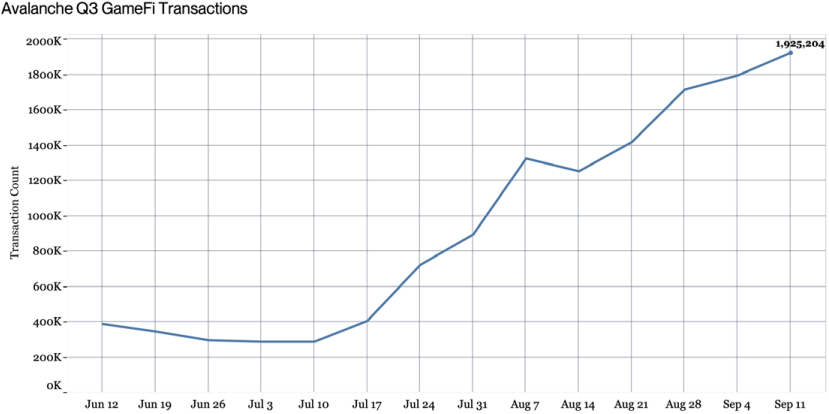

Currently, the two games built in the Avalanche ecosystem with the most transactions are DeFi Kingdoms and Chikn. The transaction count has been steadily growing since the beginning of June and is currently at nearly two million.

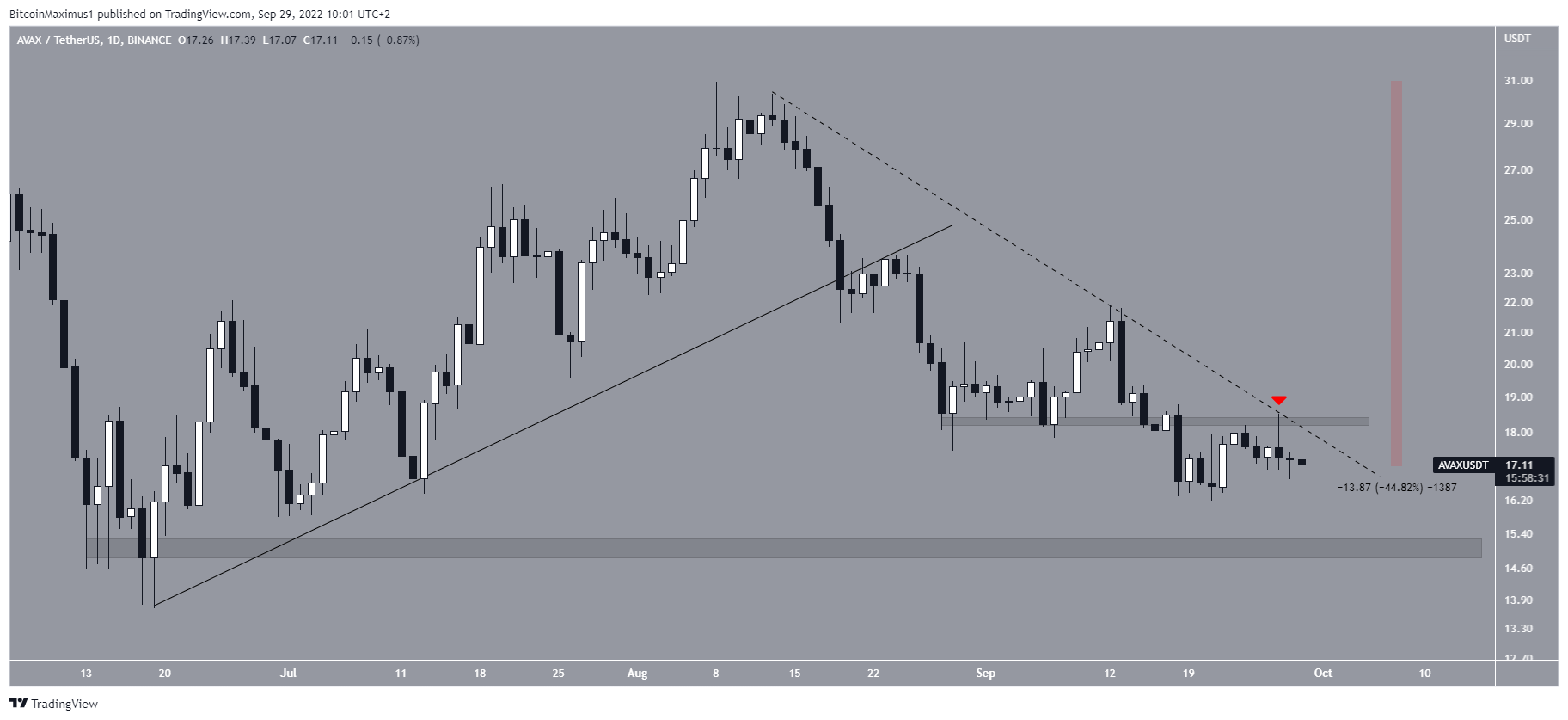

Despite this positive sentiment in the market, the AVAX price has fallen by 45% since Aug. 8 and has broken down from an ascending support line in the process. The line had previously been in place since the June lows, so it is possible that the upward movement has now come to an end.

Additionally, the price was rejected by the minor $18.30 area on Sept. 27, also validating a descending resistance line (dashed) in the process.

The closest horizontal support area is at $15.

Will there be more downside?

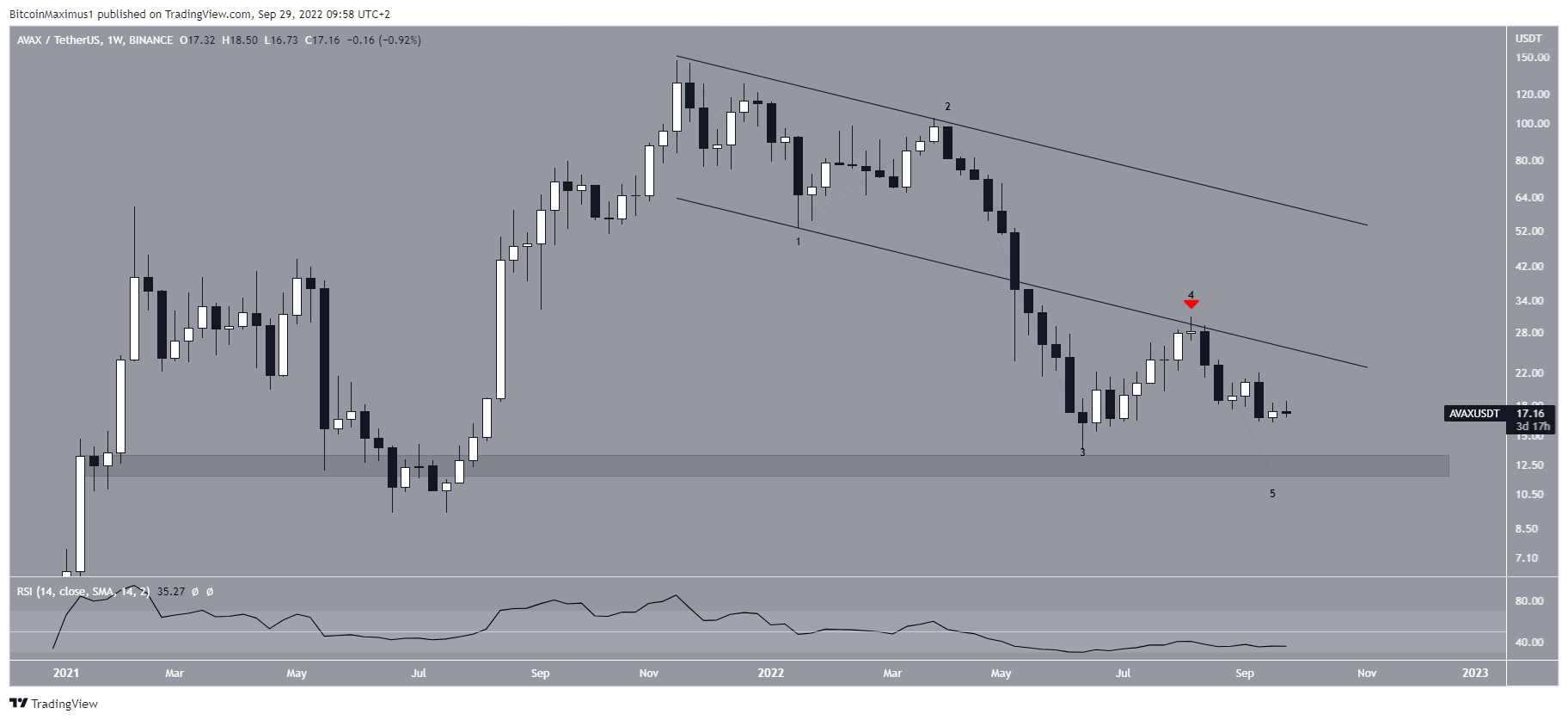

The weekly chart supports the possibility of more downside prior to the eventual low. There are three main reasons for this:

- The weekly RSI is below 50 and has not generated any bullish divergence yet

- The Aug. rejection (red icon), which could part of a fourth wave pullback

- The fact that the main support area is at $12.50 and has not yet been tested

So, the readings from the weekly timeframe suggest that the price will break down in the daily time frame and eventually reach the $12.50 horizontal support area.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.