One of the best-performing crypto assets at the moment is the layer-1 blockchain Avalanche (AVAX). The token is outperforming its high-cap brethren for yet another day, but what is driving momentum?

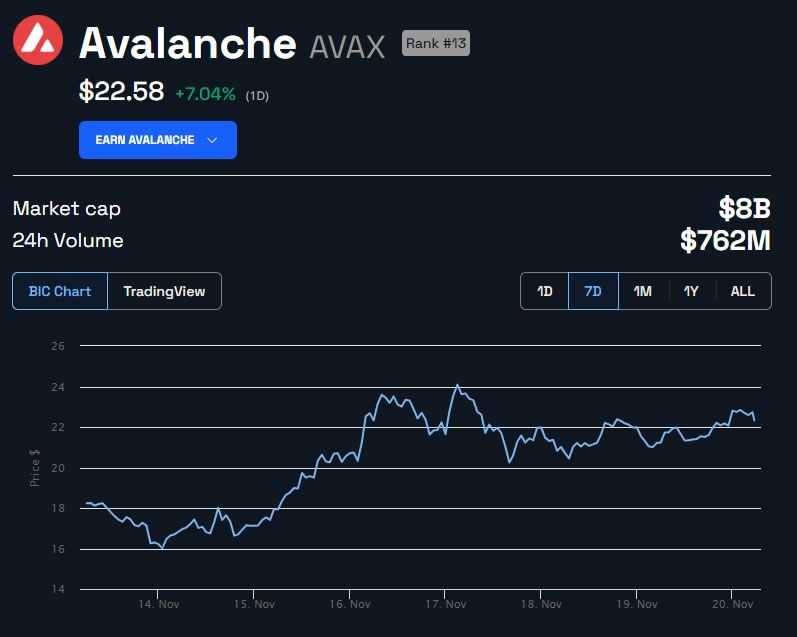

AVAX prices made almost 10% over the past 12 hours or so, returning the token to the $23 price level. It has outpaced other altcoins and overall crypto market gains, which are up around 2.3% on the day.

Avalanche Hype Driven by RWA Tokenization

There is a lot of narrative surrounding the layer-1 high-throughput blockchain at the moment, so much so that it has driven AVAX prices a whopping 80% over the past fortnight.

Moreover, a series of recent announcements, partnerships with major institutions, and a surge in GameFi and NFTs have propelled AVAX by more than 140% in the past month.

One of the main narratives is the pivot to real-world asset tokenization, which Avalanche aims to become the standard chain for.

In recent days, it has announced partnerships with JP Morgan and Citi. Both are experimenting with RWA tokenization using Avalanche technology.

DeFi researcher ‘Emperor Osmo’ said that this,

“Resurgence of excitement will trickle across the ecosystem from both retail and institutions looking to get exposure.”

Read more: How to Buy Avalanche (AVAX) with a Credit Card: A Step-by-Step Guide

RWA tokenization has been touted as the next big thing in crypto. It essentially involves putting traditional assets such as gold, commodities, treasuries, and real estate on the blockchain.

Earlier this year, private wealth management firm Bernstein estimated that roughly 2% of the global money supply, or around $3 trillion, could be tokenized over the next five years.

The big banks clearly want a slice of that tokenization pie and can turn to existing technology, such as Avalanche, rather than building systems from scratch.

In July, the Avalanche Foundation announced the launch of Avalanche Vista, a $50 million initiative to invest in RWA tokenization.

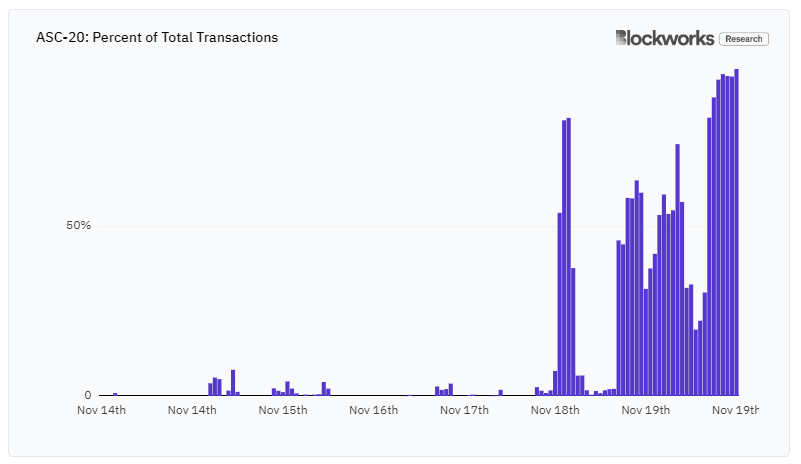

Furthermore, on Nov. 20, Blockworks researcher Dan Smith reported that Avalanche has its own ordinals standard called ASC-20.

Over the past day, ASC-20 minting has surged, accounting for 96% of transactions with over 170,000 wallets minting ordinals.

Avalanche AVAX Price Outlook

The positive momentum pushed AVAX prices to an intraday high of $23.18 during the Monday morning Asian trading session.

It is currently trading up 7% on the day at $22.58, having held on to last week’s gains.

AVAX hit a yearly high of just over $24 on November 17, and it remains up almost 25% over the past week.

However, the asset is still down 84% from its all-time high two years ago of $145, so there is plenty of room for further gains.