Arthur Hayes, the founder of BitMEX, recently updated his portfolio strategy, saying he would pivot to meme coins, among other sectors.

Recent data shows this redirection may not be working out as the crypto executive exits several positions with losses.

Arthur Hayes Exits PEPE and MOG Positions at a Loss

Only days after pivoting to meme coins, Arthur Hayes exited his position on PEPE and MOG, losing $40,000 in the process. The BitMEX executive moved his PEPE and MOG holdings to a centralized exchange on Thursday during the early hours of the Asian session.

The loss came as Hayes’ PEPE and MOG portfolios dropped in value to $460,000. This happened after he bought 24.39 billion PEPE valued at $252,000 on September 27, as part of a portfolio diversification strategy centered on meme coins. Reportedly, he also purchased $250,000 worth of MOG meme coin.

“Arthur Hayes, the founder of BitMEX, said he was optimistic about Memecoin on September 27 and bought $250,000 of PEPE and $250,000 of MOG. Today, these PEPE and MOG were transferred to CEX, and their value has dropped to $460,000. The sale resulted in a loss of $40,000,” Wu Blockchain corroborated.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market.

The transaction had attracted attention, as is characteristic of heavy purchases among renowned personalities. Accordingly, PEPE rallied by 20% on Arthur Hayes’ posts.

Despite closing his meme coin position, Hayes remains invested in Pendle (PENDLE) and Aethir (ATH). This suggests his continued alignment with the DePIN (decentralized physical infrastructure network) and real-world asset (RWA) narratives, which have emerged as two of the most prominent trends in 2024.

Arthur Hayes’ meme coin portfolio losses are closely tied to the broader market downturn, which BeInCrypto attributes to geopolitical tension. Specifically, the ongoing conflicts involving Israel and Iran have raised concerns among investors, leading to capital withdrawals from riskier assets like Bitcoin.

Read More: What Are Meme Coins?

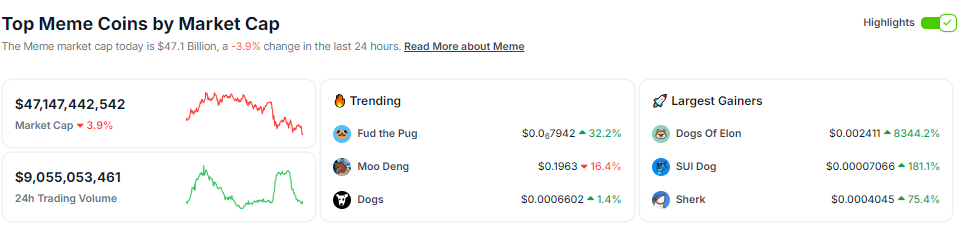

Meme coins typically rally when Bitcoin shows bullish momentum. The opposite is happening now, as seen on Thursday, when meme coin market capitalization fell nearly 4%, according to CoinGecko, while Bitcoin retraced from $65,000 to just above $60,000.