Ark of Panda (AOP) now commands more than 21% of all trades and over 30% of total trading volume on Binance Alpha, with daily volumes soaring to $6.4 billion. This surge severely outpaces its $22 million market cap and quickly overtakes established tokens.

AOP’s volume spike stems from a blend of trading incentives, gamified token rules, and speculative trading strategies. These factors make AOP both notable and risky on Binance’s experimental trading platform.

AOP Volume Outpaces Fundamentals

According to Dune Analytics, AOP leads activity on Binance Alpha, with more than 30% of total volume and over one-fifth of all executed trades.

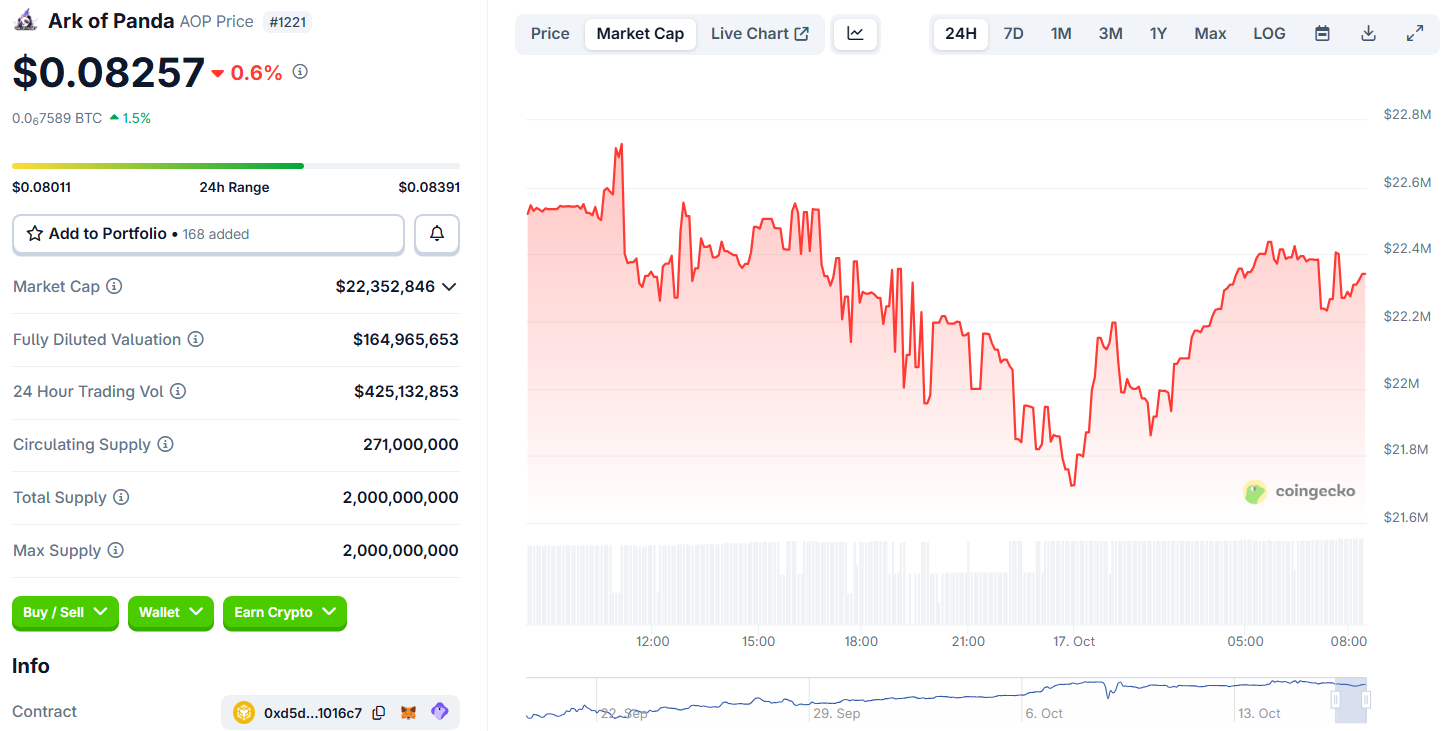

This rapid growth is striking, especially as AOP’s market cap increased from $12 million to over $22 million in the past month.

The gap between trading volume and market cap, with daily volumes more than 26,000% of AOP’s valuation, highlights the unique environment Binance Alpha offers. Most trades occur on Binance Alpha, with PancakeSwap (BSC) holding only a minor portion of liquidity.

The volume surge followed a Binance-sponsored competition in October, which awarded 8 million AOP to the top 10,000 participants and strongly incentivized frequent trades.

“AOP’s $6.4 billion Daily Volume Tops BTC—Join Tomorrow’s Binance Live at PM GMT+8! Daniel breaks down the 158% surge, trading tutorial, project demos, Panda Land Dominion features (Wild Plots to yields!), & partnership roadmap. Momentum is real—don’t miss strategies!” Ark of Panda announced.

This outsized volume places AOP above established cryptocurrencies like Bitcoin and Ethereum on Binance Alpha, with strong engagement and speculative trading driving its numbers.

Trader Incentives Drive Surge

The AOP token was created for flexibility and community engagement. It features reward and quest systems, along with AI-powered tools.

Its circulating supply remains low, 271 million based on CoinGecko data, out of a hard cap of 2 billion, producing concentrated ownership. As a result, shifts in trading behaviour can quickly move the price and increase volatility.

October’s trading contest sharply boosted activity by allowing buy and sell trades, including near-instant reverse trades, to earn leaderboard points.

Some users generated over $30,000 in volume using only $2, exploiting small price differences and farming points without much risk. These strategies enabled traders to inflate volume figures without lasting effects on price.

During the contest, limit orders earned quadruple points, further boosting volume. Consequently, trading rewards became the main driver for activity, meaning reported volume does not always represent real demand.

Still, community sentiment is bullish, with over 85% positive per CoinMarketCap, fueled by campaigns and upcoming features.

Ark of Panda Risks and Outlook

Despite massive volumes and positive sentiment, AOP is highly risky. Only a small portion of tokens are circulating, and most trading happens on a single platform.

Large holders or the end of incentives could cause major price swings. Binance’s competition rules frequently reminded participants about high volatility, concentrated ownership, and liquidity risks for Alpha tokens like AOP.

Although Ark of Panda seeks to bridge Web2 and Web3 by tokenizing real assets and supporting AI tools, trading incentives, not usage or fundamentals, now drive its volume and price. Investors must consider quick gains against potential instability as incentives wind down.

AOP’s dominance on Binance Alpha highlights how new token economies can boost activity quickly. However, sometimes the effects are lasting, though the momentum often fades when competitions end.