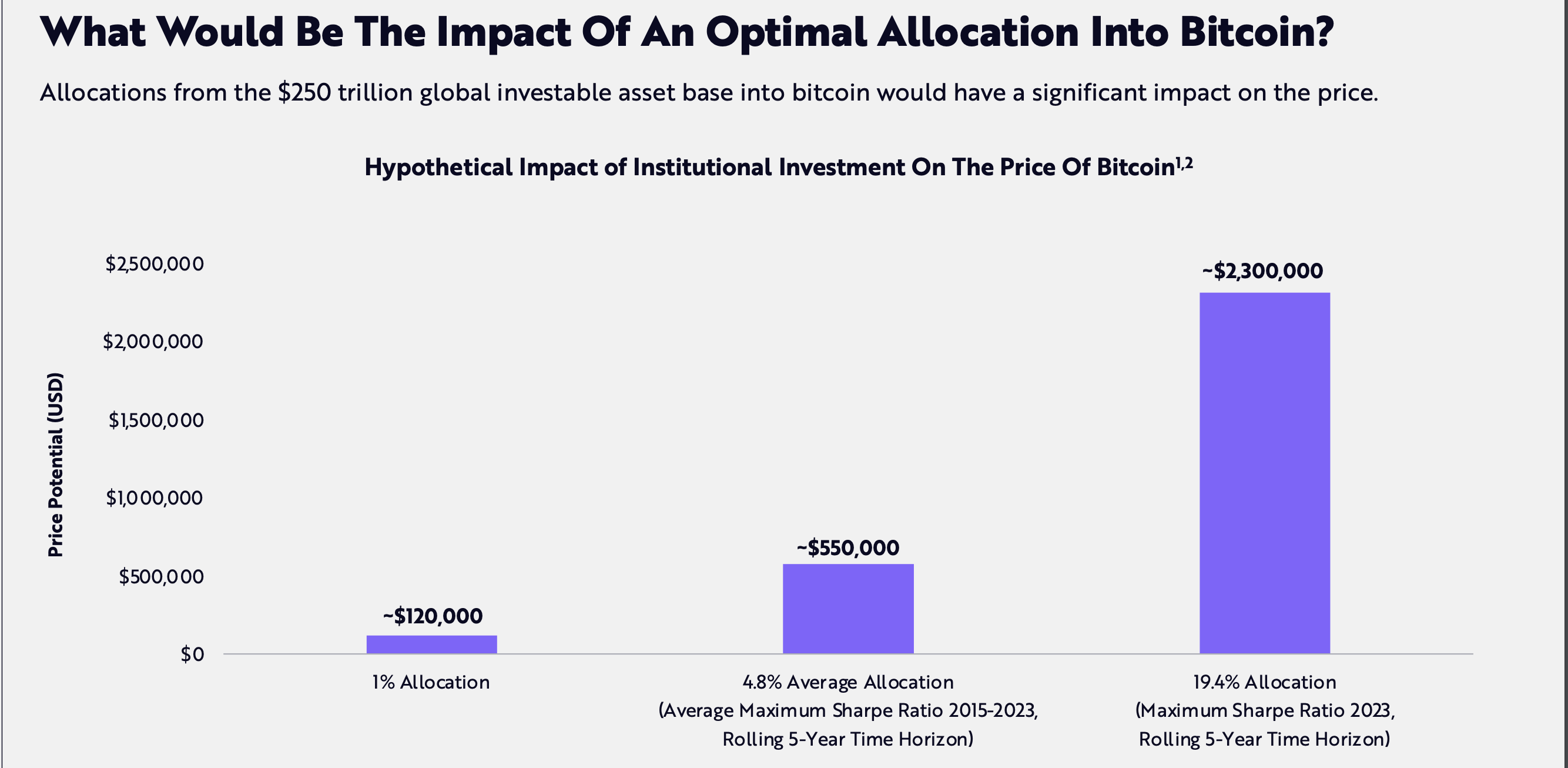

In a research report by ARK Invest, the potential trajectory of Bitcoin’s (BTC) value is meticulously analyzed, suggesting a monumental surge to $2.3 million. This projection is contingent upon a 19.4% allocation from the $250 trillion global investable asset base.

Given the digital currency’s burgeoning appeal among institutional and high-net-worth investors, this is a bold yet increasingly plausible scenario.

Can Bitcoin Achieve a Milestone of $2.3 Million?

Bitcoin’s ascension is not merely a speculative frenzy but a testament to its intrinsic value and utility. Indeed, it has fundamentally disrupted the traditional financial ecosystem, offering a decentralized alternative devoid of counterparty risk.

Bitcoin’s value rise is partly due to various investors, including nation-states and corporations, and its role as a preferred asset during uncertainty. It has a 40% market share over traditional safe havens like gold.

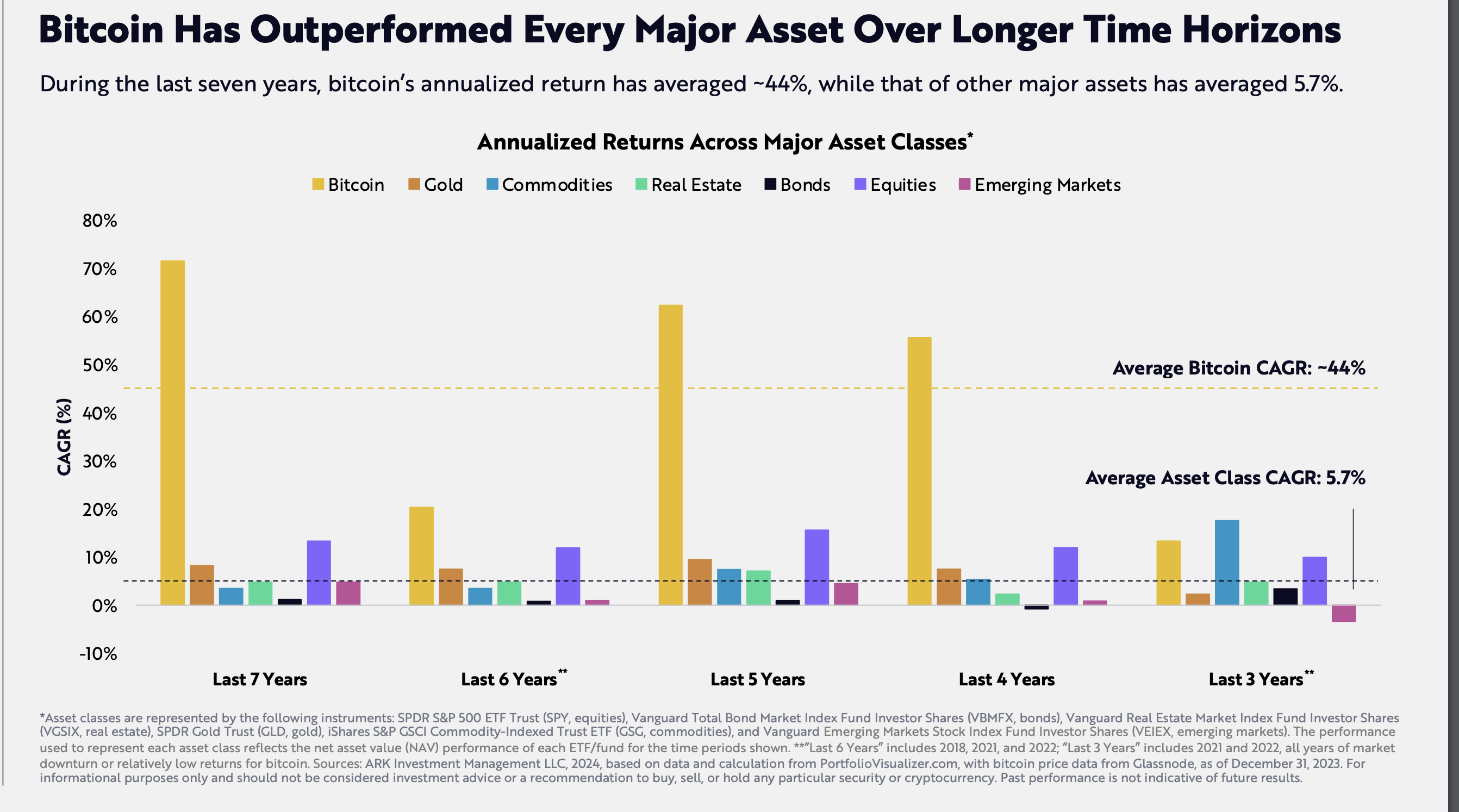

Moreover, BTC’s performance metrics are impressive, averaging a 44% annualized return in the past seven years. This dwarfs other major assets’ returns. The remarkable track record emphasizes the wisdom of a long-term Bitcoin investment. Despite its volatility, a commitment of at least five years has historically yielded profits, regardless of the initial purchase timing.

“Bitcoin’s volatility can obfuscate its long-term returns. While significant appreciation or depreciation can occur over the short term, a longterm investment horizon has been key to investing in Bitcoin,” wrote ARK Invest.

Read more: Bitcoin Price Prediction 2024/2025/2030

ARK Invest’s analysis extends to portfolio management, indicating that an optimal risk-adjusted return strategy in 2023 would have included a 19.4% Bitcoin allocation. This strategic approach has been validated over the past nine years, with a rolling 5-year analysis consistently favoring Bitcoin inclusion to maximize risk-adjusted returns.

The implications of ARK Invest’s findings are profound. A mere 1% reallocation from global investable assets to Bitcoin could catapult its price to $120,000. A more aggressive 4.8% shift would see values soar to $550,000. However, the 19.4% allocation scenario captures the imagination, envisioning a Bitcoin zenith of $2.3 million.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

This ambitious projection is not without its challenges and uncertainties. The path to such valuation levels will likely be fraught with regulatory, technological, and market volatility.