Altcoin season may be taking shape in a new and less predictable way in 2025. While the market recently saw a brief altcoin rally, analysts believe these mini-cycles will continue to appear before a broader, more sustained shift occurs.

Bitcoin dominance has dropped sharply, and altcoins have started to outperform BTC in the short term, but broader indicators suggest this rotation is still selective. Unlike past cycles, the next altcoin season could be more fragmented, favoring projects with strong fundamentals and execution rather than lifting the entire market.

Bitcoin Dominance Drops to March Lows as Altcoins Gain Ground

Bitcoin dominance has dropped sharply over the past six days, falling from 65.39% to 62.5%—a decline of nearly 5 basis points and its lowest level since March 31.

This shift suggests that capital is beginning to flow away from Bitcoin and into altcoins, weakening BTC’s share of the total crypto market cap.

Bitcoin dominance tracks the percentage of the overall crypto market made up by Bitcoin. A falling dominance level often signals the start of an altcoin season, where smaller-cap tokens outperform Bitcoin.

A notable example occurred in late 2024, when dominance dropped from 61.1% to 55% between November 21 and December 7, sparking a broad altcoin rally. If this trend continues, altcoins could see renewed momentum in the days ahead.

According to Marcin Kazmierczak, Co-founder & COO of RedStone:

“The recent mini altseason reflects growing investor interest in altcoins, driven by or possibly resulting from falling BTC dominance. It’s possible we’ll see sustained rallies, especially as the market matures and more projects gain traction.

However, I expect that, unlike past cycles, the market will continue the trend of not all altcoins benefiting equally — projects with strong products and excellent go-to-market strategies will likely outperform, while others may struggle to maintain momentum.” – Kazmierczak told BeInCrypto.

Top Altcoins Outpace Bitcoin This Week, But YTD Gap Remains Wide

Year-to-date, Bitcoin (BTC) continues to dominate most of the altcoin market, outperforming 11 of the top 12 altcoins. The only exception is XRP, which has posted a 23% gain this year, slightly edging out Bitcoin.

This performance gap is one reason the broader market has remained in a Bitcoin-led phase, with capital largely consolidating around BTC rather than spreading evenly across the altcoin space.

However, the trend has shifted sharply in the past seven days. Despite BTC rising 7% during this period, it was outperformed by all of the top 12 altcoins—most notably by Ethereum (ETH), which jumped 43%, and Dogecoin (DOGE), which surged 36%.

This short-term reversal may indicate the early stages of a potential altcoin season. According to Aurelie Barthere, Principal Research Analyst at Nansen, Solana looks bullish:

“We like SOL for strong fundamentals plus stabilizing 50-day moving average vs BTC.” – Barthere told BeInCrypto.

If altcoins continue to sustain this momentum and outperform BTC more consistently, it could signal a broader market rotation away from Bitcoin dominance and into the altcoin sector.

Altcoin Market Cap Rises, But Index Signals BTC Still Leads

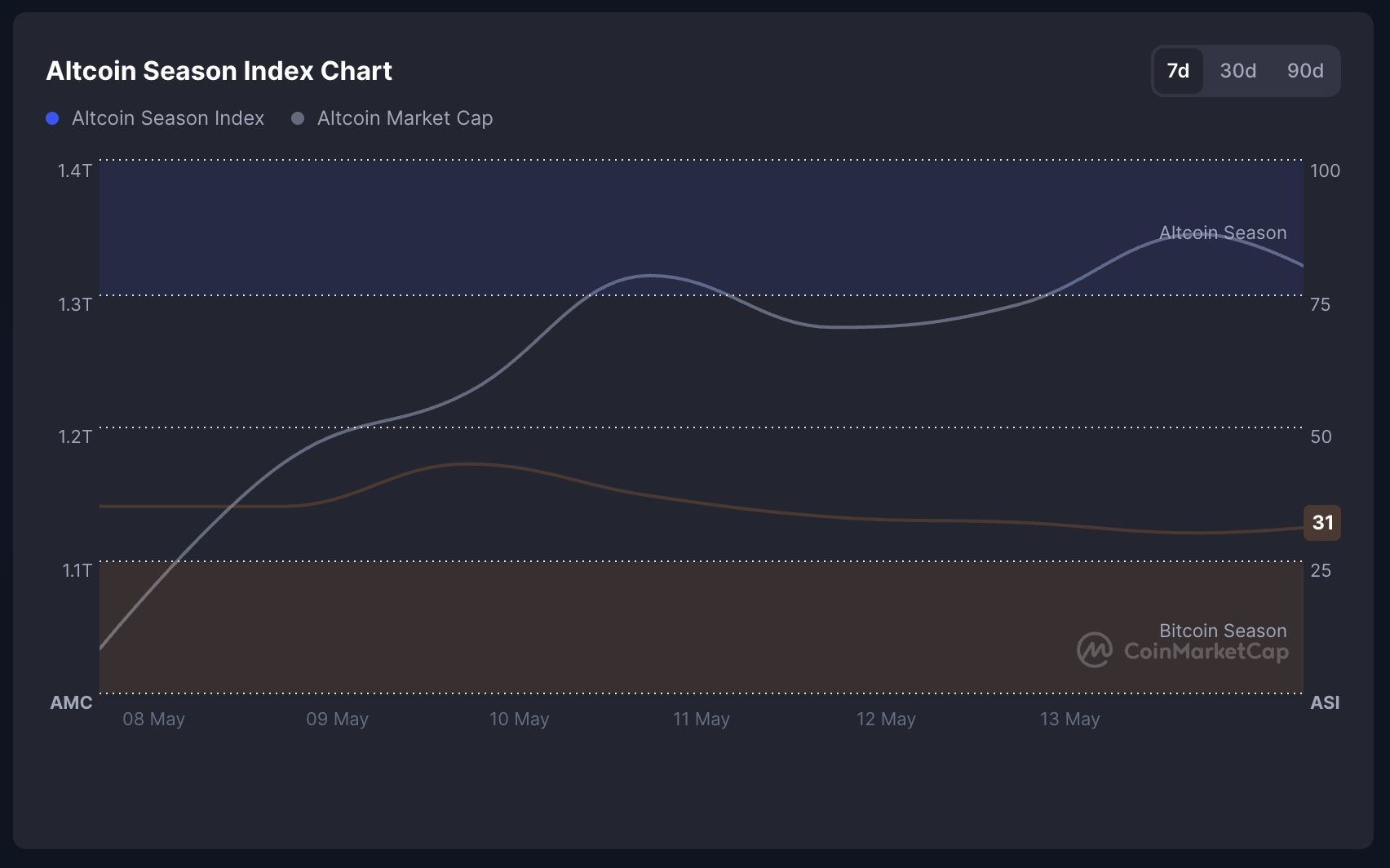

The total market cap of altcoins has surged over the past week, rising from $1.07 trillion to $1.30 trillion—a significant increase signaling strong inflows into the altcoin sector.

Despite this growth, the CoinMarketCap Altcoin Season Index has declined from 35 to 31 in the same period, showing that most altcoins are still underperforming relative to Bitcoin.

This disconnect suggests that while money is flowing into altcoins, it’s not yet broad or strong enough across the top 100 assets to trigger a true altcoin season.

The CMC Altcoin Season Index measures whether the market is favoring altcoins over Bitcoin by analyzing the performance of the top 100 altcoins.

If at least 75% of them outperform Bitcoin, it’s considered Altcoin Season; if 25% or fewer do, it’s Bitcoin Season. The index ranges from 1 to 100 and updates daily.

With the current value sitting at 31, the market remains in a Bitcoin-dominated phase, despite the rising altcoin market cap—highlighting that only a limited number of altcoins are driving the gains.