Altcoin market capitalization (TOTAL2) remained below $1 trillion in February, while market sentiment fell to its most extreme level in years. Many investors expect altcoins to form a bottom soon after five consecutive months of decline.

The first quarter of 2026 may still offer opportunities. However, investors need objective signals to evaluate the broader picture.

Persistent Selling Pressure and Fragmented Liquidity Weigh on Altcoins

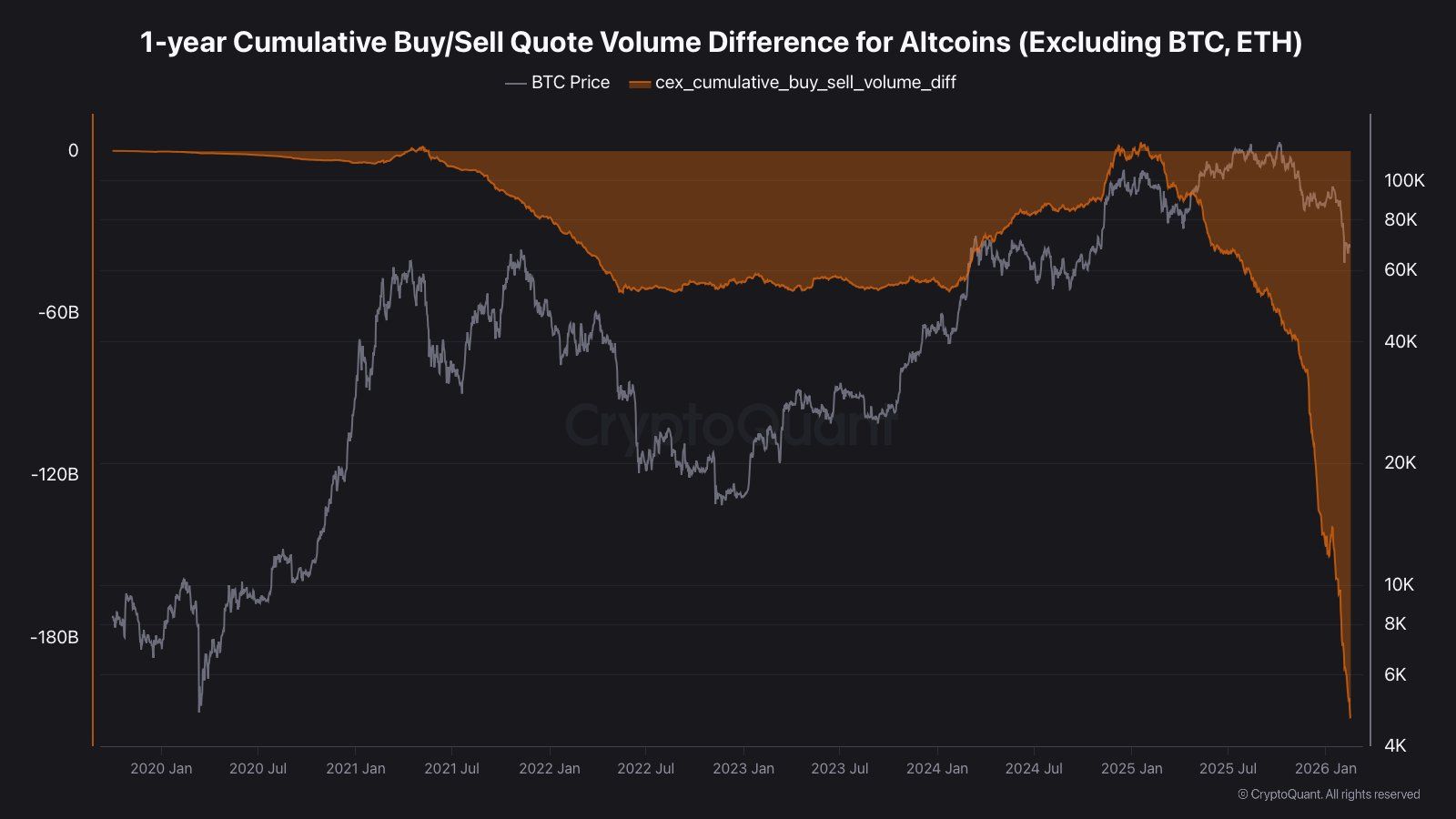

A report from CryptoQuant states that selling pressure on altcoins (excluding BTC and ETH) has reached its most extreme level in five years.

Cumulative buy/sell delta data has reached -$209 billion over the past 13 months. In January 2025, this delta was nearly zero, which reflected balanced supply and demand. Since then, it has continued to decline without any reversal.

This extreme condition differs completely from the 2022 bear market. During 2022–2023, selling pressure slowed, allowing the market to enter a sideways phase before recovering. That slowdown has not occurred in the current cycle.

“This is not a dip. It’s 13 months of continuous net selling on CEX spot. -209B doesn’t mean bottom. It means buyers are gone,” analyst IT Tech stated.

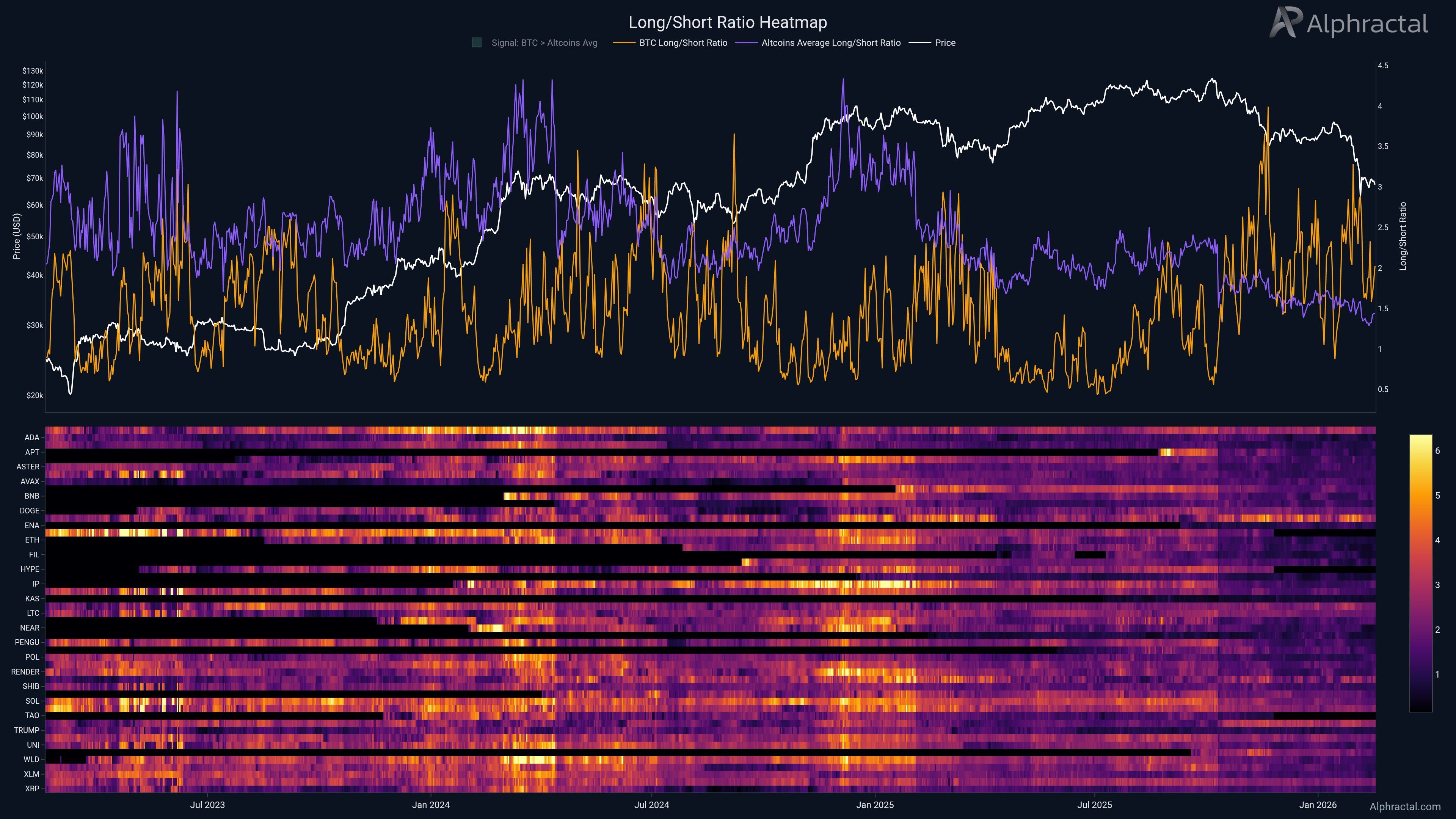

Additionally, derivatives data can provide additional short-term insights. Traders are currently holding significantly more long positions in Bitcoin than in altcoins, as reflected in Alphractal’s Long/Short Ratio data.

The chart shows that this is the first time in history that Bitcoin’s long ratio has remained above the altcoin average for four consecutive months. This indicates that short-term traders have reduced their exposure to altcoins and that expectations for altcoin volatility have weakened.

In addition, the total altcoin market capitalization has dropped back to levels five years ago, below $1 trillion. The altcoin analytics account OverDose pointed out that the biggest difference lies in the number of tokens. Five years ago, only about 430,000 coins were listed. Currently, that figure has surged to 31.8 million, an increase of roughly 70 times.

Too many tokens are competing for a market “pie” that has not grown larger. This dynamic makes recovery more fragile and threatens the survival of low-cap tokens.

Excluding the top 10, the remaining market capitalization stands at less than $200 billion. The technical structure shows a head-and-shoulders pattern, and this capitalization is moving toward its neckline support. Analyst Pentoshi commented that even if altcoins rebound, the gains will likely not be substantial.

“Even if alts bounce here, it likely won’t be substantial. I think eventually they make new lows… Imo it’s going to take some time to work through,” analyst Pentoshi predicted.

According to CoinGecko research, 53.2% of all cryptocurrencies listed on GeckoTerminal had failed by the end of 2025. In 2025 alone, 11.6 million tokens collapsed.

The current bear market may permanently reshape how investors allocate capital within the altcoin sector. Market participants may become more selective, prioritize liquidity and fundamentals, and reduce exposure to speculative low-cap assets.