Cardano’s (ADA) price has erased another part of its value over the last 24 hours, nearing a level that historical data suggests could be its bottom. This decline follows the much-anticipated Chang hard fork, which occurred three days ago.

As ADA’s price inches closer to a potential reversal point, Cardano’s founder, Charles Hoskinson, has released new details about the project’s next steps. Here is an in-depth analysis of what could be next for the blockchain and the cryptocurrency’s price.

Cardano Targets New Upgrade in 90 Days

The Chang hard fork occurred on Sunday, September 1, and, according to a BeInCrypto report, it turned out to be a “sell the news” event. Several crypto whales took the opportunity to offload large amounts of ADA during and after the upgrade, contributing to the recent price decline.

However, in a video posted on YouTube on Monday, Hoskinson revealed the project’s next step. In the session, the Cardano Founder noted that a follow-up development to the hard fork tagged “Chang+1” will take place within the next 90 days.

“Currently, we are in the bootstrap phase. People are registering Dreps, and we are going to see lots of them activated. After Chang+1, we will have a tripartite government,” Hoskinson explained.

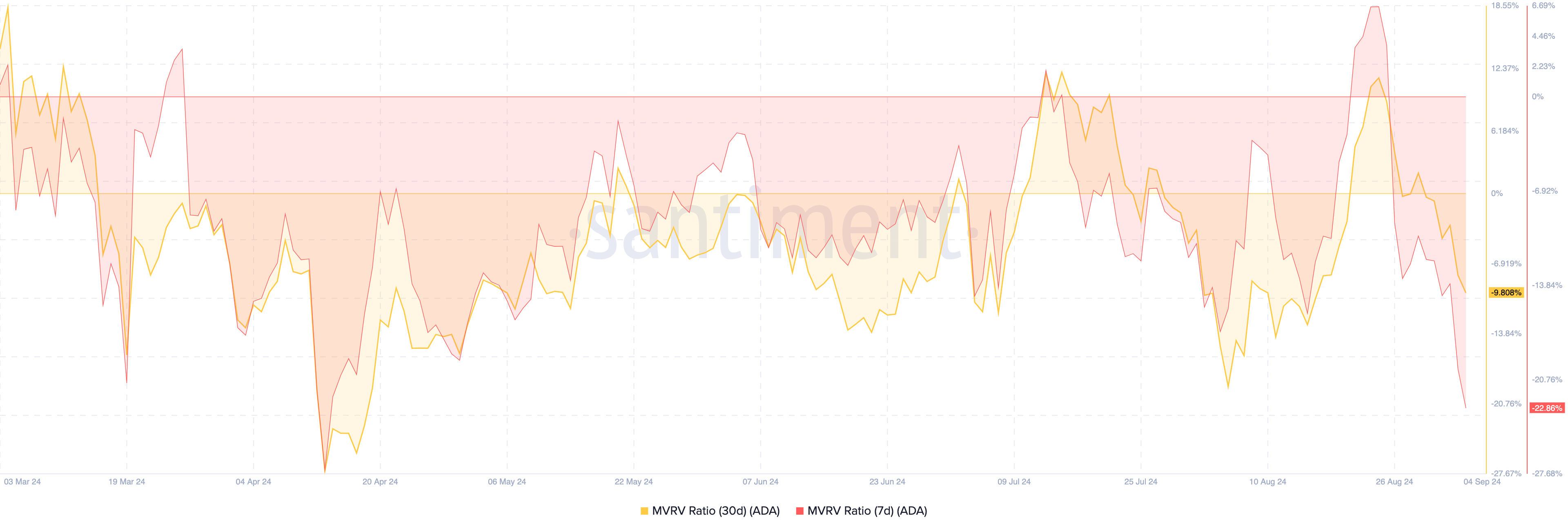

Meanwhile, on-chain data from Santiment shows that ADA’s Market Value to Realized Value (MVRV) ratio has dropped further into negative territory. The 30-day MVRV ratio is at -22.86%, while the seven-day ratio stands at -9.80%, indicating low profitability and potential price bottoming. Generally, a high MVRV ratio signals unrealized profits, raising the risk of sell-offs.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in September 2024

However, an extremely low MVRV ratio suggests that the price is near its bottom since there is a great degree of unrealized losses. In this case, many holders would rather hold than let go with a negative return on investment.

Historically, the Cardano native token hits its bottom when the 30-day MVRV ratio is between -16% and -27%. Therefore, if past performance rhymes with this trend, then a notable bounce might be close.

ADA Price Prediction: Time to Return to $0.35

Currently, ADA is trading at $0.31, down nearly 10% since Monday’s upgrade. However, the daily chart shows a bullish technical pattern — a falling wedge.

This pattern indicates a potential trend reversal, with two descending trendlines representing the highs and lows. A breakout occurs when sellers weaken, and buyers step in, pushing the price upward.

The Relative Strength Index (RSI) also supports this outlook. As a momentum indicator, an RSI below 30.00 suggests an asset is oversold, signaling a possible rebound. ADA’s current RSI stands at 29.76, indicating oversold conditions.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in September 2024

If buyers accumulate at this level, ADA could break out and reach $0.35. However, if Bitcoin’s price continues to weigh on the market, ADA might drop further to $0.30.