This week could prove bumpy for crypto markets which will face macroeconomic headwinds from crucial U.S. and European economic indicators against the backdrop of looming U.S midterm elections.

The U.S. and the Eurozone will reveal key macroeconomic numbers this week that have historically been linked to volatility in the crypto markets.

1 Nov: US manufacturing PMI

Those betting against the prices of cryptocurrencies (short sellers) may face the prospect of liquidations as the week unfolds. They may also see a more significant correlation between the stock market and crypto.

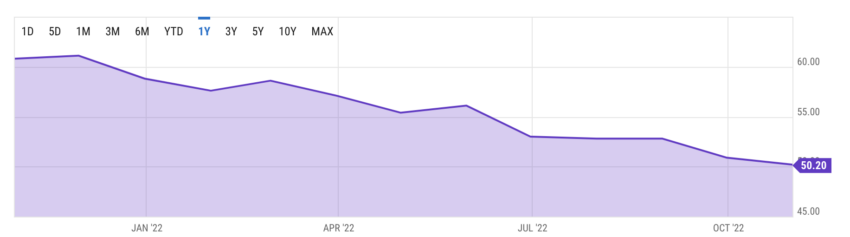

The first port of call is the U.S. ISM Manufacturing Purchasing Managers Index, due for release on Nov. 1, 2022. It comes from a monthly survey of purchasing managers who can access early information about their company’s performance.

A PMI over 50 means that the manufacturing sector is booming, which raises investor confidence and causes a boom in the stock market. A PMI of 50 means no change, while a PMI of under 50 means that the manufacturing sector has stagnated.

2 Nov: Eurozone manufacturing PMI and federal funds rate

A similar metric in the Eurozone, the manufacturing PMI, is due on Nov. 2, 2022. It shows the health of the manufacturing sector in the Eurozone region.

The ISM PMI for Oct. 2022 is down to 50.2, beating analysts’ expectations of 50 after hitting 50.9 last month. Historically, fiat currencies like the U.S. dollar have become stronger, with a PMI of over 50.

On the other hand, a PMI of below 50 for two months in a row indicates that the economy is in a recession.

A lower PMI of 50.2 indicates that the economy has slowed slightly, possibly due to recent Fed interest rate hikes. At press time, the crypto market is mostly stable, with five of the top ten cryptos by market cap in the green and five in the red.

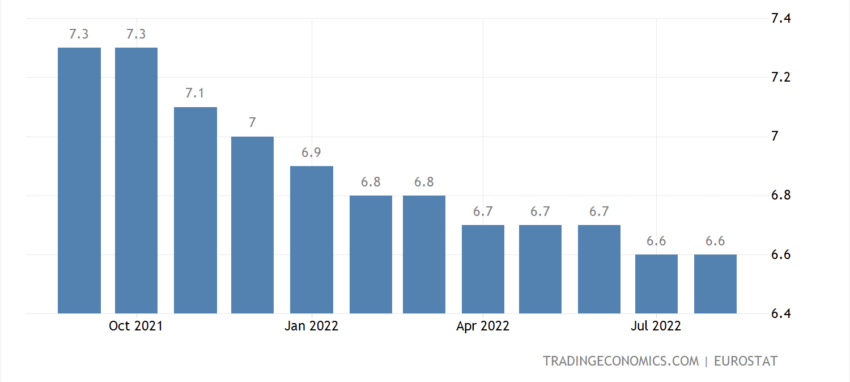

3 Nov: Eurozone September unemployment rate

The U.S. Labor Department is also set to release the unemployment rate for Oct. 2022. Falling unemployment rates usually mean a strong labor market driven by economic prosperity. The Eurozone will release its Sep. 2022 employment rate on Nov. 3, 2022.

4 Nov: US October unemployment rate

Analysts expect the U.S. unemployment rate to increase to 3.6% for 3.5% in Sep. 2022.

If this proves true, this could encourage the Federal Reserve to apply brakes to its interest rate hike cautiously. This slowdown could be bullish for crypto markets, meaning the economy is less likely to fall into a recession.

So far, analysts have predicted that the Fed will increase the funds’ rate by 75 basis points to 4% on Nov. 2, 2022.

After the release of the Sep. 2022 unemployment rate, which showed a lower number than in Aug. 2022, Bitcoin liquidations hit $12 million as its price dropped 2%.

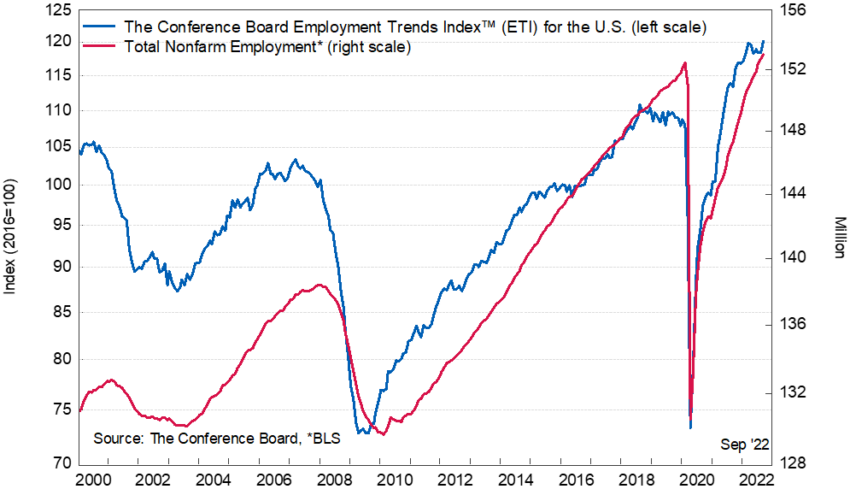

7 Nov: US Employment trends index

The Employment Trends Index is another significant number showing where the job market will likely go in the next few months. A higher number means that jobs are likely to increase soon. A lower number means that jobs will likely decrease in the short term.

If the Fed continues hiking rates to cool down the labor market, this could decrease hiring in the next few months. As the rate of inflation falls towards the Fed target, the central bank could slow its pace of interest rate hikes.

This could be positive for Bitcoin as a risky asset, as investors would likely pile into the cryptocurrency as threats of a recession fade.

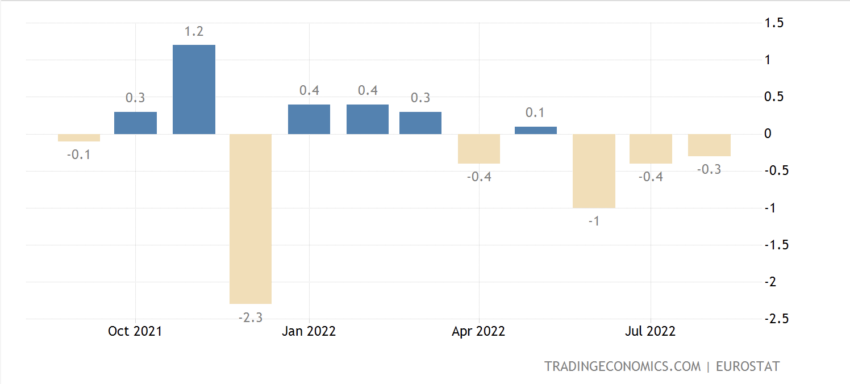

8 Nov: Eurozone retail sales

Sept. 2022 Eurozone retail sales, slated for a Nov. 8 release, could indicate that the region is falling into a recession. In Aug. 2022, retail sales, a proxy for consumer demand, dropped 0.3% compared to July 2022.

The area has been hit hard by rising energy prices caused by the war in Ukraine. If demand continues to fall, cryptocurrencies will likely be impacted, as consumers will have less disposable income to spend on risky assets.

Still, the picture can be more nuanced if European governments introduce measures to reduce taxes or provide rebates for energy costs.

8 Nov: US midterm elections

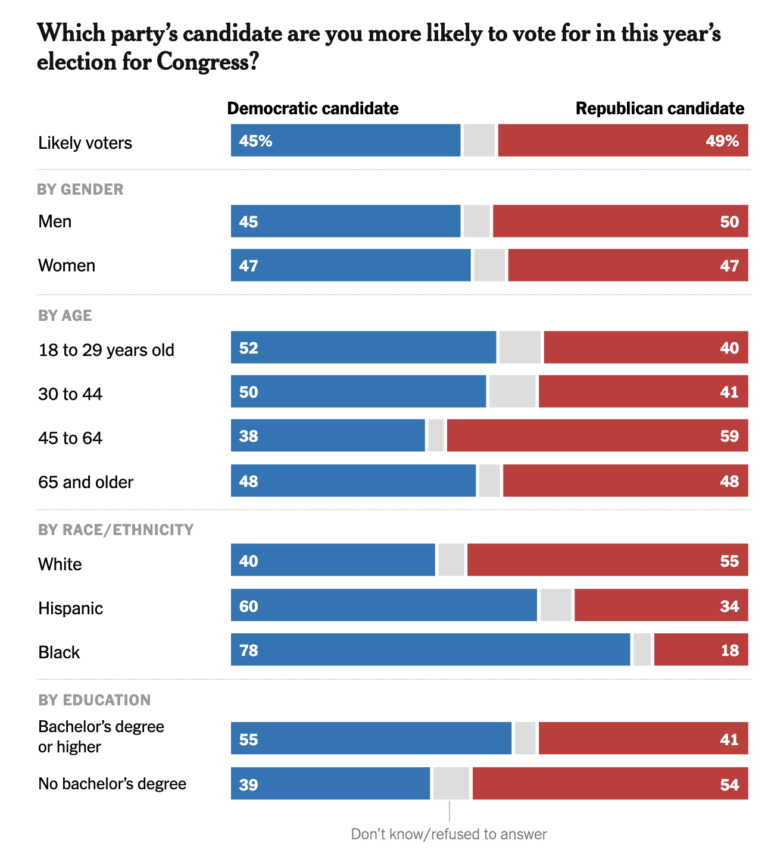

With the U.S. midterm elections around the corner, the future for crypto markets in the U.S. becomes less clear.

There are 435 seats in the House of Representatives being contested and 35 seats in the Senate. While Republicans have generally been more pro-crypto than their Democrat counterparts, a Republican win may not necessarily result in pro-crypto legislation.

President Joe Biden’s Crypto Framework further complicates the issue, likely resulting in a legislative deadlock as different bills pass through Congress.

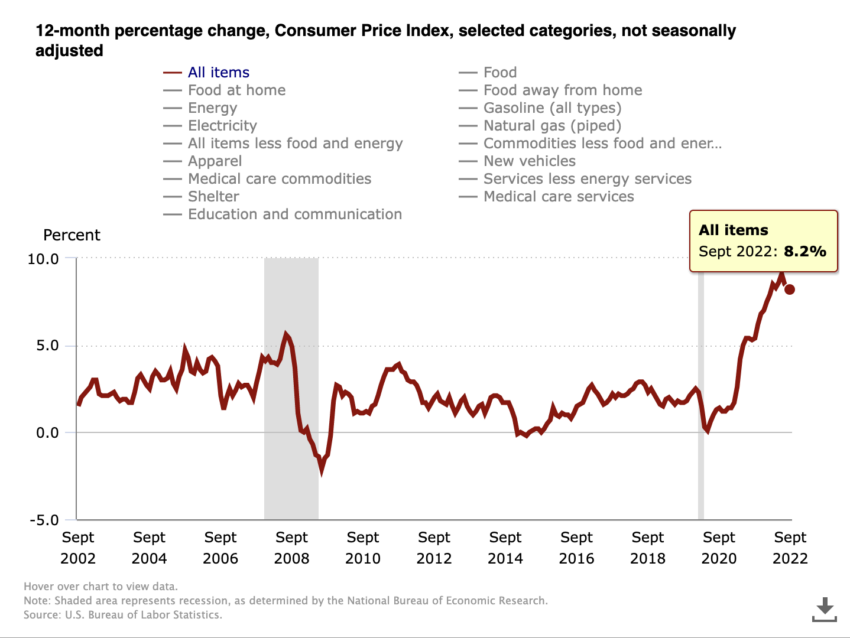

10 Nov: US October CPI and real earnings dynamic

The Consumer Price Index (CPI) for Oct. 2022 is scheduled to be released on Nov. 10, 2022, at 8:30 A.M. Eastern Time. The CPI rate for Sep. came out to be at 8.2%, just a 0.1% drop from the Aug. rate of 8.3%.

The crypto markets didn’t react much to the Sep. rate. But they are likely to react to the release of the Oct. 2022 rate if it comes out to be higher than the previous month. Previously, a higher month-on-month CPI caused the crypto markets to tank as inflation ran red-hot. If the Oct. rate is higher than the previous month, it could result in a sharp dip in the price of Bitcoin and the liquidation of leveraged positions. However, from the chart, it seems that the CPI rates have formed a peak.

How’s the Crypto Market Preparing for These Macroeconomic Events?

Amidst all the macroeconomic factors listed above, Bitcoin is battling the resistance of the descending triangle trendline on a weekly timeframe as the market approaches FED interest rate hikes.

Descending triangles are generally considered a bearish chart pattern. Not just that, Bitcoin is also testing the 20-week Simple Moving Average (SMA) for the first time after seven months.

These strong resistances might send the price back to the support of the $18,000 level. The BTC price has been holding on to the $18,000 support for almost five months. The breach of this support level will be a breakdown of the descending triangle pattern. It may result in extreme volatility in the crypto market.

Still, if the FED interest rate hike comes at 50 BPS, Bitcoin may give a weekly close above the trendline. Then, the bearish pattern will get invalidated.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.