The inflation rate in Australia has hit a 32-year-high. Australians seem to be moving to Bitcoin (BTC) to hedge against inflation, according to P2P Bitcoin trading volumes.

Australians are flocking to bitcoin and cryptocurrencies as the country sees inflation rates hit a 32-year-high. Last quarter, the consumer price index increased by 1.8%, according to the Australian Bureau of Statistics. That makes the annual rate of inflation 7.3%, which is the highest it has been since 1990.

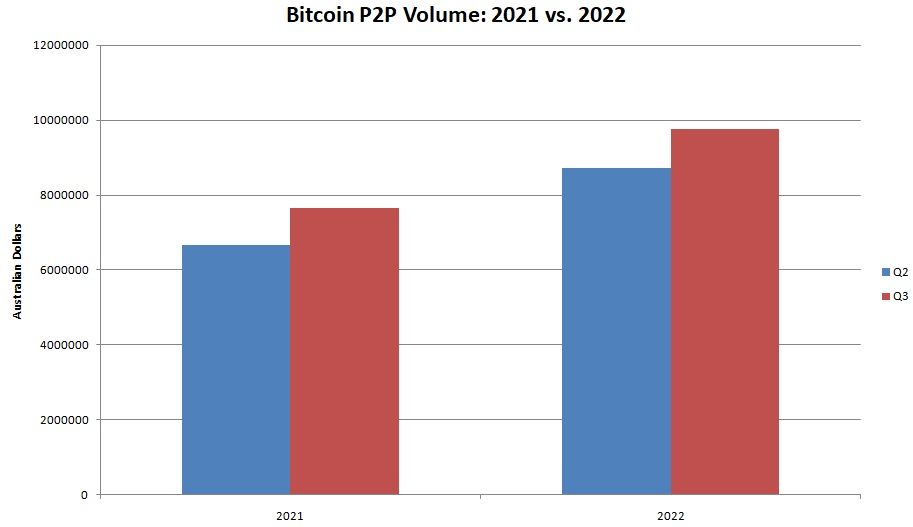

As this inflation rate has been rising, Australians have been turning to Bitcoin to protect their wealth. P2P trading volume for the asset has soared in recent quarters. Q3 2022 volume has increased by 15% from the quarter before, while year-over-year it has increased by 27%. Similarly, Q2 2022 saw a 31% year-over-year increase.

These numbers are particularly significant given the bear market that the crypto asset class has been undergoing this year. Australians are clearly willing to put some of their wealth in bitcoin to hedge against inflation. While this narrative has been losing some of its weight in recent months, it hasn’t entirely disappeared.

Bitcoin Still Seen as an Inflation Hedge

The inflation rate in Australia is drawing concern among experts. The Reserve Bank of Australia (RBA) had expected the inflation rate to peak at 6%. Analysts believe that this quarter will see even worse figures in core and headline measures. As such, the RBA may institute rate hikes, which are already taking place in many countries.

Since May, the RBA has increased rates by 250 basis points, a substantial figure. At a time like this, the increase in bitcoin trading means that Australians are seeing the crypto market as a place to keep their money safely.

Australia Working On Crypto Regulations

While Australians have been increasing their positions in Bitcoin, the government has been stepping up its game on crypto regulations. The Australian Treasury released a statement in Aug. saying that it had begun work on crypto asset reforms. It claims that this regulation would be unlike anything “anywhere else in the world.”

One of the reasons the government is expediting work on regulations is because of the use of crypto in criminal activities. The federal law enforcement agency believes this is an emerging threat, as do many other law enforcement agencies. Australia’s securities regulator also suspended three crypto funds by Holon recently.

Meanwhile, Australia has published a CBDC whitepaper and released details on a pilot program. The government is very keen on leveraging the technology and the pilot will last a year.