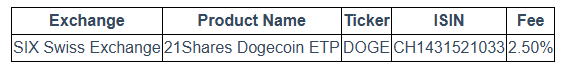

21Shares has listed a Dogecoin ETP (exchange-traded product) on the SIX Swiss Exchange under the “DOGE” ticker.

The launch represents a major leap in meme coin legitimacy. It also marks the first Dogecoin ETP endorsed by the Dogecoin Foundation.

Sponsored21Shares Lists DOGE ETP In Europe

Christened 21Shares Dogecoin ETP (ISIN: CH1431521033), the financial instrument is backed through an exclusive partnership with the House of Doge. Duncan Moir, President at 21Shares, framed the listing as more than just a financial product.

“Dogecoin has become more than a cryptocurrency: it represents a cultural and financial movement. With this exclusive partnership, we’re providing investors with the most direct and accessible way to gain exposure to the Dogecoin ecosystem,” an excerpt in the press release read, citing Moir.

It is 100% physically backed, offering traditional investors an institutional-grade on-ramp to the Dogecoin ecosystem. With a management fee of 2.50%, the product is now live and available through banks and brokerages across Europe.

21Shares boasts over $7.3 billion in assets under management (AUM) and listings on 11 major exchanges. The latest developments are shaping the future of regulated crypto investing. The Dogecoin ETP is its latest move in mainstreaming digital assets.

The move signals growing regulatory clarity and investor demand for European meme coin exposure. The Floki DAO approved similar listings, including the Floki ETP. The financial instrument was launched with liquidity funding to target the European market.

SponsoredThis shows Europe’s regulatory environment has made it a fertile ground for altcoin ETPs. It outpaces the US, where regulatory hesitation limits innovation beyond Bitcoin and Ethereum.

The move reflects Europe’s growing appetite for regulated exposure to non-traditional digital assets. BlackRock, the world’s largest asset manager, recently expanded its Bitcoin ETPs in Europe, further validating the region as a proving ground for crypto financial products.

Meanwhile, in the US, Bitwise has been pushing for Dogecoin ETF approval. Three months ago, it filed with the Delaware Trust Company. The firm also resubmitted updated filings as a follow-up, seeking SEC (Securities and Exchange Commission) approval.

The SEC has yet to green-light any Dogecoin-based ETFs stateside. This puts Europe in a leading position to capture institutional interest in meme coins.

Sarosh Mistry, Director-Elect at the House of Doge and CEO of Sodexo North America, sees today’s ETP launch as a sign of the token’s maturity.

“Institutional products will empower new types of investors to participate in the Dogecoin ecosystem, reinforcing its role as a leader in the future of digital assets,” he said.

Despite this news, DOGE’s price has fallen almost 3% in the last 24 hours. As of this writing, DOGE was trading for $0.15, down 0.6% in the past hour.