India’s economic agency officials have discovered a cryptocurrency wallet worth almost $1 million while investigating a case against a man suspected of fraud and money laundering.

The wallet is supposedly controlled by Dubai-based entrepreneur-investor Vinod Khute.

The Uncertain Crypto Seizure

Reports claim that the crypto wallet can only make transactions three times per month. Meanwhile, the Enforcement Directorate (ED) suspects Khute of engaging in illegal activities. This includes launching his own cryptocurrency and siphoning off the proceeds. The ED will investigate the case and will likely seek action against Khute and associated entities.

However, a crypto seizure is challenging if it’s true that the wallet can only be operated in specific intervals. The ED is working to prevent Khute from emptying the wallet and is seeking technical assistance to secure the funds elsewhere. According to reports, officials formerly thought that the crypto seizure would be simple. The wallet’s connection to the owners’ bank account explains this. But that has not been the case.

Learn more about how hot and cold crypto wallets work in our feature-length guide!

A History of Confiscations

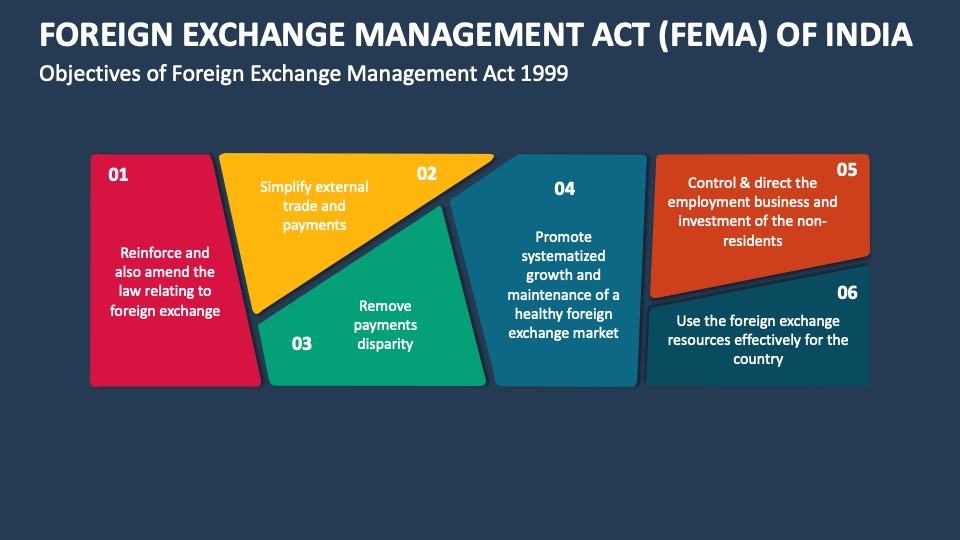

The Enforcement Directorate (ED), according to a report in the Indian Parliament in February, has made crypto seizures worth more than $100 million. Oftentimes, these cases involved violating the Foreign Exchange Management Act (FEMA).

Cryptocurrency exchange WazirX was previously probed for money laundering and violations of foreign exchange rules. The Directorate of Enforcement investigated allegations that the exchange laundered over $350 million.

Crypto Seizures in Other Countries

According to recent reports, the UK government is considering giving the HM Revenue & Customs (HMRC) division authority for crypto seizure. It would include custodial wallets of companies evading taxes. The proposal spearheads revision in the Direct Recovery of Debts legislation to allow the HMRC to access custodial wallets and PayPal accounts.

The U.S. Internal Revenue Service (IRS) is also aggressively pursuing cryptocurrency tax evasion and has sent agents abroad to assist law enforcement agencies fighting financial crimes using cryptocurrencies. In 2024, the IRS will receive $80 billion for enforcement activities, including initiatives to monitor client transactions of cryptocurrency brokers.

Meanwhile, the FBI and Ukrainian authorities have targeted nine cryptocurrency exchanges in the United States on suspicion of money laundering and lax Know Your Customer (KYC) procedures. In a separate incident, the U.S. Department of Justice (DoJ) made a crypto seizure of $112 million from six accounts associated with pig butchering scams.