Binance CEO Changpeng Zhao recently revealed that the exchange’s user base had swelled to a whopping 150 million, with 22 million of those added in just the last quarter. Despite this mammoth growth, many wonder about the risk of using Binance, considering the exchange’s ongoing legal battles.

First, let’s dive into the appeal of Binance and how it has managed to pull such a large user base.

Binance Risks Examined

According to Paul Howard, head of sales at Zodia Markets, liquidity is the primary driving force for many traders and institutions.

Coalition Greenwich, a noted financial data and research firm, recently found that institutional crypto traders prioritize the ‘deepest liquidity available’ from a trading platform. The firm found that liquidity even trumps a platform’s regulatory status for most traders. This suggests why many are willing to overlook Binance’s current regulatory quagmire.

Binance, unlike many other exchanges, does not have a fixed headquarters, allowing it to dance around jurisdictional regulations. This flexible approach has led to a large retail user base, as Howard observed,

“They have arguably one of the broadest product sets in the market.”

Yet, this advantage also opens up Binance to myriad risks. Without official nods from local regulators, some users open multiple accounts, blurring the line between individual users and accounts.

Read more: 7 Best Binance Alternatives in 2023

While Binance continues to grow in popularity, some analysts advise caution. A game theory analysis on the topic of withdrawing funds from Binance presents four potential scenarios, the most alarming of which is the risk of Binance restricting withdrawals, causing significant financial losses for those who kept their funds on the platform:

- You take out funds, and Binance experiences no issues (-1): There’s a minor cost for the withdrawal, yet your money is safe.

- You take out funds, and Binance subsequently limits withdrawals (+100): Taking your funds out before any limitations is favorable.

- You keep your funds in, and Binance operates smoothly (-0): There’s neither a profit nor a loss, and your money stays within the platform.

- You keep your funds in, and Binance ends up halting withdrawals (-100): Failing to retrieve funds leads to a major financial setback.

A Cause for Concern or Concerns Blown Out of Proportion?

Given Binance’s international stature, the potential challenges in fund recovery, if any issues should arise, are emphasized.

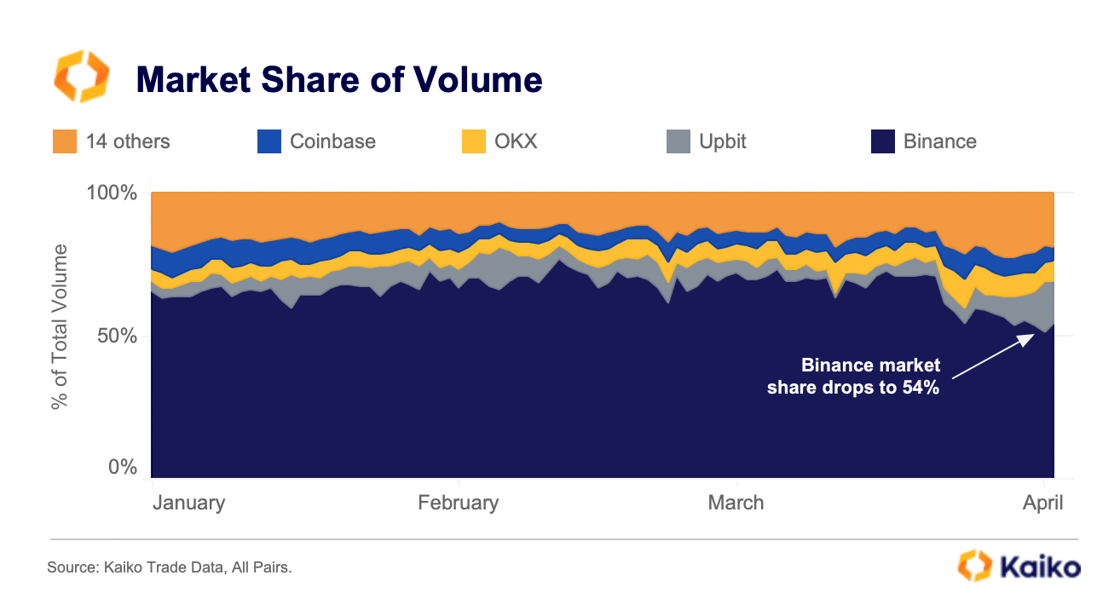

Recent data also suggests that Binance is not immune to market shifts. The exchange’s global market share has dropped to 52% from 60% at the beginning of the year, largely credited to an SEC lawsuit.

Dessislava Aubert, an analyst at Kaiko, observed that Binance’s market share losses benefited exchanges like Bybit and OKX. Even Binance.US has seen its market share dip, a clear indication that regulatory pressures are reshaping crypto exchange rankings.

The central question remains: Should you overlook Binance’s risks for the sake of liquidity and a vast user base? Many still remain unperturbed by the looming clouds of regulation. However, it is crucial for every investor to carefully evaluate the risks and benefits.

With regulatory pressures intensifying, it may be wise to tread carefully, especially if you’re in it to trade.