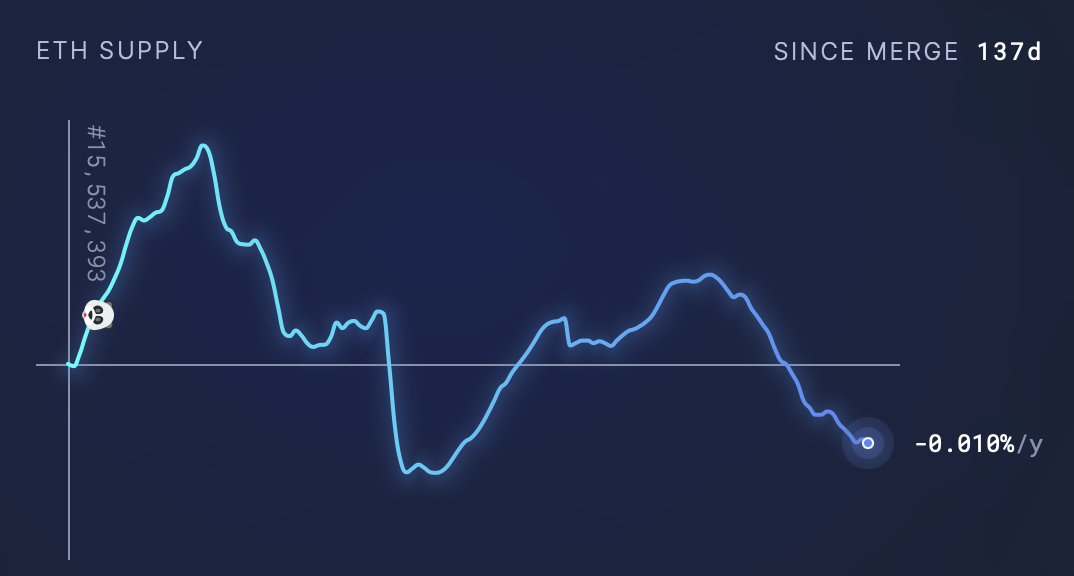

Ethereum (ETH) has made headlines for turning deflationary two weeks ago despite underperforming Bitcoin. According to Ultrasound Money, the second-largest cryptocurrency’s net issuance or annualized inflation rate dropped below zero on Jan. 15.

This means that the leading smart-contract blockchain is now burning more ETH than what is being minted, which is in contrast to BTC. Despite this, Ethereum is still lagging behind Bitcoin as the month of January draws to a close.

While Bitcoin has seen a gain of nearly 44.97% this month, Ether has appreciated by 40.66%. The Ether-Bitcoin ratio, or ETH/BTC, is also on track to post its second straight monthly decline. There are three factors that could be responsible for Ether’s underperformance, which will be discussed in detail below.

Defensive Positioning Before Shanghai Upgrade

The first factor responsible for Ether’s underperformance is defensive positioning ahead of the Shanghai upgrade.

Ethereum’s Shanghai upgrade, which is expected in March, will allow the withdrawals of 17.2 million ETH staked or deposited in the Beacon Chain since Dec, 2020. Although the whole staking balance of 17.26 million cannot be withdrawn on the day of the upgrade, only 43,200 ETH can be unstaked per day.

The total staking reward of the past two years, which equates to around 1 million ETH, can be withdrawn instantly. This has caused some concern among traders, as the whole stack becomes withdrawable and holders may rush to exchanges to liquidate their ETH as soon as the floodgates are open, potentially pushing down the price.

Macro-Driven Bull Revival

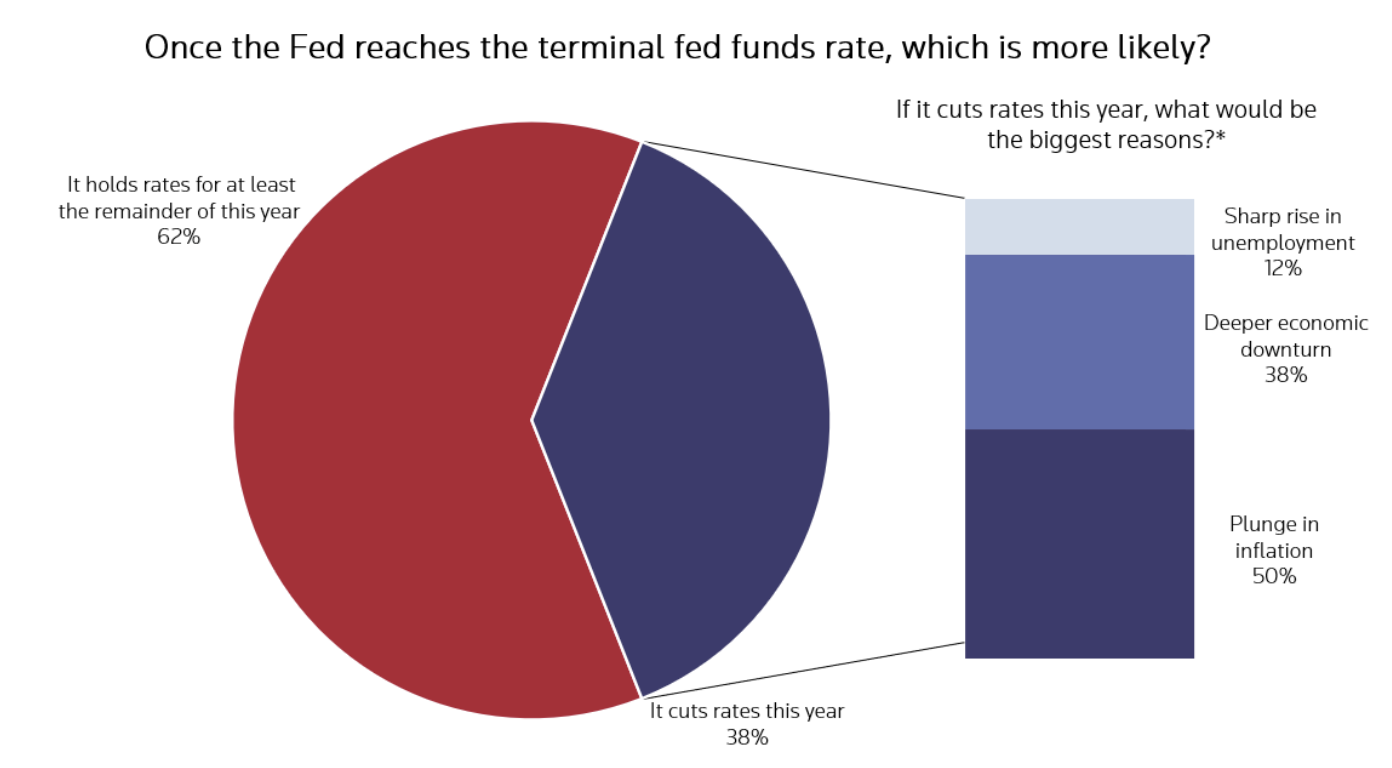

The second factor responsible for Ether’s underperformance is the recent revival of the crypto market, which has been partly fueled by favorable macroeconomic developments. Recent U.S. government reports and business surveys have shown a decline in manufacturing activity and inflation expectations, which has helped bolster hopes for an early end to Federal Reserve’s liquidity tightening that roiled risky assets last year.

As inflation continues to decline, more than 80% of forecasters in the latest Reuters poll predicted the Fed would downshift to a 25-basis-point hike at its next meeting. Meanwhile, traders saw a 55% probability that the central bank would pause rate hikes in May, according to the CME’s Fed Watch tool.

Bitcoin’s relatively bigger gains stem from a changing macro regime towards the end of the Fed hike cycle, so it’s a pure monetary policy play, hence gold is also performing. This move is being driven by institutions, not retail. Notably all of the Bitcoin gains this year have come during U.S. trading hours, with a sharp increase in open interest in CME futures.

Short Squeeze

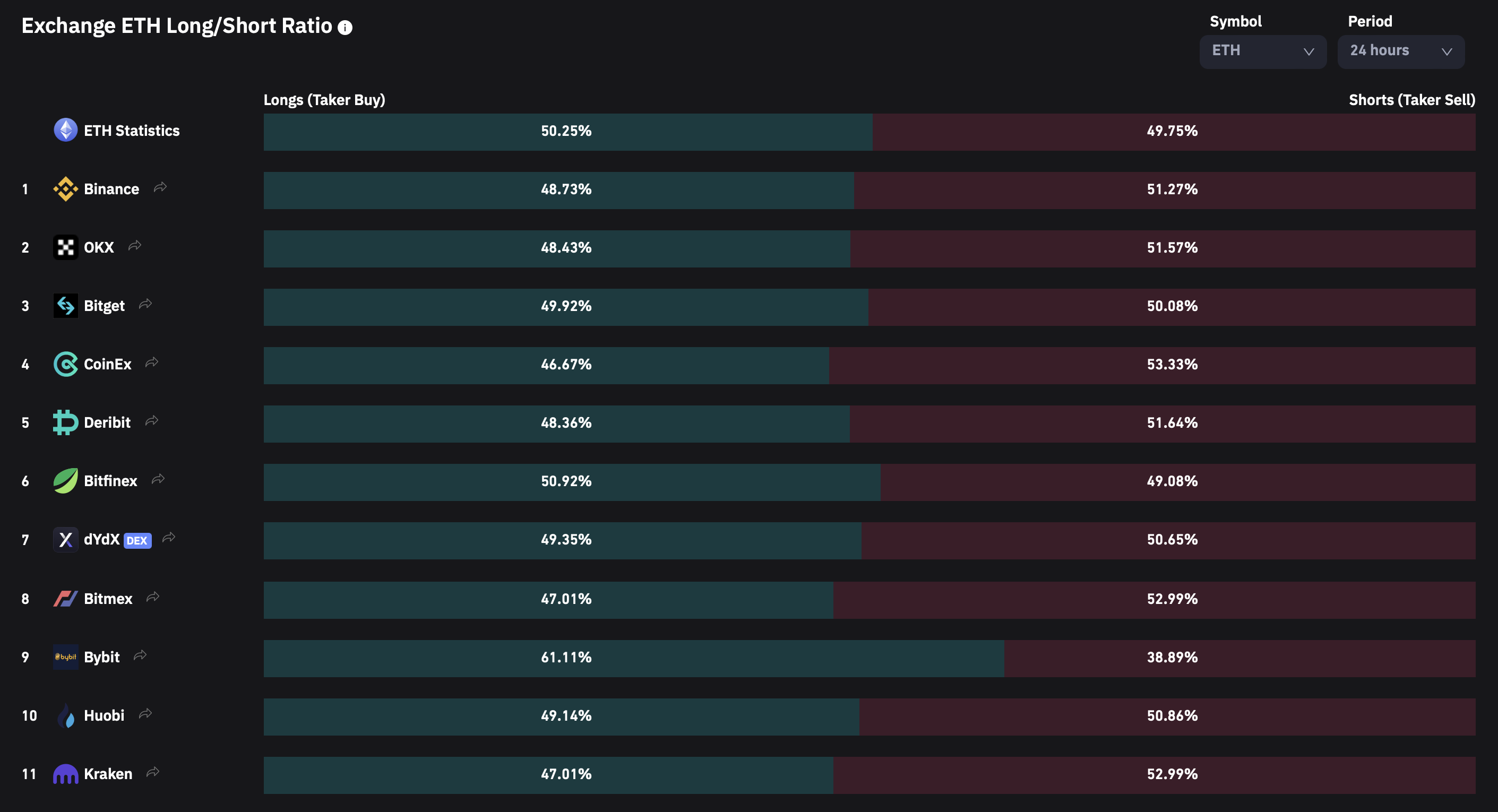

The third factor responsible for Ethereums’s underperformance is a short squeeze, which has driven the rally of Bitcoin. The market held a short on Bitcoin in Q4 2022 against perceived credit risk issues, which is now being unwound.

The market did not hold a short in ETH, so there is no unwind.

Short interest in Bitcoin rose after Sam Bankman Fried’s crypto exchange FTX went bust in early November, raising the risk of a market-wide contagion.