The price of Bitcoin whipsawed yesterday, dropping to almost $6,000 before bouncing to over $6,400 in less than two hours. What happened?

As noted by Forbes, the volatile price action is likely an automated and preparatory move as short sellers pile on ahead of the U.S. Securities and Exchange Commission’s expected denial of the high-profile VanEck SolidX Bitcoin exchange-traded fund (ETF).

The much-watched ETF proposal, if approved, would open the doors to a whole new market of investors looking to get involved with the cryptocurrency market leader. However, investors are currently betting that the pipe dream will be shut down.

Watch Me Whip

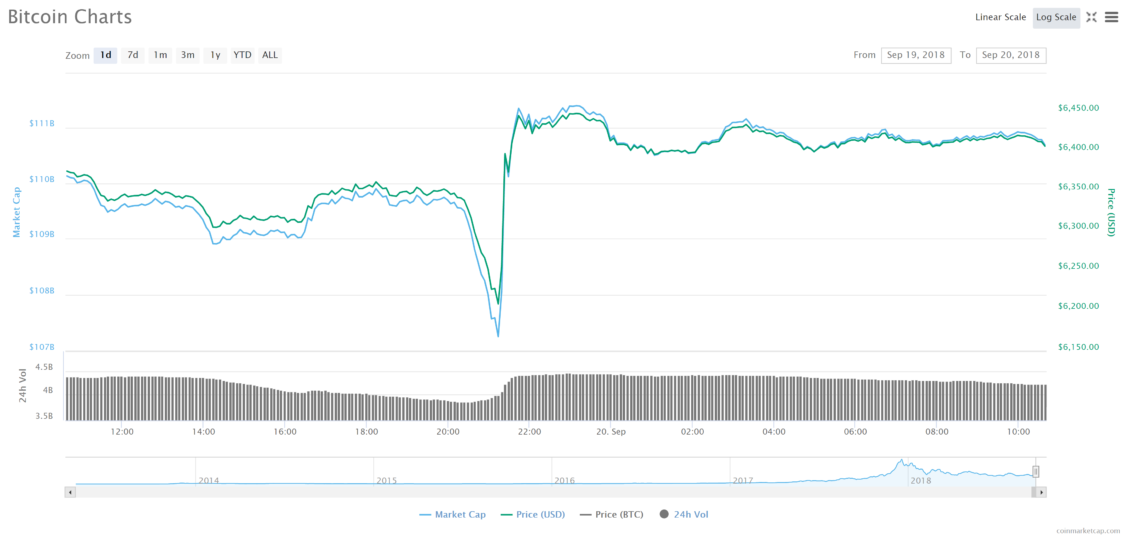

When sell orders and short positions stack up to levels near their all-time high, automated trading bots can create whipsaw patterns, as seen below: These patterns, of course, wreak havoc on weak-handed or inexperienced day-traders.

In this case, holders who weathered the whipsaw came out on top.

These patterns, of course, wreak havoc on weak-handed or inexperienced day-traders.

In this case, holders who weathered the whipsaw came out on top.

Stacking Shorts

The fact that traders are betting on Bitcoin (BTC) to break through the key resistance zone around $6,000 following an ETF denial can be clearly illustrated by the sheer amount of short orders in the market today. As illustrated in the chart below, BTC/USD shorts still remain near their all-time high. The trend isn’t particularly new, either.

As noted by Forbes, September 1 saw a 10,000 bitcoin short position opened.

However, it is still worth noting that the phrase ‘what comes up, must come down’ applies here as well. When short orders are hanging out at such high levels, the opportunity for big money traders to short squeeze the bears dangles out in front like a carrot.

What do you think of Bitcoin’s whipsaw pattern yesterday? Do you think the VanEck SolidX ETF will be denied? Let us know your thoughts in the comments below!

[Disclaimer: This article is not intended as financial advice, and should not be taken as such. Neither the author nor BeInCrypto is responsible for any financial gains or losses from any readers of this article.]

The trend isn’t particularly new, either.

As noted by Forbes, September 1 saw a 10,000 bitcoin short position opened.

However, it is still worth noting that the phrase ‘what comes up, must come down’ applies here as well. When short orders are hanging out at such high levels, the opportunity for big money traders to short squeeze the bears dangles out in front like a carrot.

What do you think of Bitcoin’s whipsaw pattern yesterday? Do you think the VanEck SolidX ETF will be denied? Let us know your thoughts in the comments below!

[Disclaimer: This article is not intended as financial advice, and should not be taken as such. Neither the author nor BeInCrypto is responsible for any financial gains or losses from any readers of this article.]

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored