Venezuela has officially ended its ambitious yet controversial petro cryptocurrency. Launched six years ago by President Nicolas Maduro to circumvent US sanctions, the petro has now become history, embroiled in a web of scandals and operational challenges.

As per the latest updates, all Petro holdings will be converted to the nation’s struggling local currency, the bolivar.

Venezuela Calls It Quits on Petro Project

The Petro, initially priced at $60 per unit and backed by Venezuela’s extensive petrol reserves, was unveiled in February 2018 with considerable fanfare. Maduro envisioned it as a tool for,

“New forms of international financing.”

He aimed to break free from the constraints of economic sanctions imposed by Washington. However, the cryptocurrency faced an uphill battle for acceptance and utility.

Citizens found Petro’s usage confusing, and its credibility suffered as some risk rating agencies labeled it a scam. Despite efforts in 2020 to boost its usage — including mandates for its use in paying for state services and airline fuel — the Petro’s practical application remained largely confined to limited state operations.

This included tax payments and traffic fines issued in Petros, though they couldn’t actually be paid with the cryptocurrency.

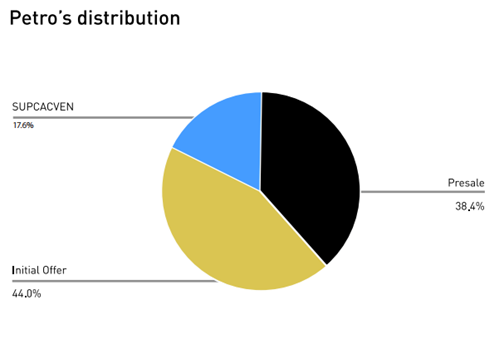

Banks in Venezuela were compelled to show their balances in both bolivars and Petros. On the Patria Platform, users could convert their Petros to bolivars solely through an auction system. The platform, mainly utilized for distributing government subsidies, displayed a message announcing the shutdown of all crypto wallets trading in Petro by January 15.

The Final Blow

The final blow to the Petro came amid a corruption scandal involving irregularities in oil operations conducted with crypto assets.

This scandal led to the resignation of Petroleum Minister Tareck El Aissami and the detention of numerous officials, including the top brass of the Sunacrip crypto regulator.

As a result, there was also a crackdown on Bitcoin mining operations in Venezuela. Bitcoin remains a popular hedge against hyperinflation and the bolivar’s devaluation.

Further compounding the Petro’s woes, Venezuela imposed a temporary ban on crypto mining, severely impacting the industry Maduro had strived to promote. The ban, instigated by a corruption scheme investigation, has led to the arrest of about 80 individuals.

Despite the majority of miners focusing on Bitcoin, the mining ban has disconnected an estimated 75,000 units of mining equipment.

Read more: How To Mine Cryptocurrency: A Step-by-Step Guide

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.