Cryptocurrency collateral locked up on Uniswap, the world’s most popular decentralized exchange, has hit an all-time high and is very close to breaking the $3 billion milestone.

Uniswap’s total value locked, which is a measure of crypto collateral in dollar terms, is at an all-time high of $2.84 billion according to metrics from DeFi Pulse.

It is the top ranked DeFi protocol in terms of TVL, leading crypto stalwart MakerDAO which has $2.15 billion in value locked. Uniswap has the greatest market share as a result with just under 23%.

Token Farming Coming to a Close

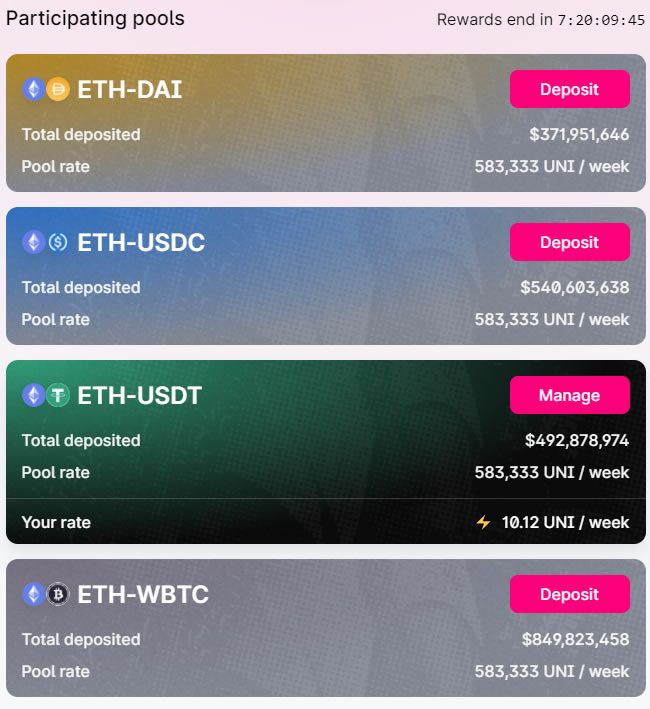

The four liquidity pools farming UNI tokens hold the lion’s share of liquidity on Uniswap. Around $2.25 billion has been deposited in ETH, stablecoins, and wrapped BTC across these four pools with the wBTC being the most popular holding 38% of the total.

UNI Price Update

As reported by BeInCrypto over the weekend, many DeFi-related tokens have seen a resurgence in prices following a two-month correction. UNI added over 10% on the day to reach $2.90 before pulling back slightly to the $2.70 level. Since its low point of $1.80 on Nov 5, UNI has recovered 53% to current levels. However, it still has a long climb back as the token is still down 65% from its all-time high of almost $8 in mid-September. Next week could see those prices plummet further if farmers decide to sell off after UNI farming dries up.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored