In a bid to regulate crypto, the UK’s Financial Conduct Authority (FCA) issued 146 alerts identifying malpractice on the first day of new promotion regulations. The FCA’s proactive approach is seen as a significant stride towards curbing the excesses of crypto investment promotions.

The FCA’s recently published handbook provides a comprehensive framework for crypto firms’ promotion of digital assets.

New UK Crypto Promotion Rules in Full Effect

The 32-page guide aims to ensure promotions are “fair, clear and not misleading” while acknowledging the evolving nature of the crypto market. It also indicates potential future modifications to the rules, reflecting the dynamic nature of the sector.

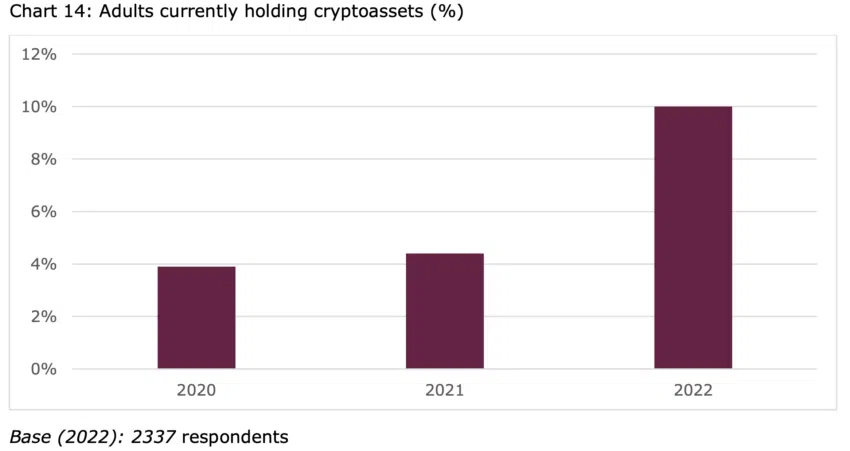

The FCA’s tough stance comes despite pressure for leniency from a minister, as reported by the Financial Times. The regulator estimates that nearly 5 million British adults owned crypto assets as of August 2022. The introduction of the new rules aims to protect these investors, who may regret making hasty decisions to invest in crypto.

James Daley, managing director of Fairer Finance, hailed the FCA’s move as a “good moment” to instate “proper regulation.” He stated,

“At least now the marketing of it is regulated and that means that the FCA has been issuing warnings and ensuring that misinformation is stopped.”

Laith Khalaf, head of investment analysis at AJ Bell, echoed Daley’s sentiments. Khalaf stated the FCA was definitely “making progress” on regulating cryptocurrency. He warned that a significant minority of investors had put “too much money” into these currencies based on “very unrealistic expectations.” He added that he hoped better regulation would benefit these individuals.

Read more: Bitcoin Halving Cycles And Investment Strategies: What To Know

Critics Speak Out

However, the FCA’s decision to regulate the marketing of cryptocurrency investments has sparked controversy.

Critics argue that treating cryptocurrencies as regulated investments could create a “halo effect.” This means that investors may take them more seriously due to the regulator’s apparent approval.

Despite these concerns, some cryptocurrency investment platforms have welcomed the tighter rules. Luno, for instance, paused the sign-up of new UK customers and introduced a test for existing customers to ensure they understood the risks of their investment. The company hailed the new rules as an,

“Important step for the crypto industry.”

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.