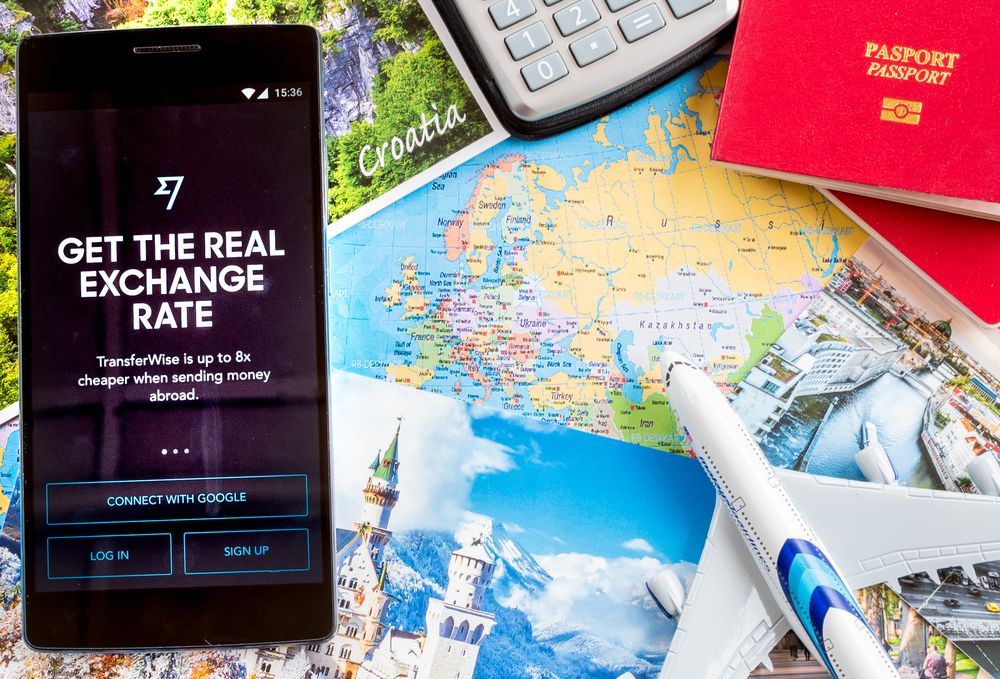

Peer-to-peer money transfer and exchange platform TransferWise has become Europe’s most valued fintech startup — with a valuation of $3.5 billion.

Founded eight years ago, the company competes with the likes of Western Union in a crowded currency exchange industry — which is, in turn, witnessing a revolution due to the advent of cryptocurrencies.

On May 22, 2019, CNBC reported that Vitruvian Partners, Lone Pine, and Lead Edge bought equity stakes in TransferWise through a $292 million secondary share sale. The platform reportedly has five million customers who send and receive an average of $5 billion every month. The payment company has been aggressively pushing to gain a significant market share and now has an official presence in 71 countries.

TransferWise vs. Western Union

The global remittance and payment transfer industry was estimated at $689 billion in 2018 and is projected to continue growing slowly. That said, future prospects could be adversely impeded by cryptocurrencies and similar low-cost alternatives. Digital tokens offer a convenient, faster, simpler, and cheaper alternative, especially when compared to traditional banks and financial institutions. Western Union, one of TransferWise’s competitors, has already announced plans to enter the cryptocurrency market. Several other companies are also rumored to be drawing up their own plans for a possible cryptocurrency market entry. Facebook, for instance, indicated that the company is in the final stages of developing a stablecoin codenamed ‘Project Libra.’ The rumors gained more wind when Reuters reported that Facebook had registered Libra Networks as a company in Geneva on May 2, 2019.

Stiff Competition in Fintech Industry

Western Union, MoneyGram, PayPal, and Currencies Direct have historically been some of the biggest names in the money transfer and exchange industry. Western Union, founded in 1851, has an annual revenue of $5.6 billion and is considered the market leader. TransferWise, meanwhile, was founded in 2011 by Taavet Hinrikus and Kristo Käärmann as a peer-to-peer money exchange and transfer platform. Since the platform is P2P, it could offer lower transfer fees when compared to banks and other rival companies operating in the same industry. While TransferWise may currently be Europe’s most valued fintech startup, it is looking increasingly likely that the company will have to venture into the crypto market sooner or later. Any delay on its part to provide a comparable payment settlement solution to its customers could see it lose a significant chunk of its user base and market share. Considering that TransferWise is already P2P, a potential cryptocurrency integration does not seem completely unlikely either. Do you think the payment service industry will follow Western Union and adopt the digital currency paradigm? Let us know your thoughts in the comments below.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored